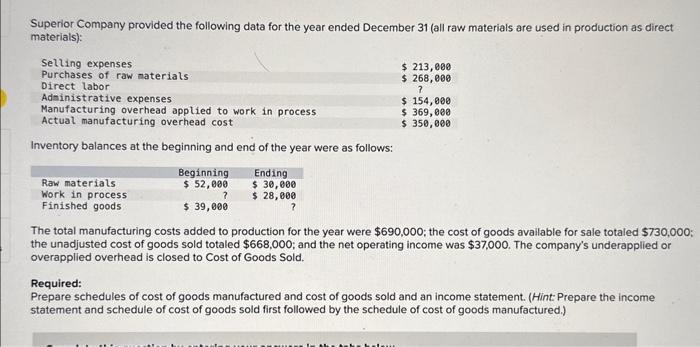

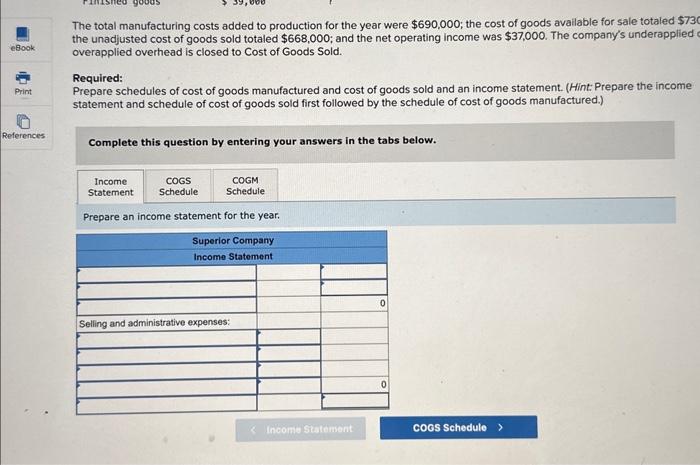

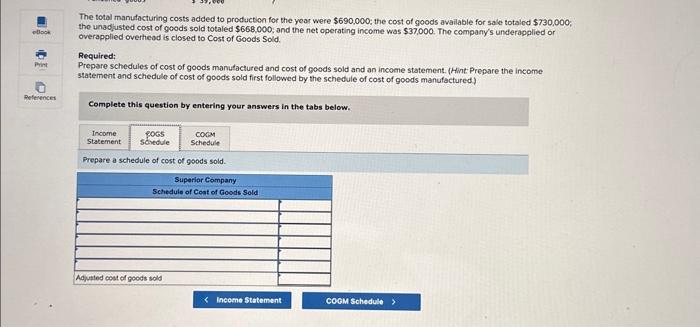

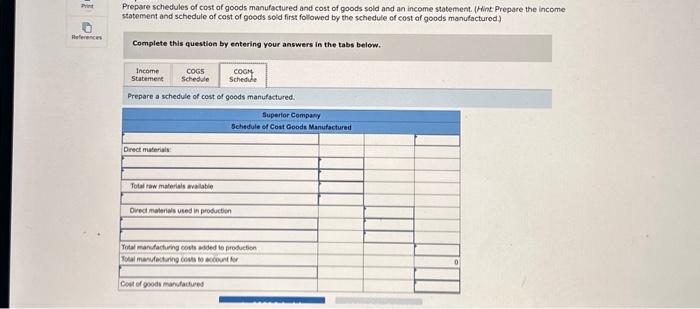

Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials: Inventory balances at the beginning and end of the year were as follows: The total manufacturing costs added to production for the year were $690,000; the cost of goods available for sale totaled $730,000 the unadjusted cost of goods sold totaled $668,000; and the net operating income was $37,000. The company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured.) The total manufacturing costs added to production for the year were $690,000; the cost of goods avallable for sale totaled $73 the unadjusted cost of goods sold totaled $668,000; and the net operating income was $37,000. The company's underapplied overapplied overhead is closed to Cost of Goods Sold. Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured.) Complete this question by entering your answers in the tabs below. Prepare an income statement for the year. The total manufacturing costs added to production for the year were $690,000; the cost of goods available for sale totaled $730,000; the unad,usted cost of geods sold totaled $668,000, and the net cperating income was $37,000. The company's underapplied or overapplied overheod is clesed to Cost of Goods Sold. Required; Prepare schedules of cost of goods manutactured and cost of goods sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of gocds manufactured) Complete this question by entering your answers in the tabs below. Prepare a schedule of cost of goods sold. Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint Prepare the income statement and schedule of cost of goods sold first followed by the schedule of cost of goods manufactured) Complete this question by entering your answers in the tabs below. Prepare a schedule of cost of goods manufactured