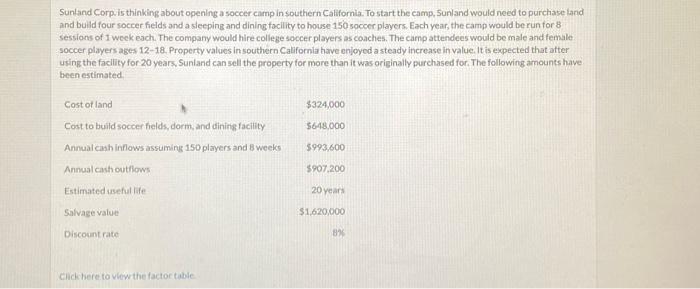

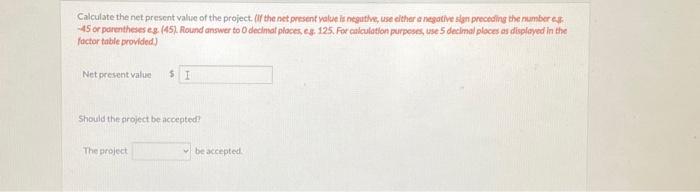

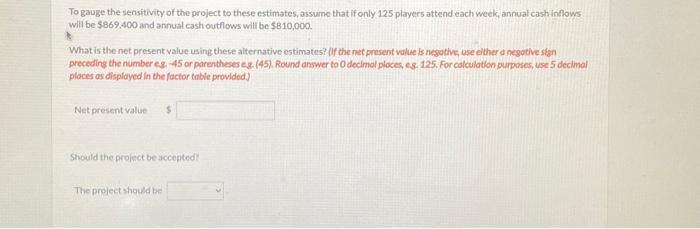

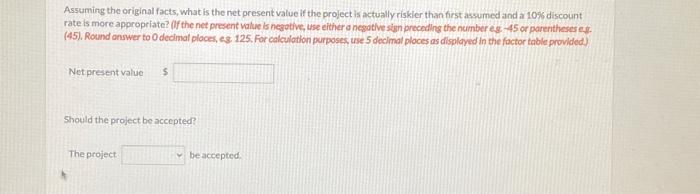

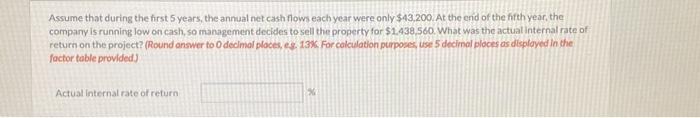

Sunland Corp is thinking about opening a soccer camp in southern California. To start the camp, Sunland would need to purchase land and bulid four socrer fields and a sleeping and dining facility to house 150 soccer players. Each year, the camp would be run for 8 sessions of 1 week each. The company would hire college soccer players as coaches. The carnp attendees would be male and female soccer players ages 12-18. Property values in southern California have enjoyod a steady increase in value. It is expected that after using the faclity for 20 years, Sunland can sell the property for more than it was originally purchased for. The following amounts have been estimated. cilick bere to view the factor table Calculate the net present value of the project. (II the net present value is neguthe, use elther a negotive slyn prectoling the number ef -45 or porentheses eg. (45). Round answer to 0 decimat ploces, eg. 125. For calculation purposes, use 5 decimal places as displeved in the factor table provided) Net present value Should the sroject be accepted? The project be accepted. To gauge the sensitivity of the project to these estimates, assume that if only 125 players attend each week, anniual cashinflows will be $869,400 and annual cash outflows will be $810,000. What is the net present value using these alternative es timates? (if the net present value is negutive, use either a negotive stgn preceding the number es 45 or parentheses es. (45). Round answer to 0 decimal ploces, es. 125. For calculation purposes, use 5 decimal places as displayed in the factar table provided.) Net present value Should the project be accepted? The project should be Assuming the original facts, what is the net present value if the project is actually riskier than first assumed and a 10% discount (45). Round onswer to 0 dedimal ploces, 48 125. For calculation purposes, use 5 decimal ploces as displayed in the foctor table provided) Netpresent value Should the project be accepted? The project be accepted. Assume that during the first 5 years, the annual net cash flows each year were only $43,200. At the crid of the fith year, the company is running low on cash, so management decides to sell the property for $1.438,560. What was the actual internal rate of return on the project? (Round answer to 0 decimal places, es, 13\%. For colculation purposes use 5 decimal places as dilsplayed in the factor table provided) Actual internal rate of return