Answered step by step

Verified Expert Solution

Question

1 Approved Answer

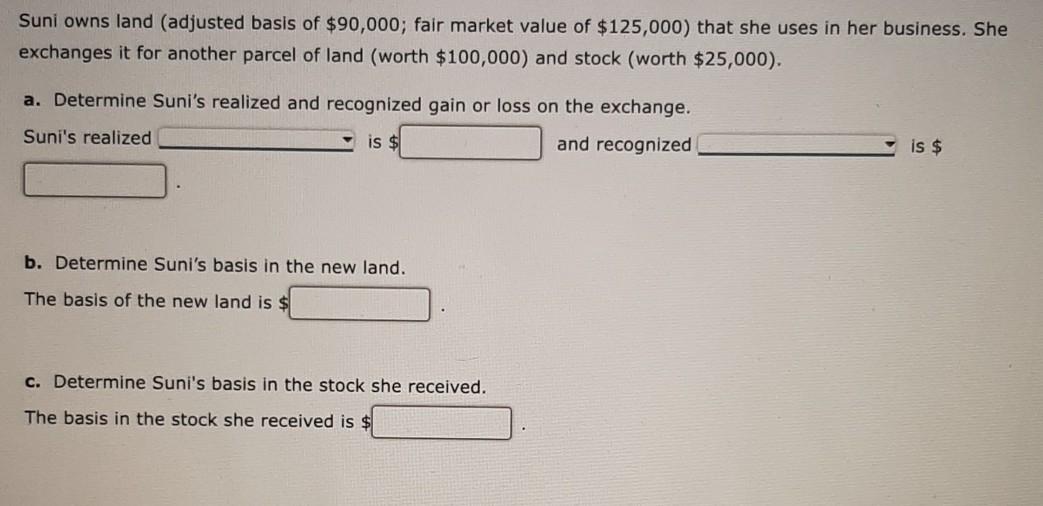

Suni owns land (adjusted basis of $90,000; fair market value of $125,000) that she uses in her business. She exchanges it for another parcel of

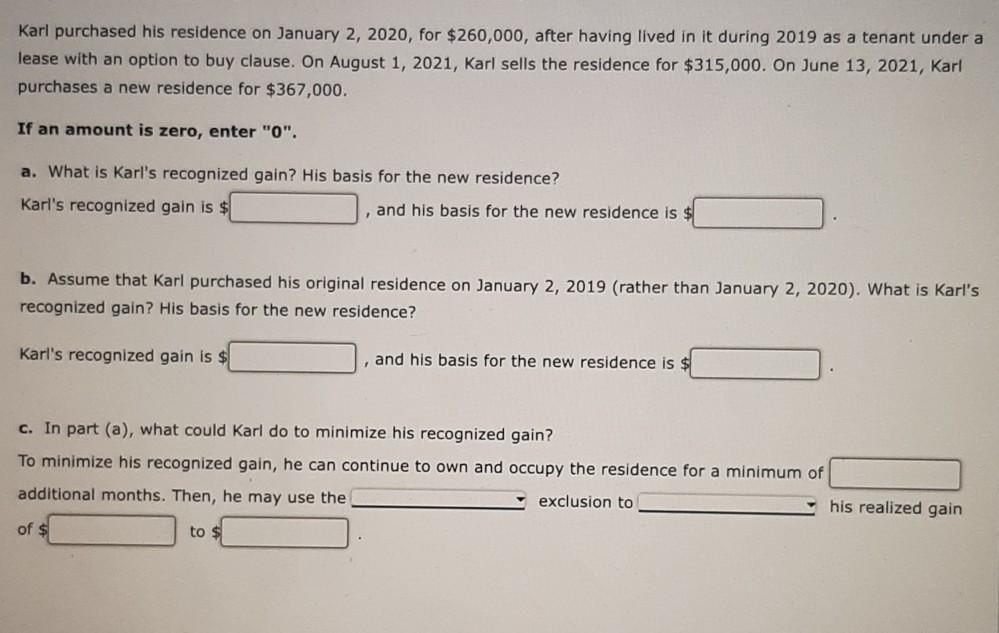

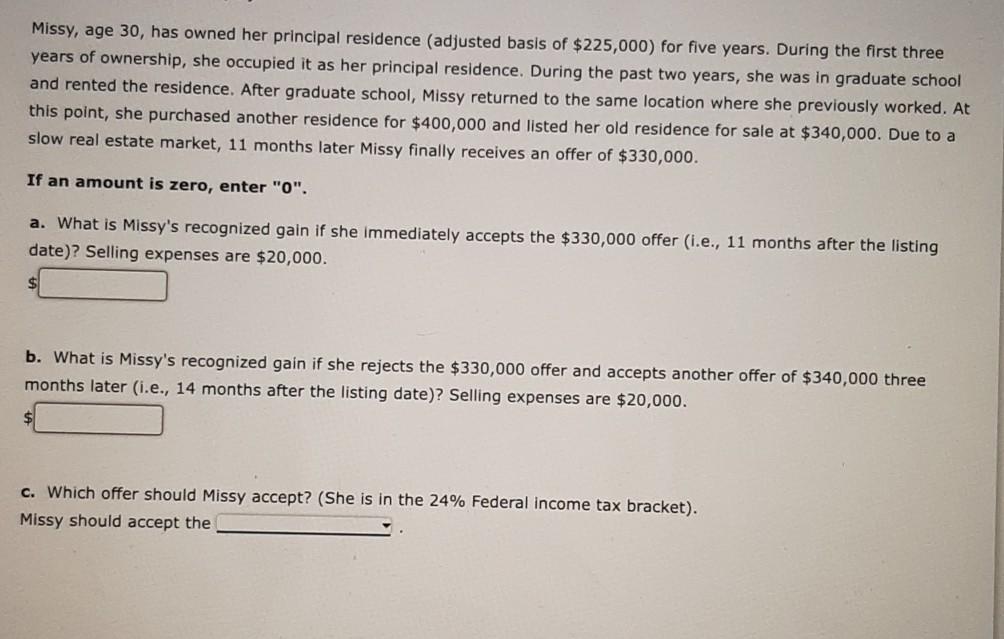

Suni owns land (adjusted basis of $90,000; fair market value of $125,000) that she uses in her business. She exchanges it for another parcel of land (worth $100,000) and stock (worth $25,000). a. Determine Suni's realized and recognized gain or loss on the exchange. Suni's realized is $1 and recognized is $ b. Determine Suni's basis in the new land. The basis of the new land is $ c. Determine Suni's basis in the stock she received. The basis in the stock she received is $ Karl purchased his residence on January 2, 2020, for $260,000, after having lived in it during 2019 as a tenant under a lease with an option to buy clause. On August 1, 2021, Karl sells the residence for $315,000. On June 13, 2021, Karl purchases a new residence for $367,000. If an amount is zero, enter "0". a. What is Karl's recognized gain? His basis for the new residence? Karl's recognized gain is and his basis for the new residence is $ b. Assume that Karl purchased his original residence on January 2, 2019 (rather than January 2, 2020). What is Karl's recognized gain? His basis for the new residence? Karl's recognized gain is $ and his basis for the new residence is $ c. In part (a), what could Karl do to minimize his recognized gain? To minimize his recognized gain, he can continue to own and occupy the residence for a minimum of additional months. Then, he may use the exclusion to his realized gain of to $ Missy, age 30, has owned her principal residence (adjusted basis of $225,000) for five years. During the first three years of ownership, she occupied it as her principal residence. During the past two years, she was in graduate school and rented the residence. After graduate school, Missy returned to the same location where she previously worked. At this point, she purchased another residence for $400,000 and listed her old residence for sale at $340,000. Due to a slow real estate market, 11 months later Missy finally receives an offer of $330,000. If an amount is zero, enter "O". a. What is Missy's recognized gain if she immediately accepts the $330,000 offer (i.e., 11 months after the listing date)? Selling expenses are $20,000. b. What is Missy's recognized gain if she rejects the $330,000 offer and accepts another offer of $340,000 three months later (i.e., 14 months after the listing date)? Selling expenses are $20,000. c. Which offer should Missy accept? (She is in the 24% Federal income tax bracket). Missy should accept the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started