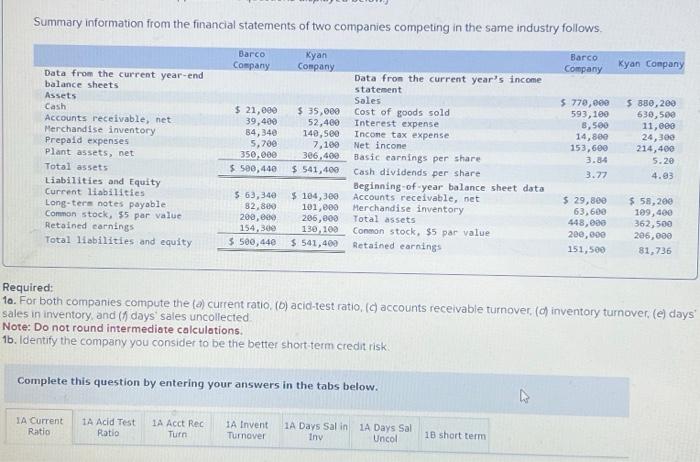

Summary information from the financial statements of two companies competing in the same industry follows. Barco Company Kyan Company Barco Company Kyan Company Data

Summary information from the financial statements of two companies competing in the same industry follows. Barco Company Kyan Company Barco Company Kyan Company Data from the current year-end Data from the current year's income balance sheets Assets Sales Cash $ 21,000 $ 35,000 Accounts receivable, net 39,400 52,400 Merchandise inventory 84,340 Prepaid expenses Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term notes payable. Common stock, $5 par value Retained earnings 306,400 $ 500,440 $ 541,400 $ 63,340 82,800 200,000 154,300 130,100 Total liabilities and equity $ 500,440 $ 541,400 5,700 350,000 140,500 7,100 statement Cost of goods sold Interest expense Income tax expense Net incone $770,000 $ 880,200 593,100 8,500 630,500 11,000 Basic earnings per share $ 104,300 101,000 206,000 Cash dividends per share Beginning-of-year balance sheet data Accounts receivable, net Merchandise inventory Total assets Common stock, $5 par value Retained earnings 14,800 153,600 3.84 3.77 24,300 214,400 5.20 4.03 $ 29,800 $ 58,200 63,600 109,400 448,000 362,500 200,000 206,000 151,500 81,736 Required: 10. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (f) days' sales uncollected Note: Do not round intermediate calculations. 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. IA Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent 1A Days Sal in 1A Days Sal Turnover Uncol Inv 18 short term

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets analyze the financial data of Barco and Kyan companies Understanding the Ratios Before we dive into the calculationslets quickly recap what each ratio signifies Current Ratio Measures a companys ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started