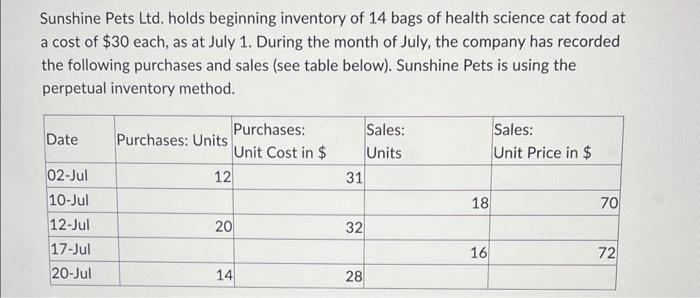

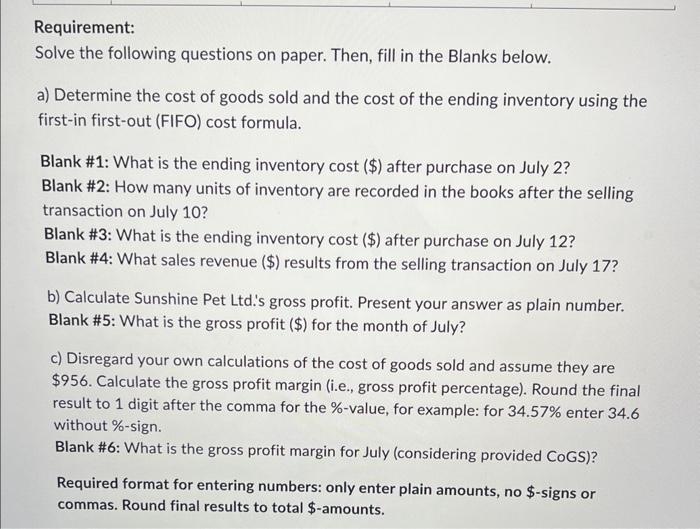

Sunshine Pets Ltd. holds beginning inventory of 14 bags of health science cat food at a cost of $30 each, as at July 1 . During the month of July, the company has recorded the following purchases and sales (see table below). Sunshine Pets is using the perpetual inventory method. Requirement: Solve the following questions on paper. Then, fill in the Blanks below. a) Determine the cost of goods sold and the cost of the ending inventory using the first-in first-out (FIFO) cost formula. Blank \#1: What is the ending inventory cost (\$) after purchase on July 2? Blank \#2: How many units of inventory are recorded in the books after the selling transaction on July 10 ? Blank \#3: What is the ending inventory cost (\$) after purchase on July 12? Blank \#4: What sales revenue ($) results from the selling transaction on July 17? b) Calculate Sunshine Pet Ltd.'s gross profit. Present your answer as plain number. Blank \#5: What is the gross profit (\$) for the month of July? c) Disregard your own calculations of the cost of goods sold and assume they are \$956. Calculate the gross profit margin (i.e., gross profit percentage). Round the final result to 1 digit after the comma for the \%-value, for example: for 34.57% enter 34.6 without \%-sign. Blank \#6: What is the gross profit margin for July (considering provided CoGS)? Required format for entering numbers: only enter plain amounts, no $-signs or commas. Round final results to total \$-amounts. Sunshine Pets Ltd. holds beginning inventory of 14 bags of health science cat food at a cost of $30 each, as at July 1 . During the month of July, the company has recorded the following purchases and sales (see table below). Sunshine Pets is using the perpetual inventory method. Requirement: Solve the following questions on paper. Then, fill in the Blanks below. a) Determine the cost of goods sold and the cost of the ending inventory using the first-in first-out (FIFO) cost formula. Blank \#1: What is the ending inventory cost (\$) after purchase on July 2? Blank \#2: How many units of inventory are recorded in the books after the selling transaction on July 10 ? Blank \#3: What is the ending inventory cost (\$) after purchase on July 12? Blank \#4: What sales revenue ($) results from the selling transaction on July 17? b) Calculate Sunshine Pet Ltd.'s gross profit. Present your answer as plain number. Blank \#5: What is the gross profit (\$) for the month of July? c) Disregard your own calculations of the cost of goods sold and assume they are \$956. Calculate the gross profit margin (i.e., gross profit percentage). Round the final result to 1 digit after the comma for the \%-value, for example: for 34.57% enter 34.6 without \%-sign. Blank \#6: What is the gross profit margin for July (considering provided CoGS)? Required format for entering numbers: only enter plain amounts, no $-signs or commas. Round final results to total \$-amounts