Answered step by step

Verified Expert Solution

Question

1 Approved Answer

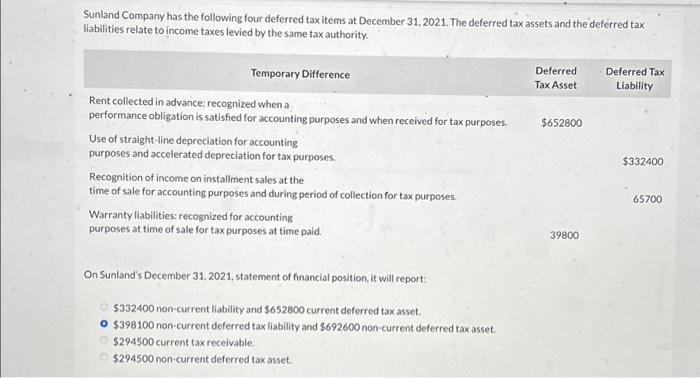

Sunland Company has the following four deferred tax items at December 31, 2021. The deferred tax assets and the deferred tax liabilities relate to income

Sunland Company has the following four deferred tax items at December 31, 2021. The deferred tax assets and the deferred tax liabilities relate to income taxes levied by the same tax authority. Temporary Difference Rent collected in advance: recognized when a performance obligation is satisfied for accounting purposes and when received for tax purposes. Use of straight-line depreciation for accounting purposes and accelerated depreciation for tax purposes. Recognition of income on installment sales at the time of sale for accounting purposes and during period of collection for tax purposes. Warranty liabilities: recognized for accounting purposes at time of sale for tax purposes at time paid. On Sunland's December 31, 2021, statement of financial position, it will report: $332400 non-current liability and $652800 current deferred tax asset. O $398100 non-current deferred tax liability and $692600 non-current deferred tax asset. $294500 current tax receivable. O $294500 non-current deferred tax asset. Deferred Tax Asset $652800 39800 Deferred Tax Liability $332400 65700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started