Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Summit Energy is an alternative energy producer. Your hedge fund is interested in investing into the company. As an analyst, you need to

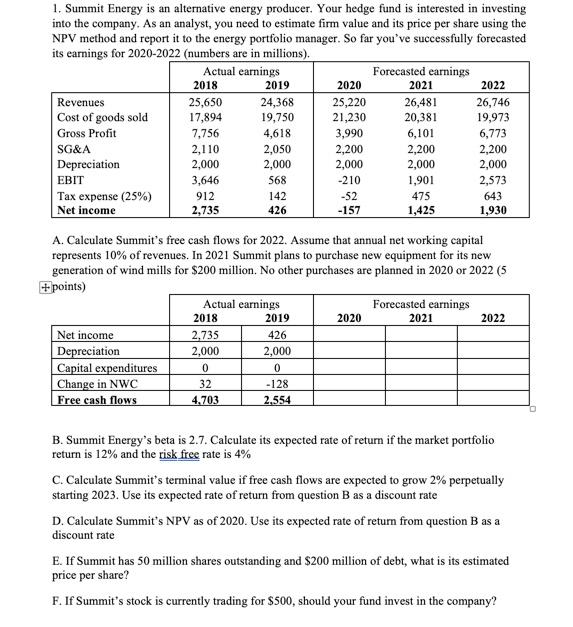

1. Summit Energy is an alternative energy producer. Your hedge fund is interested in investing into the company. As an analyst, you need to estimate firm value and its price per share using the NPV method and report it to the energy portfolio manager. So far you've successfully forecasted its earnings for 2020-2022 (numbers are in millions). Actual earnings Forecasted earnings 2018 2019 2020 2021 2022 Revenues 25,650 17,894 7,756 24,368 19,750 25,220 21,230 26,481 20,381 6,101 26,746 19,973 Cost of goods sold Gross Profit 4,618 3,990 6,773 SG&A 2,110 2,000 2,050 2,000 2,200 2,000 2,200 2,000 2,200 2,000 Depreciation EBIT 3,646 568 -210 1,901 475 2,573 142 -52 643 Tax expense (25%) Net income 912 2,735 426 -157 1,425 1,930 A. Calculate Summit's free cash flows for 2022. Assume that annual net working capital represents 10% of revenues. In 2021 Summit plans to purchase new equipment for its new generation of wind mills for $200 million. No other purchases are planned in 2020 or 2022 (5 + points) Actual earnings 2018 Forecasted earnings 2019 2020 2021 2022 Net income Depreciation Capital expenditures Change in NWC Free cash flows 2,735 2,000 426 2,000 32 -128 4,703 2,554 B. Summit Energy's beta is 2.7. Calculate its expected rate of return if the market portfolio return is 12% and the risk free rate is 4% C. Calculate Summit's terminal value if free cash flows are expected to grow 2% perpetually starting 2023. Use its expected rate of return from question B as a discount rate D. Calculate Summit's NPV as of 2020. Use its expected rate of returm from question B as a discount rate E. If Summit has 50 million shares outstanding and $200 million of debt, what is its estimated price per share? F. If Summit's stock is currently trading for $500, should your fund invest in the company?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Free cash flows B Expected Rate of ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started