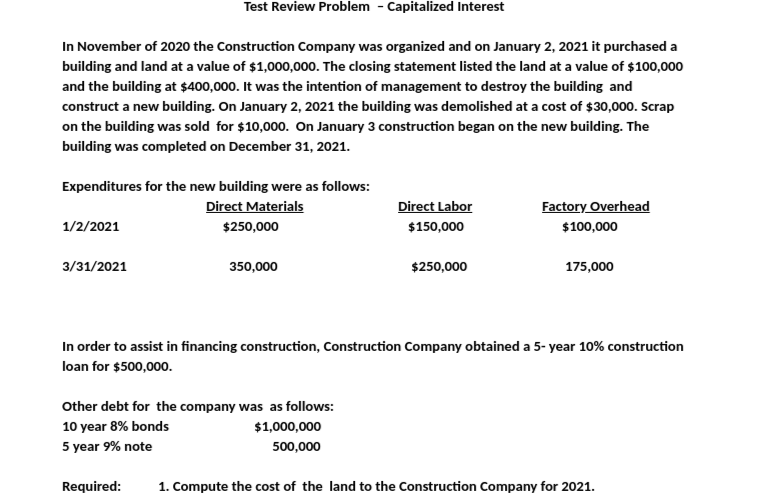

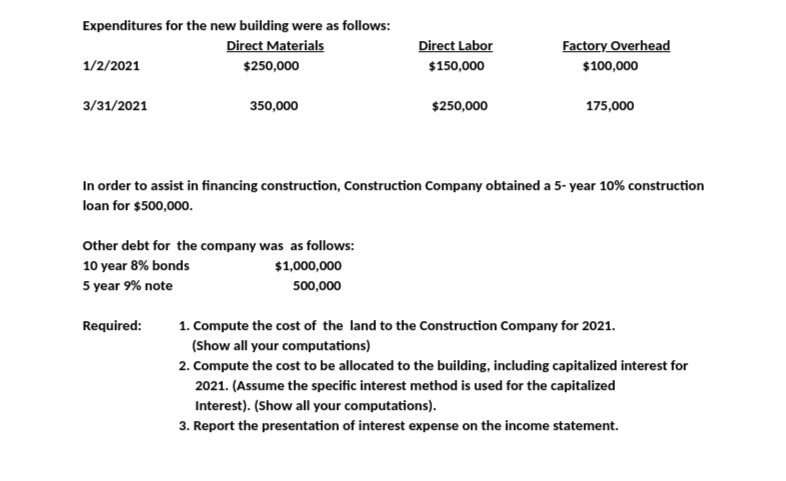

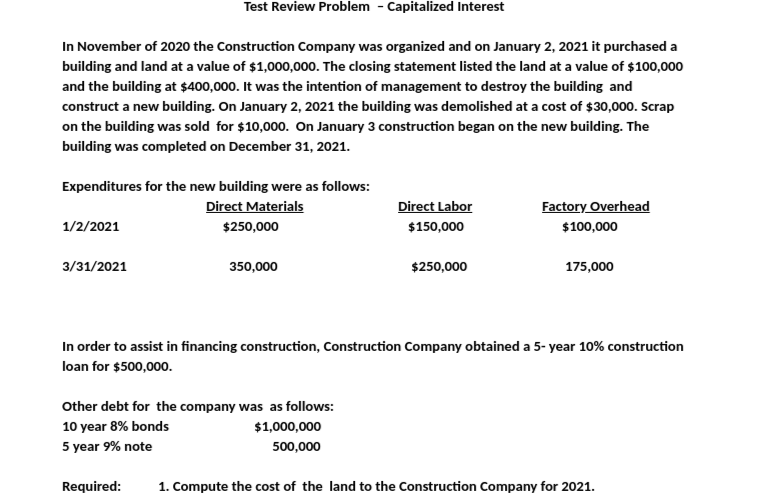

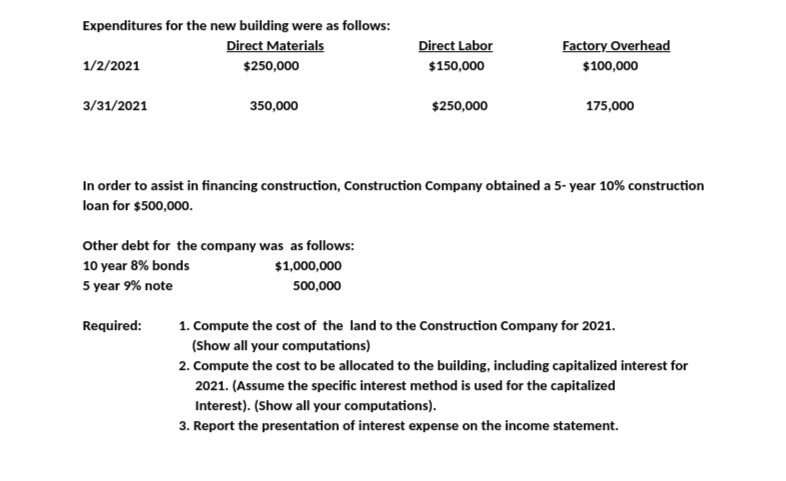

Test Review Problem - Capitalized Interest In November of 2020 the Construction Company was organized and on January 2, 2021 it purchased a building and land at a value of $1,000,000. The closing statement listed the land at a value of $100,000 and the building at $400,000. It was the intention of management to destroy the building and construct a new building. On January 2, 2021 the building was demolished at a cost of $30,000. Scrap on the building was sold for $10,000. On January 3 construction began on the new building. The building was completed on December 31, 2021. Expenditures for the new building were as follows: Direct Materials 1/2/2021 $250,000 Direct Labor $150,000 Factory Overhead $100,000 3/31/2021 350,000 $250,000 175,000 In order to assist in financing construction, Construction Company obtained a 5-year 10% construction loan for $500,000. Other debt for the company was as follows: 10 year 8% bonds $1,000,000 5 year 9% note 500,000 Required: 1. Compute the cost of the land to the Construction Company for 2021. Expenditures for the new building were as follows: Direct Materials 1/2/2021 $250,000 Direct Labor $150,000 Factory Overhead $100,000 3/31/2021 350,000 $250,000 175,000 In order to assist in financing construction, Construction Company obtained a 5-year 10% construction loan for $500,000 Other debt for the company was as follows: 10 year 8% bonds $1,000,000 5 year 9% note 500,000 Required: 1. Compute the cost of the land to the Construction Company for 2021. (Show all your computations) 2. Compute the cost to be allocated to the building, including capitalized interest for 2021. (Assume the specific interest method is used for the capitalized Interest). (Show all your computations). 3. Report the presentation of interest expense on the income statement. Test Review Problem - Capitalized Interest In November of 2020 the Construction Company was organized and on January 2, 2021 it purchased a building and land at a value of $1,000,000. The closing statement listed the land at a value of $100,000 and the building at $400,000. It was the intention of management to destroy the building and construct a new building. On January 2, 2021 the building was demolished at a cost of $30,000. Scrap on the building was sold for $10,000. On January 3 construction began on the new building. The building was completed on December 31, 2021. Expenditures for the new building were as follows: Direct Materials 1/2/2021 $250,000 Direct Labor $150,000 Factory Overhead $100,000 3/31/2021 350,000 $250,000 175,000 In order to assist in financing construction, Construction Company obtained a 5-year 10% construction loan for $500,000. Other debt for the company was as follows: 10 year 8% bonds $1,000,000 5 year 9% note 500,000 Required: 1. Compute the cost of the land to the Construction Company for 2021. Expenditures for the new building were as follows: Direct Materials 1/2/2021 $250,000 Direct Labor $150,000 Factory Overhead $100,000 3/31/2021 350,000 $250,000 175,000 In order to assist in financing construction, Construction Company obtained a 5-year 10% construction loan for $500,000 Other debt for the company was as follows: 10 year 8% bonds $1,000,000 5 year 9% note 500,000 Required: 1. Compute the cost of the land to the Construction Company for 2021. (Show all your computations) 2. Compute the cost to be allocated to the building, including capitalized interest for 2021. (Assume the specific interest method is used for the capitalized Interest). (Show all your computations). 3. Report the presentation of interest expense on the income statement