Answered step by step

Verified Expert Solution

Question

1 Approved Answer

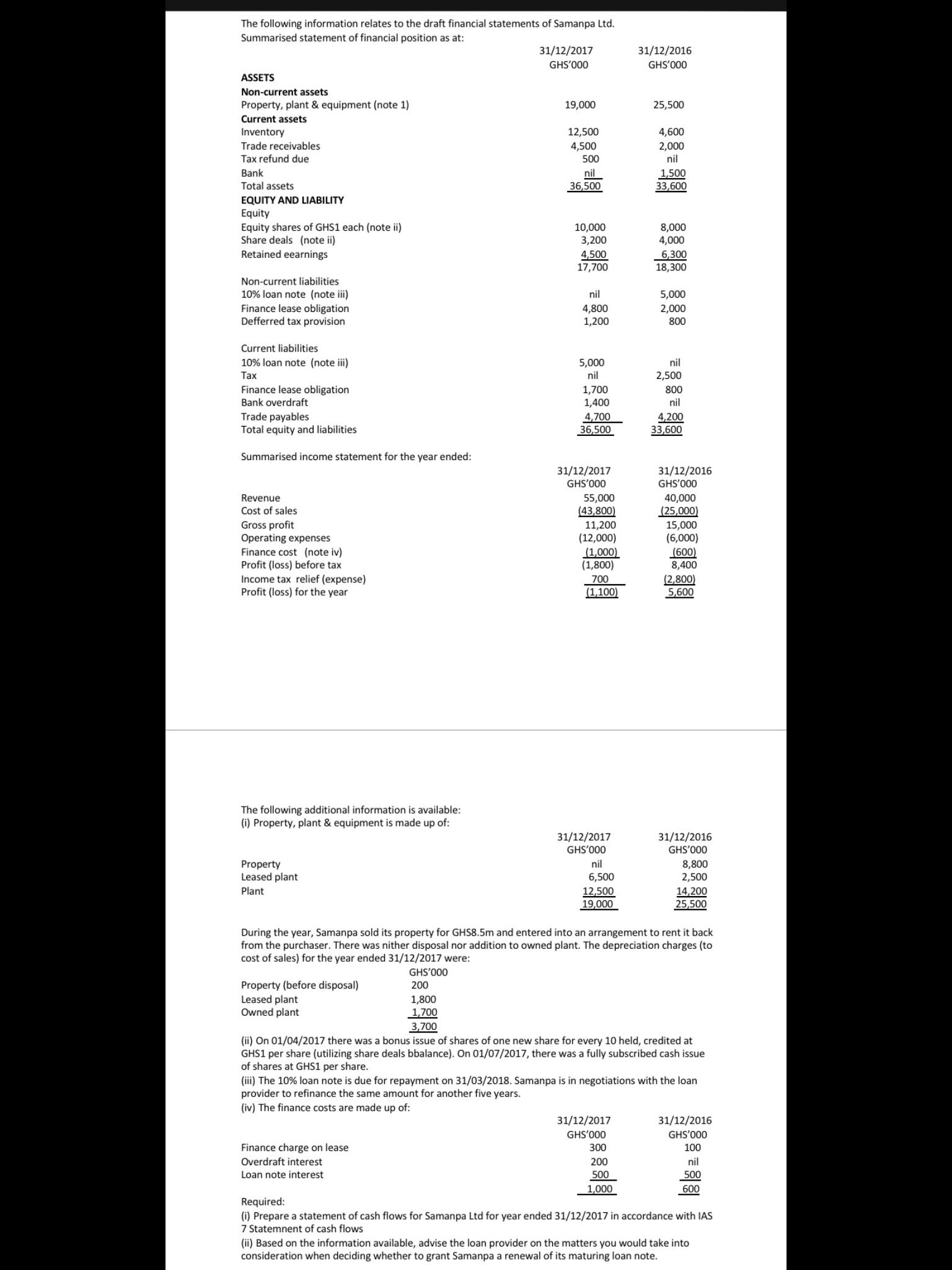

The following information relates to the draft financial statements of Samanpa Ltd. Summarised statement of financial position as at: 31/12/2017 31/12/2016 GHS'000 GHS'000 ASSETS

The following information relates to the draft financial statements of Samanpa Ltd. Summarised statement of financial position as at: 31/12/2017 31/12/2016 GHS'000 GHS'000 ASSETS Non-current assets Property, plant & equipment (note 1) 19,000 25,500 Current assets 4,600 2,000 nil Inventory 12,500 Trade receivables 4,500 500 Tax refund due 1,500 33,600 Bank nil 36,500 Total assets EQUITY AND LIABILITY Equity Equity shares of GHS1 each (note i) Share deals (note ii) Retained eearnings 10,000 3,200 8,000 4,000 4,500 17,700 6,300 18,300 Non-current liabilities 10% loan note (note iii) Finance lease obligation Defferred tax provision nil 5,000 4,800 1,200 2,000 800 Current liabilities 10% loan note (note iii) 5,000 nil nil Tax 2,500 Finance lease obligation Bank overdraft 800 1,700 1,400 4,700 36,500 nil Trade payables Total equity and liabilities 4,200 33,600 Summarised income statement for the year ended: 31/12/2017 31/12/2016 GHS'000 GHS'000 40,000 (25,000) 15,000 (6,000) (600) 8,400 Revenue 55,000 Cost of sales (43,800) Gross profit Operating expenses Finance cost (note iv) Profit (loss) before tax Income tax relief (expense) Profit (loss) for the year 11,200 (12,000) (1,000) (1,800) (2,800) 5,600 700 (1,100) The following additional information is available: (i) Property, plant & equipment is made up of: 31/12/2017 GHS'000 31/12/2016 GHS'000 nil Property Leased plant 8,800 2,500 6,500 Plant 12,500 19,000 14,200 25,500 During the year, Samanpa sold its property for GHS8.5m and entered into an arrangement to rent it back from the purchaser. There was nither disposal nor addition to owned plant. The depreciation charges (to cost of sales) for the year ended 31/12/2017 were: GHS'000 Property (before disposal) Leased plant Owned plant 200 1,800 1,700 3,700 (ii) On 01/04/2017 there was a bonus issue of shares of one new share for every 10 held, credited at GHS1 per share (utilizing share deals bbalance). On 01/07/2017, there was a fully subscribed cash issue of shares at GHS1 per share. (iii) The 10% loan note is due for repayment on 31/03/2018. Samanpa is in negotiations with the loan provider to refinance the same amount for another five years. (iv) The finance costs are made up of: 31/12/2017 31/12/2016 GHS'000 GHS'000 Finance charge on lease 300 100 Overdraft interest 200 nil Loan note interest 500 500 1,000 600 Required: (i) Prepare a statement of cash flows for Samanpa Ltd for year ended 31/12/2017 in accordance with IAS 7 Statemnent of cash flows (ii) Based on the information available, advise the loan provider on the matters you would take into consideration when deciding whether to grant Samanpa a renewal of its maturing loan note.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

C ash Flow Statement of Sampanna Limited as at 31 st December 2017 OPERTING ACTIVITIES GHS000 Cash Received from Customers 52500 Cash paid to Suppliers 51200 Cash Paid against Operative Expenses 7800 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started