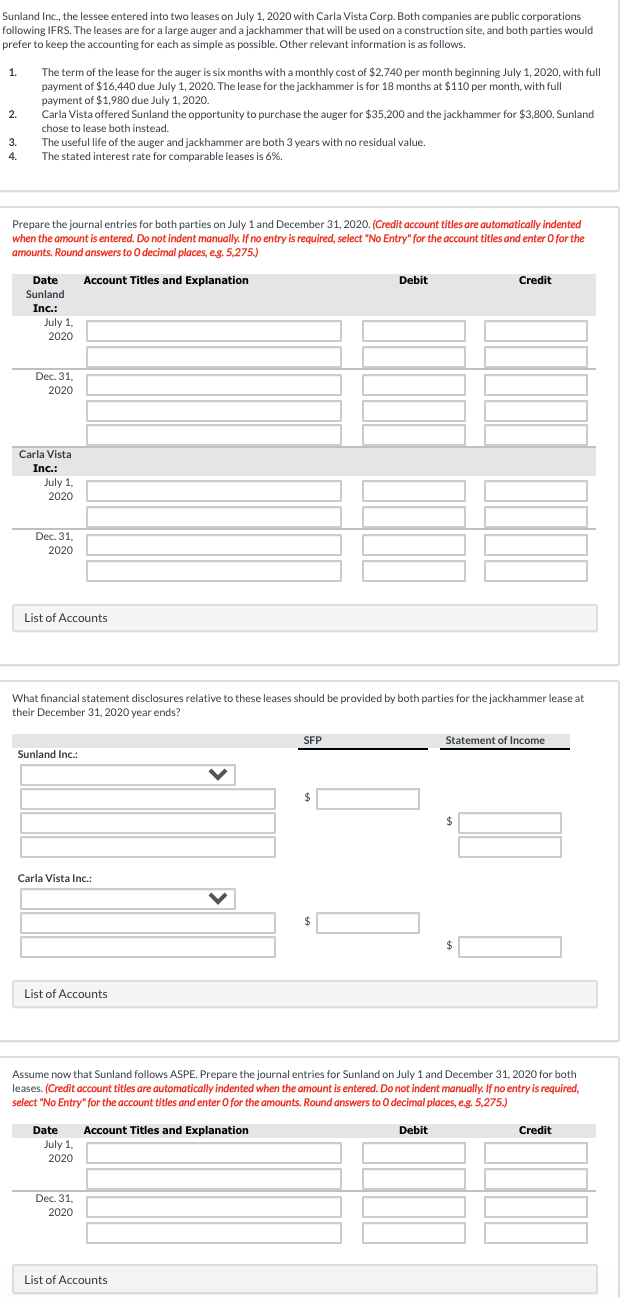

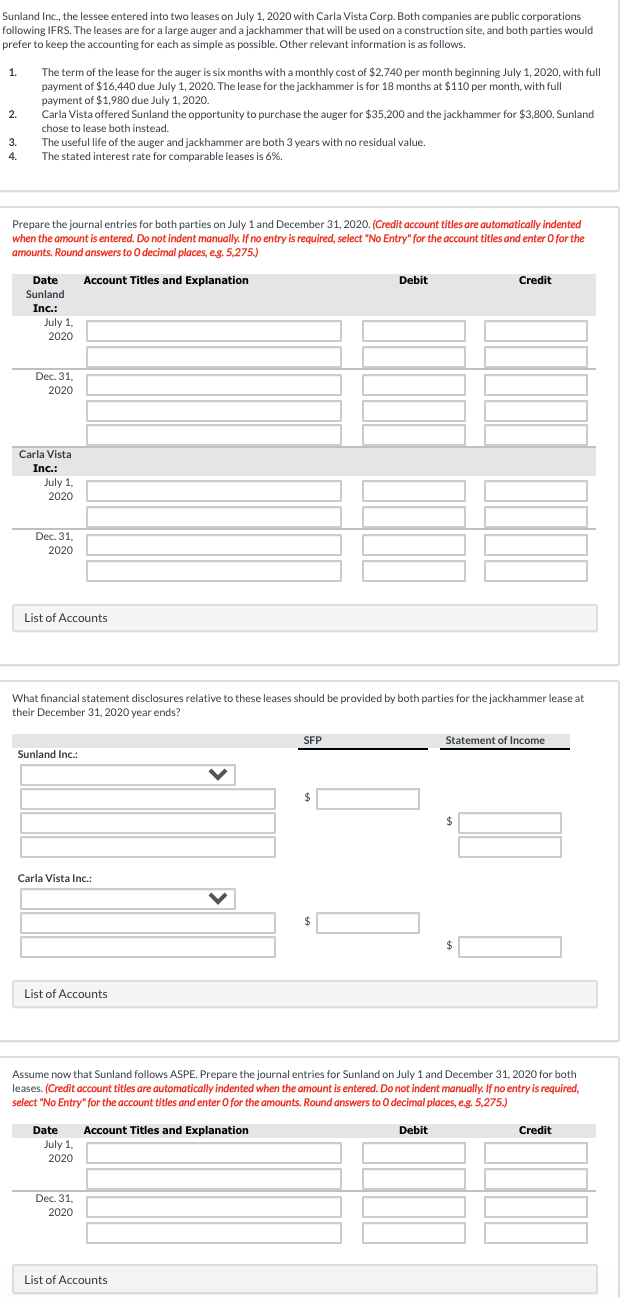

Sunland Inc., the lessee entered into two leases on July 1, 2020 with Carla Vista Corp. Both companies are public corporations following IFRS. The leases are for a large auger and a jackhammer that will be used on a construction site, and both parties would prefer to keep the accounting for each as simple as possible. Other relevant information is as follows. 1. 2. The term of the lease for the auger is six months with a monthly cost of $2,740 per month beginning July 1, 2020, with full payment of $16,440 due July 1, 2020. The lease for the jackhammer is for 18 months at $110 per month, with full payment of $1,980 due July 1, 2020. Carla Vista offered Sunland the opportunity to purchase the auger for $35,200 and the jackhammer for $3,800. Sunland chose to lease both instead. The useful life of the auger and jackhammer are both 3 years with no residual value. The stated interest rate for comparable leases is 6%. 3. 4. Prepare the journal entries for both parties on July 1 and December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and enter for the amounts. Round answers to decimal places, eg. 5,275.) Account Titles and Explanation Debit Credit Date Sunland Inc.: July 1, 2020 Dec. 31. 2020 Carla Vista Inc.: July 1, 2020 Dec. 31, 2020 List of Accounts What financial statement disclosures relative to these leases should be provided by both parties for the jackhammer lease at their December 31, 2020 year ends? SFP Statement of Income Sunland Inc.: $ $ Carla Vista Inc.: $ $ List of Accounts Assume now that Sunland follows ASPE. Prepare the journal entries for Sunland on July 1 and December 31, 2020 for both leases. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to decimal places, eg. 5,275.) Account Titles and Explanation Debit Credit Date July 1, 2020 Dec. 31. 2020 List of Accounts