Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunland Company is in the process of preparing its financial statements for 2020 . Assume that no entries for depreciation have been recorded in 2020

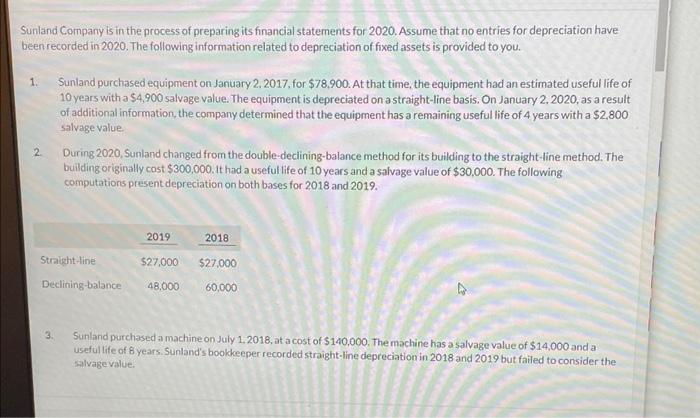

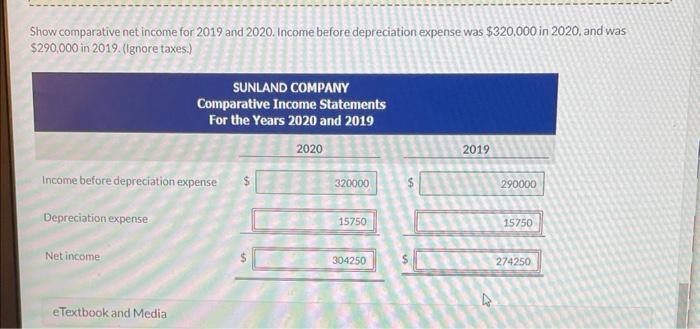

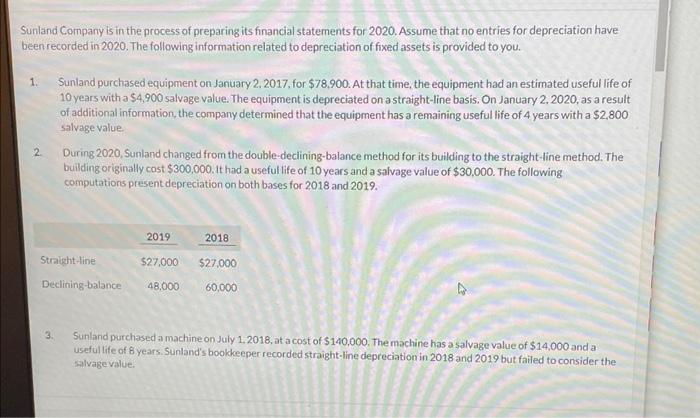

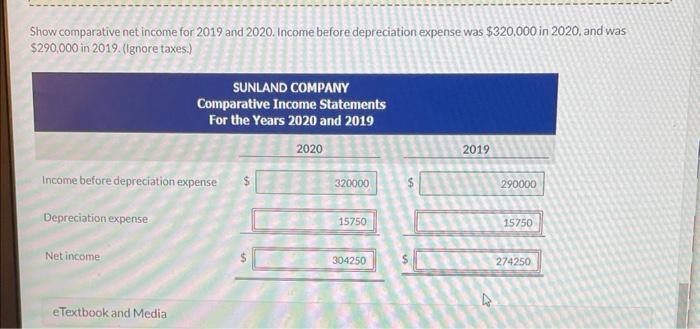

Sunland Company is in the process of preparing its financial statements for 2020 . Assume that no entries for depreciation have been recorded in 2020 . The following information related to depreciation of fixed assets is provided to you. 1. Sunland purchased equipment on January 2. 2017, for $78,900. At that time, the equipment had an estimated useful life of 10 years with a $4,900 salvage value. The equipment is depreciated on astraight-line basis. On January 2,2020 , as a result of additional information, the company determined that the equipment has a remaining useful life of 4 years with a $2,800 salvage value. 2. During 2020, Sunland changed from the double-declining-balance method for its building to the straight-line method. The building originally cost $300,000. It had a useful life of 10 years and a salvage value of $30,000. The following computations present depreciation on both bases for 2018 and 2019. 3. Sunland purchased a machine on July 1.2018, at a cost of $140,000. The machine has a salvage value of $14,000 and a useful life of 8 years. Sunland's bookkeeper recorded straight-line depreciation in 2018 and 2019 but failed to consider the salvarevalue. Show comparative net income for 2019 and 2020 . Income before depreciation expense was $320,000 in 2020 , and was $290,000 in 2019. (Ignore taxes.)

Sunland Company is in the process of preparing its financial statements for 2020 . Assume that no entries for depreciation have been recorded in 2020 . The following information related to depreciation of fixed assets is provided to you. 1. Sunland purchased equipment on January 2. 2017, for $78,900. At that time, the equipment had an estimated useful life of 10 years with a $4,900 salvage value. The equipment is depreciated on astraight-line basis. On January 2,2020 , as a result of additional information, the company determined that the equipment has a remaining useful life of 4 years with a $2,800 salvage value. 2. During 2020, Sunland changed from the double-declining-balance method for its building to the straight-line method. The building originally cost $300,000. It had a useful life of 10 years and a salvage value of $30,000. The following computations present depreciation on both bases for 2018 and 2019. 3. Sunland purchased a machine on July 1.2018, at a cost of $140,000. The machine has a salvage value of $14,000 and a useful life of 8 years. Sunland's bookkeeper recorded straight-line depreciation in 2018 and 2019 but failed to consider the salvarevalue. Show comparative net income for 2019 and 2020 . Income before depreciation expense was $320,000 in 2020 , and was $290,000 in 2019. (Ignore taxes.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started