Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunrise Sdn. Bhd. plans to accumulate funds to provide a retirement package for its President of Research, Jill Moran. Jill Moran by contract will retire

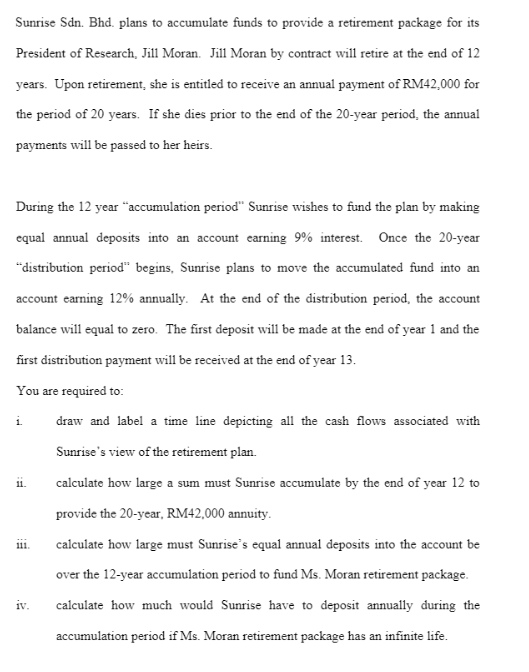

Sunrise Sdn. Bhd. plans to accumulate funds to provide a retirement package for its President of Research, Jill Moran. Jill Moran by contract will retire at the end of 12 years. Upon retirement, she is entitled to receive an annual payment of RM42,000 for the period of 20 years. If she dies prior to the end of the 20 -year period, the annual payments will be passed to her heirs. During the 12 year "accumulation period" Sunrise wishes to fund the plan by making equal annual deposits into an account earning 9% interest. Once the 20 -year "distribution period" begins, Sunrise plans to move the accumulated fund into an account earning 12% annually. At the end of the distribution period, the account balance will equal to zero. The first deposit will be made at the end of year 1 and the first distribution payment will be received at the end of year 13 . You are required to: i. draw and label a time line depicting all the cash flows associated with Sunrise's view of the retirement plan. ii. calculate how large a sum must Sunrise accumulate by the end of year 12 to provide the 20-year, RM42,000 annuity. iii. calculate how large must Sunrise's equal annual deposits into the account be over the 12-year accumulation period to fund Ms. Moran retirement package. iv. calculate how much would Sunrise have to deposit annually during the accumulation period if Ms. Moran retirement package has an infinite life. Sunrise Sdn. Bhd. plans to accumulate funds to provide a retirement package for its President of Research, Jill Moran. Jill Moran by contract will retire at the end of 12 years. Upon retirement, she is entitled to receive an annual payment of RM42,000 for the period of 20 years. If she dies prior to the end of the 20 -year period, the annual payments will be passed to her heirs. During the 12 year "accumulation period" Sunrise wishes to fund the plan by making equal annual deposits into an account earning 9% interest. Once the 20 -year "distribution period" begins, Sunrise plans to move the accumulated fund into an account earning 12% annually. At the end of the distribution period, the account balance will equal to zero. The first deposit will be made at the end of year 1 and the first distribution payment will be received at the end of year 13 . You are required to: i. draw and label a time line depicting all the cash flows associated with Sunrise's view of the retirement plan. ii. calculate how large a sum must Sunrise accumulate by the end of year 12 to provide the 20-year, RM42,000 annuity. iii. calculate how large must Sunrise's equal annual deposits into the account be over the 12-year accumulation period to fund Ms. Moran retirement package. iv. calculate how much would Sunrise have to deposit annually during the accumulation period if Ms. Moran retirement package has an infinite life

Sunrise Sdn. Bhd. plans to accumulate funds to provide a retirement package for its President of Research, Jill Moran. Jill Moran by contract will retire at the end of 12 years. Upon retirement, she is entitled to receive an annual payment of RM42,000 for the period of 20 years. If she dies prior to the end of the 20 -year period, the annual payments will be passed to her heirs. During the 12 year "accumulation period" Sunrise wishes to fund the plan by making equal annual deposits into an account earning 9% interest. Once the 20 -year "distribution period" begins, Sunrise plans to move the accumulated fund into an account earning 12% annually. At the end of the distribution period, the account balance will equal to zero. The first deposit will be made at the end of year 1 and the first distribution payment will be received at the end of year 13 . You are required to: i. draw and label a time line depicting all the cash flows associated with Sunrise's view of the retirement plan. ii. calculate how large a sum must Sunrise accumulate by the end of year 12 to provide the 20-year, RM42,000 annuity. iii. calculate how large must Sunrise's equal annual deposits into the account be over the 12-year accumulation period to fund Ms. Moran retirement package. iv. calculate how much would Sunrise have to deposit annually during the accumulation period if Ms. Moran retirement package has an infinite life. Sunrise Sdn. Bhd. plans to accumulate funds to provide a retirement package for its President of Research, Jill Moran. Jill Moran by contract will retire at the end of 12 years. Upon retirement, she is entitled to receive an annual payment of RM42,000 for the period of 20 years. If she dies prior to the end of the 20 -year period, the annual payments will be passed to her heirs. During the 12 year "accumulation period" Sunrise wishes to fund the plan by making equal annual deposits into an account earning 9% interest. Once the 20 -year "distribution period" begins, Sunrise plans to move the accumulated fund into an account earning 12% annually. At the end of the distribution period, the account balance will equal to zero. The first deposit will be made at the end of year 1 and the first distribution payment will be received at the end of year 13 . You are required to: i. draw and label a time line depicting all the cash flows associated with Sunrise's view of the retirement plan. ii. calculate how large a sum must Sunrise accumulate by the end of year 12 to provide the 20-year, RM42,000 annuity. iii. calculate how large must Sunrise's equal annual deposits into the account be over the 12-year accumulation period to fund Ms. Moran retirement package. iv. calculate how much would Sunrise have to deposit annually during the accumulation period if Ms. Moran retirement package has an infinite life Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started