Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sunset co has been investing heavily in real estate. Its financial structure is as follows it has 100 million dollars of debt, its equity

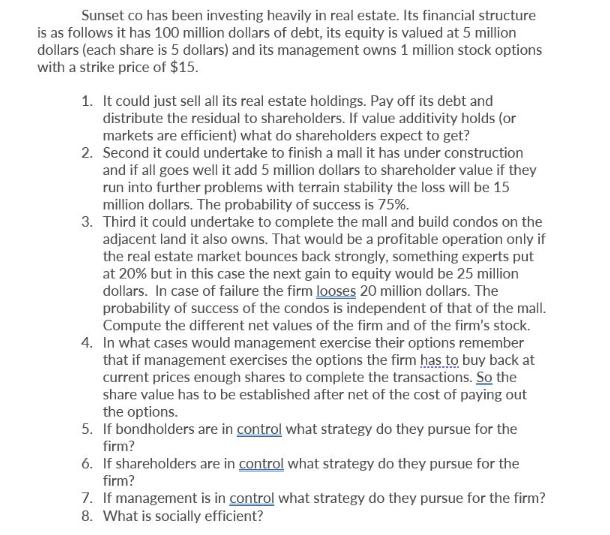

Sunset co has been investing heavily in real estate. Its financial structure is as follows it has 100 million dollars of debt, its equity is valued at 5 million dollars (each share is 5 dollars) and its management owns 1 million stock options with a strike price of $15. 1. It could just sell all its real estate holdings. Pay off its debt and distribute the residual to shareholders. If value additivity holds (or markets are efficient) what do shareholders expect to get? 2. Second it could undertake to finish a mall it has under construction and if all goes well it add 5 million dollars to shareholder value if they run into further problems with terrain stability the loss will be 15 million dollars. The probability of success is 75%. 3. Third it could undertake to complete the mall and build condos on the adjacent land it also owns. That would be a profitable operation only if the real estate market bounces back strongly, something experts put at 20% but in this case the next gain to equity would be 25 million dollars. In case of failure the firm looses 20 million dollars. The probability of success of the condos is independent of that of the mall. Compute the different net values of the firm and of the firm's stock. 4. In what cases would management exercise their options remember that if management exercises the options the firm has to buy back at current prices enough shares to complete the transactions. So the share value has to be established after net of the cost of paying out the options. 5. If bondholders are in control what strategy do they pursue for the firm? 6. If shareholders are in control what strategy do they pursue for the firm? 7. If management is in control what strategy do they pursue for the firm? 8. What is socially efficient? Sunset co has been investing heavily in real estate. Its financial structure is as follows it has 100 million dollars of debt, its equity is valued at 5 million dollars (each share is 5 dollars) and its management owns 1 million stock options with a strike price of $15. 1. It could just sell all its real estate holdings. Pay off its debt and distribute the residual to shareholders. If value additivity holds (or markets are efficient) what do shareholders expect to get? 2. Second it could undertake to finish a mall it has under construction and if all goes well it add 5 million dollars to shareholder value if they run into further problems with terrain stability the loss will be 15 million dollars. The probability of success is 75%. 3. Third it could undertake to complete the mall and build condos on the adjacent land it also owns. That would be a profitable operation only if the real estate market bounces back strongly, something experts put at 20% but in this case the next gain to equity would be 25 million dollars. In case of failure the firm looses 20 million dollars. The probability of success of the condos is independent of that of the mall. Compute the different net values of the firm and of the firm's stock. 4. In what cases would management exercise their options remember that if management exercises the options the firm has to buy back at current prices enough shares to complete the transactions. So the share value has to be established after net of the cost of paying out the options. 5. If bondholders are in control what strategy do they pursue for the firm? 6. If shareholders are in control what strategy do they pursue for the firm? 7. If management is in control what strategy do they pursue for the firm? 8. What is socially efficient?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the different net values of the firm and its stock we need to make several assumptions about the value of the real estate holdings the cost of finishing the mall and building condos and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started