Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunland Company purchased equipment on account on September 3, 2022, at an invoice price of $187,000. On September 4, 2022, it paid $4,400 for delivery

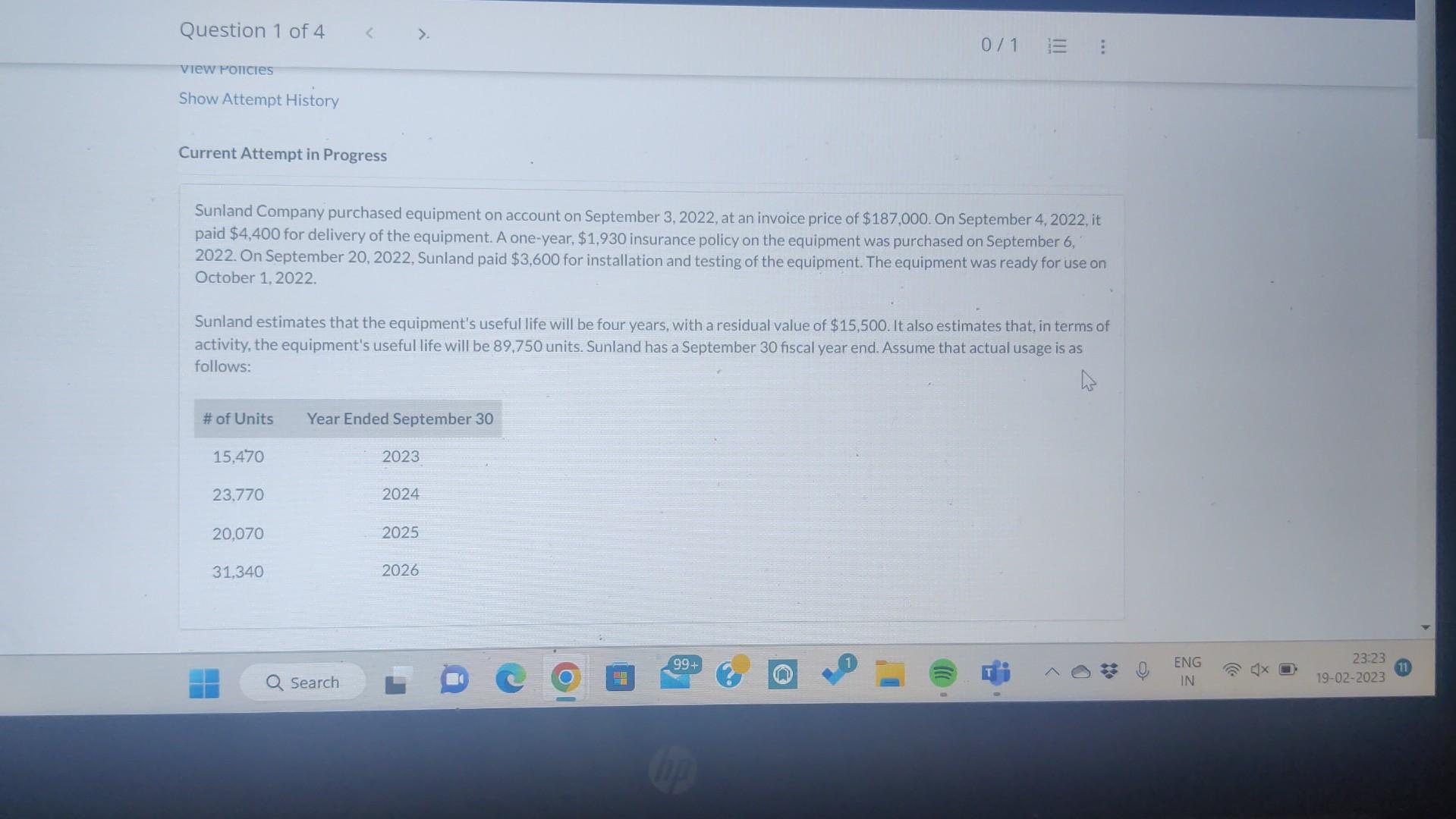

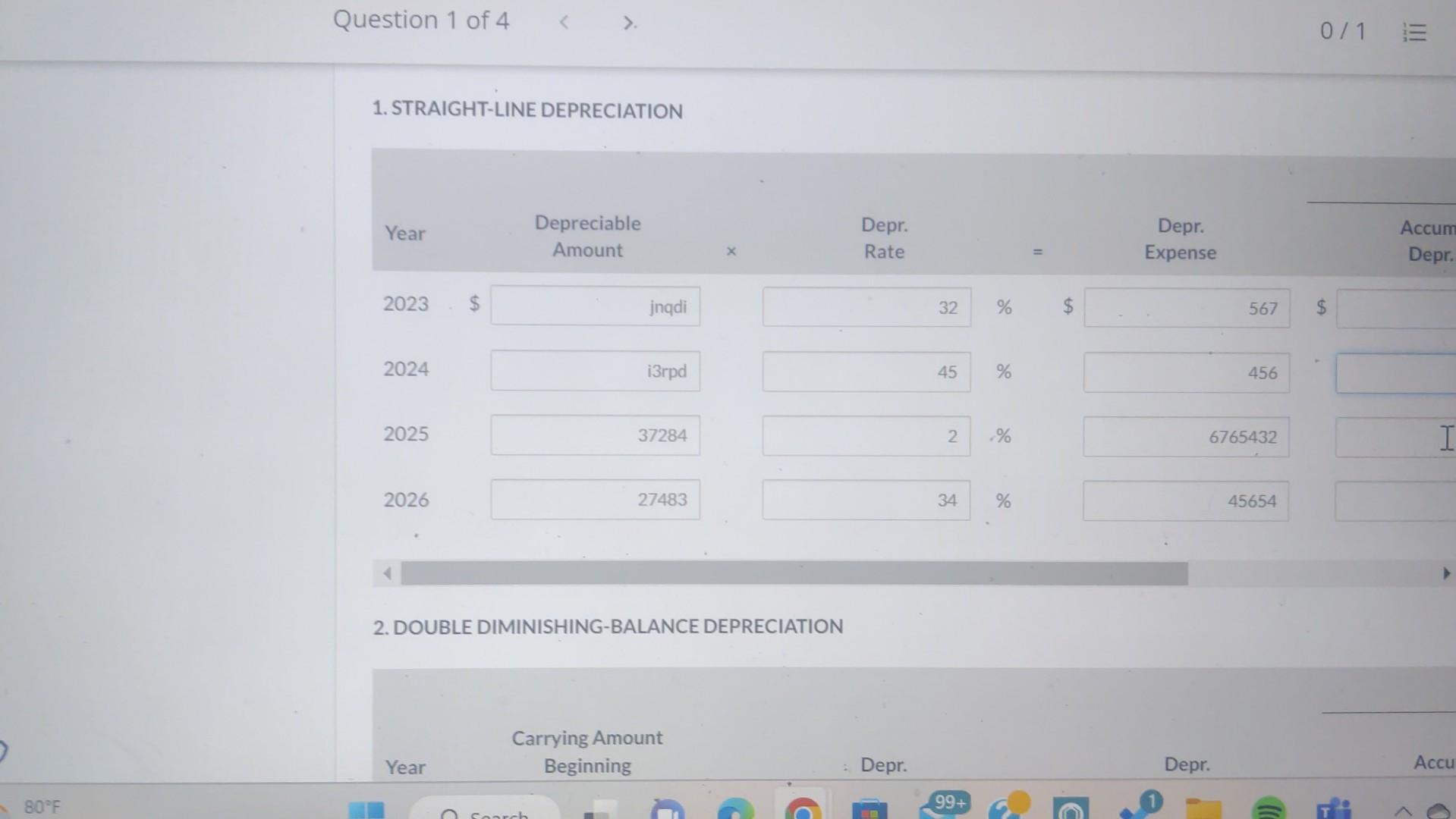

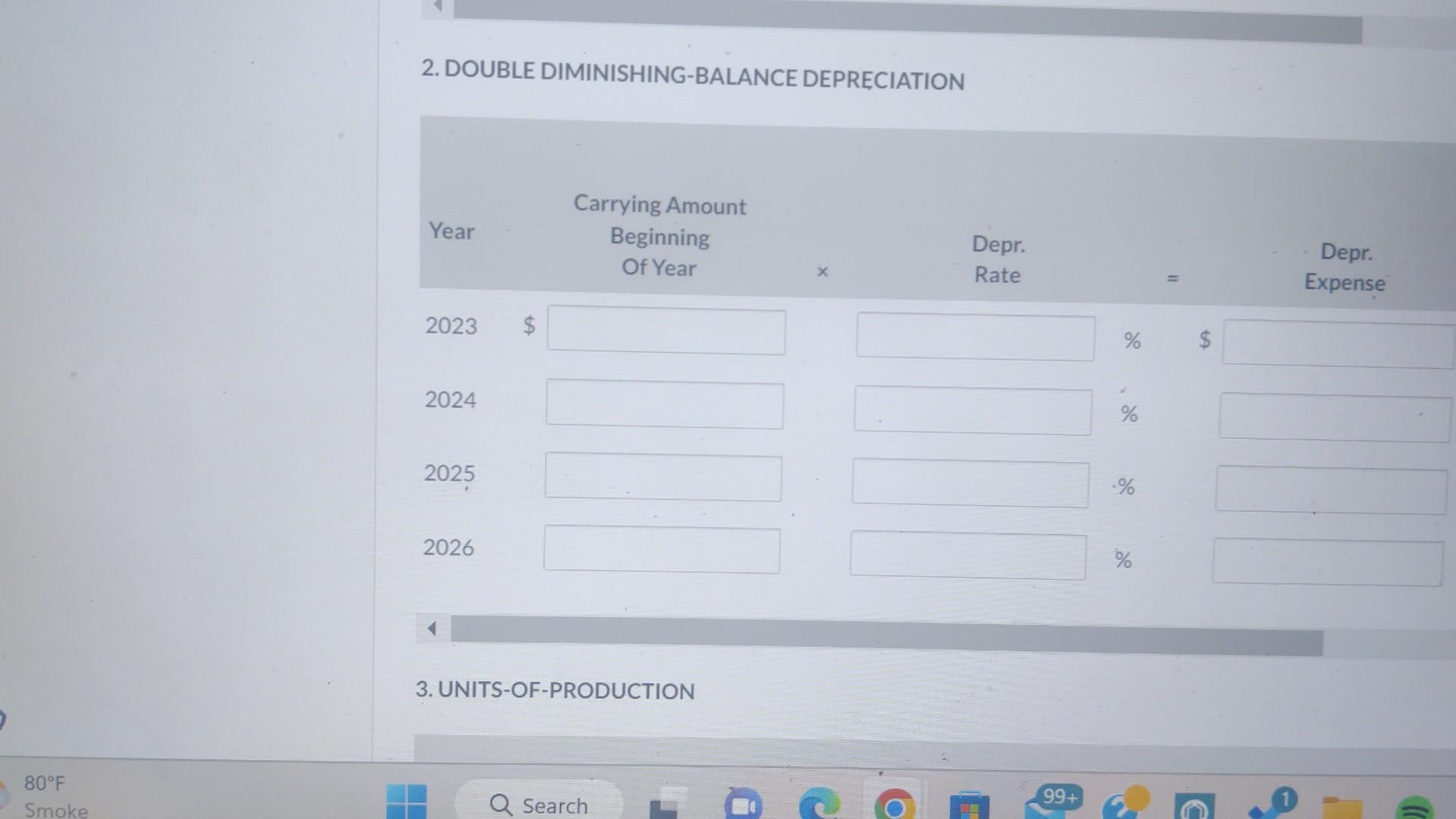

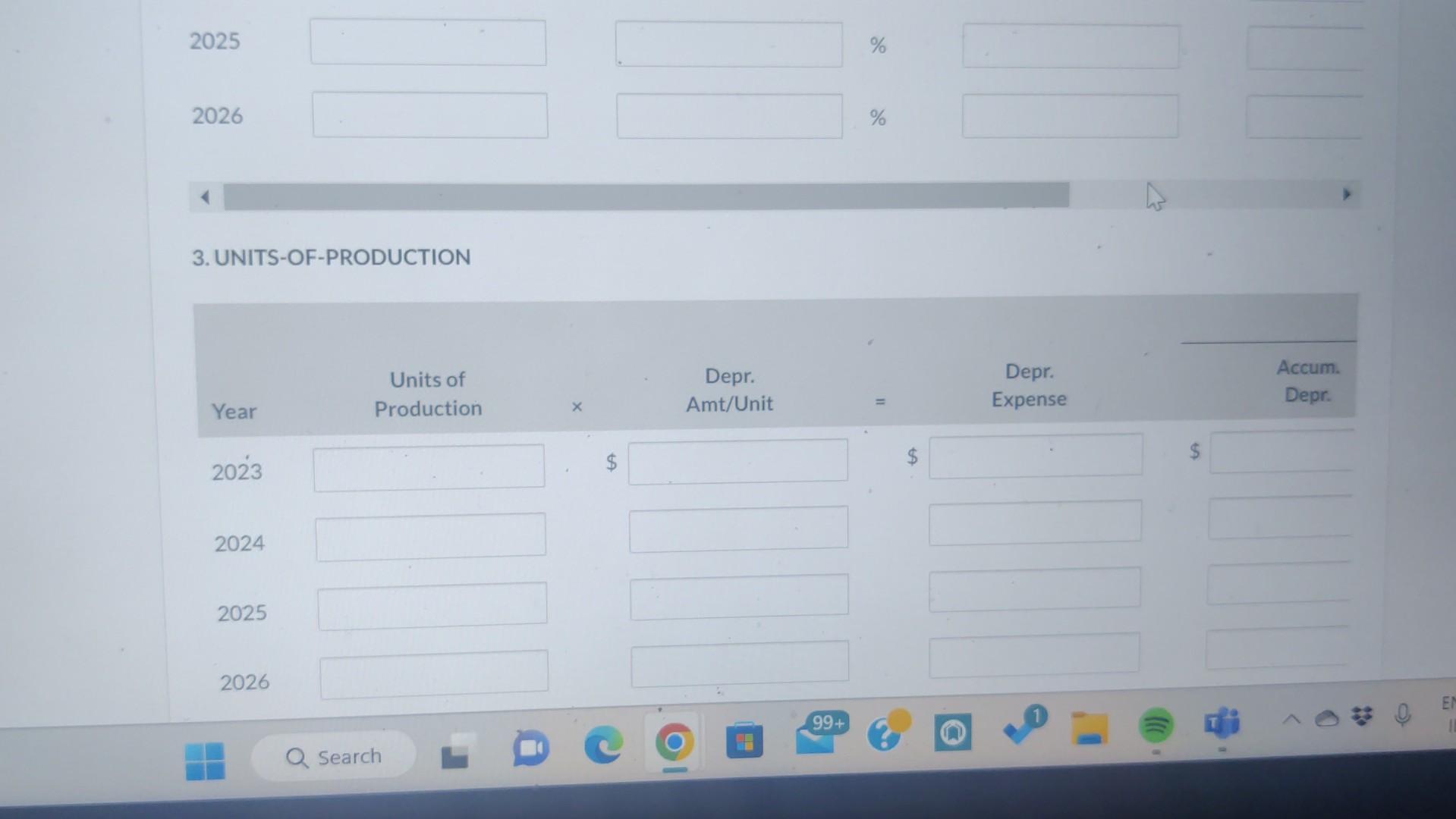

Sunland Company purchased equipment on account on September 3, 2022, at an invoice price of $187,000. On September 4, 2022, it paid $4,400 for delivery of the equipment. A one-year, $1,930 insurance policy on the equipment was purchased on September 6 , 2022. On September 20,2022, Sunland paid $3,600 for installation and testing of the equipment. The equipment was ready for use on October 1, 2022 Sunland estimates that the equipment's useful life will be four years, with a residual value of $15,500. It also estimates that, in terms of activity, the equipment's useful life will be 89,750 units. Sunland has a September 30 fiscal year end. Assume that actual usage is as follows: 1. STRAIGHT-LINE DEPRECIATION 2. DOUBLE DIMINISHING-BALANCE DEPRECIATION 2. DOUBLE DIMINISHING-BALANCE DEPRECIATION 3. UNITS-OF-PRODUCTION

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started