Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Co. uses normal job costing. The firm does not prorate over/under allocated MOH and uses first- in-first-out (FIFO) inventory flow. In 2021, they had

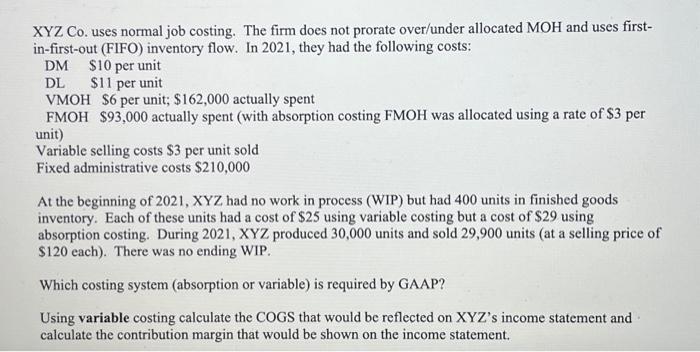

XYZ Co. uses normal job costing. The firm does not prorate over/under allocated MOH and uses first- in-first-out (FIFO) inventory flow. In 2021, they had the following costs: DM $10 per unit DL $11 per unit VMOH $6 per unit; $162,000 actually spent FMOH $93,000 actually spent (with absorption costing FMOH was allocated using a rate of $3 per unit) Variable selling costs $3 per unit sold Fixed administrative costs $210,000 At the beginning of 2021, XYZ had no work in process (WIP) but had 400 units in finished goods inventory. Each of these units had a cost of $25 using variable costing but a cost of $29 using absorption costing. During 2021, XYZ produced 30,000 units and sold 29,900 units (at a selling price of $120 each). There was no ending WIP. Which costing system (absorption or variable) is required by GAAP? Using variable costing calculate the COGS that would be reflected on XYZ's income statement and calculate the contribution margin that would be shown on the income statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started