Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SuperStores, Inc is considering expanding retail operations. Project X involves opening a new store in a nearby city, while Project Y involves upgrading the company's

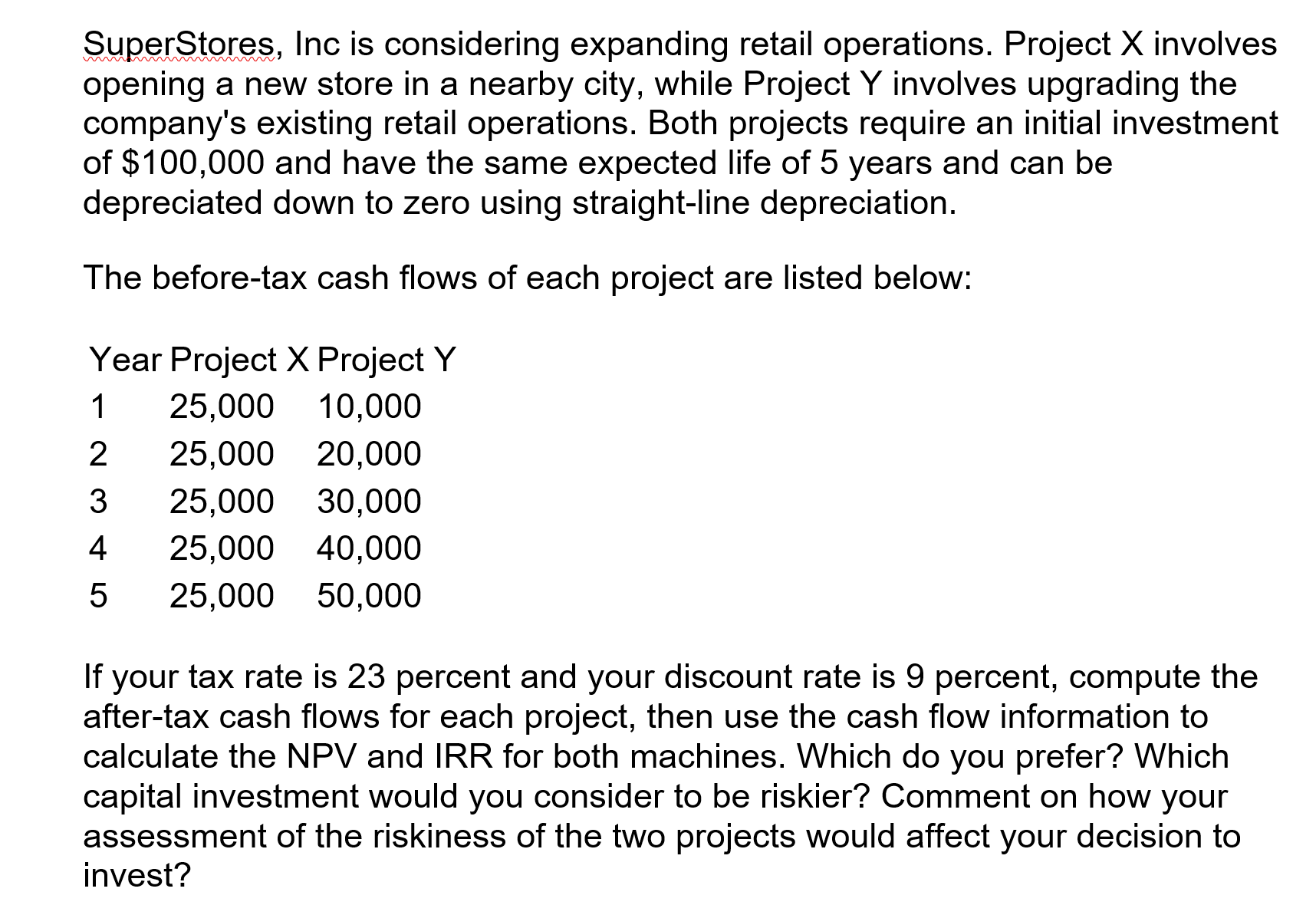

SuperStores, Inc is considering expanding retail operations. Project X involves opening a new store in a nearby city, while Project Y involves upgrading the company's existing retail operations. Both projects require an initial investment of $100,000 and have the same expected life of 5 years and can be depreciated down to zero using straight-line depreciation. The before-tax cash flows of each project are listed below: If your tax rate is 23 percent and your discount rate is 9 percent, compute the after-tax cash flows for each project, then use the cash flow information to calculate the NPV and IRR for both machines. Which do you prefer? Which capital investment would you consider to be riskier? Comment on how your assessment of the riskiness of the two projects would affect your decision to invest

SuperStores, Inc is considering expanding retail operations. Project X involves opening a new store in a nearby city, while Project Y involves upgrading the company's existing retail operations. Both projects require an initial investment of $100,000 and have the same expected life of 5 years and can be depreciated down to zero using straight-line depreciation. The before-tax cash flows of each project are listed below: If your tax rate is 23 percent and your discount rate is 9 percent, compute the after-tax cash flows for each project, then use the cash flow information to calculate the NPV and IRR for both machines. Which do you prefer? Which capital investment would you consider to be riskier? Comment on how your assessment of the riskiness of the two projects would affect your decision to invest Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started