Question: supply chain mangment case study answer the qustions Industrial Engineering and Engineering Management Department 0405433: Supply Chain Management Spring 2021/2022 Instructor: Dr. Ridvan Aydin Date:

supply chain mangment

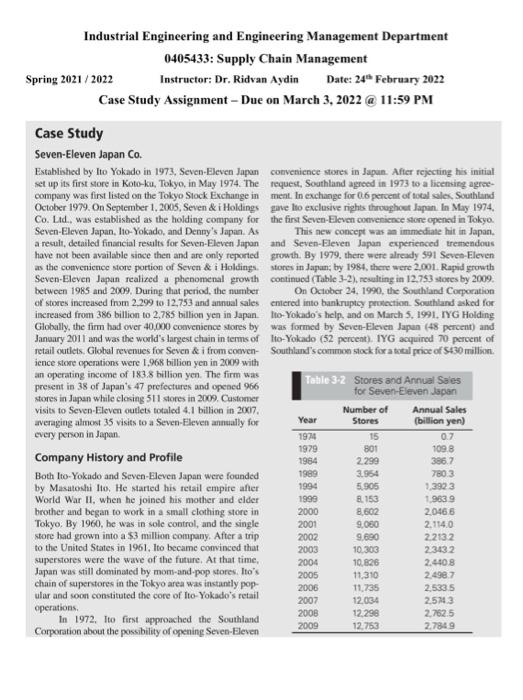

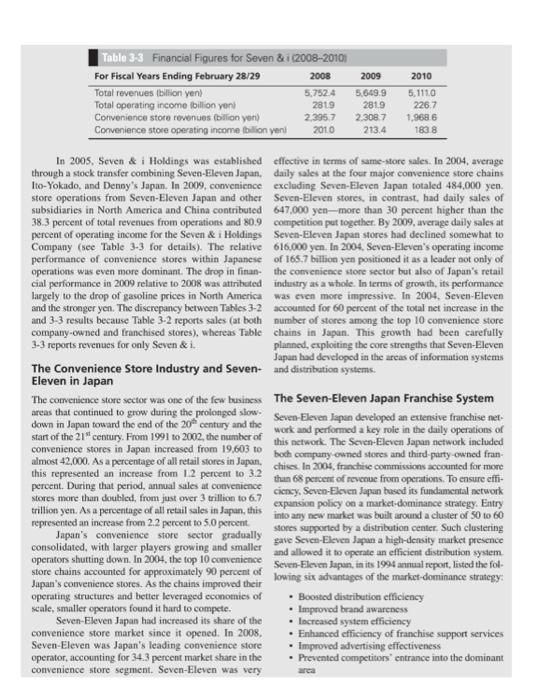

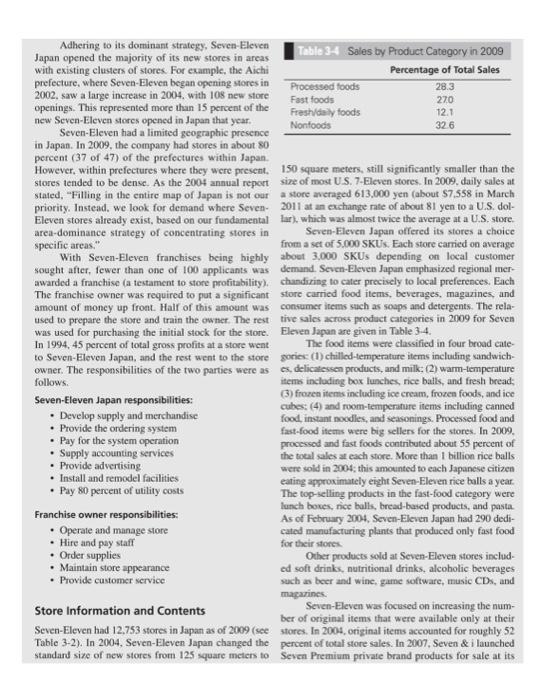

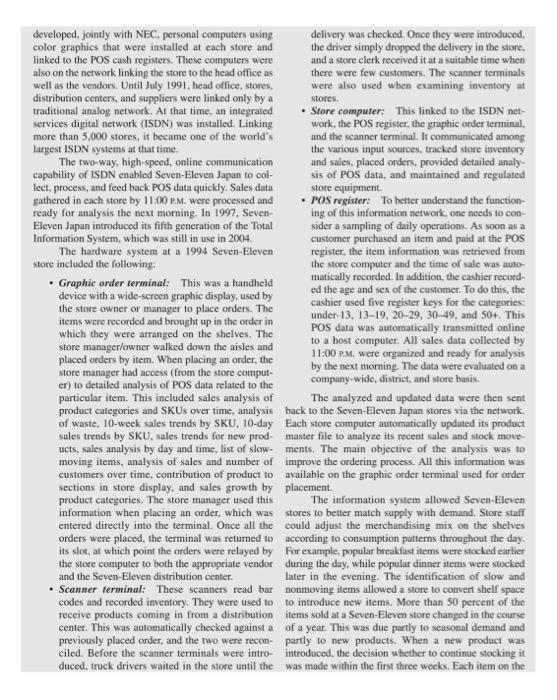

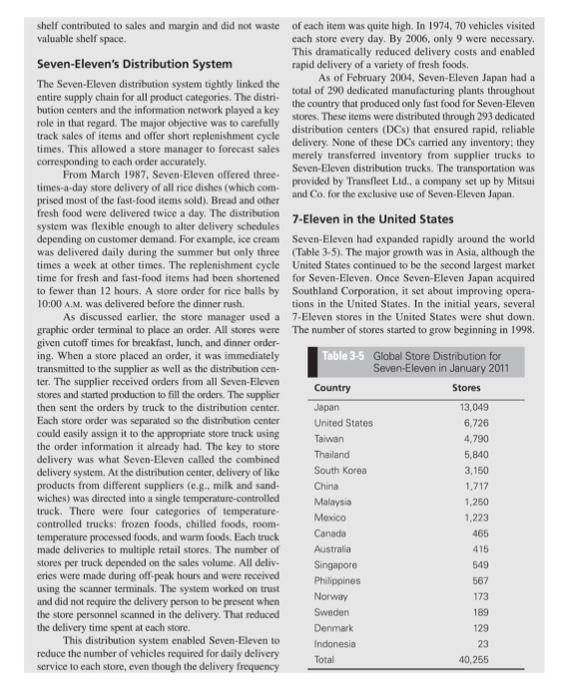

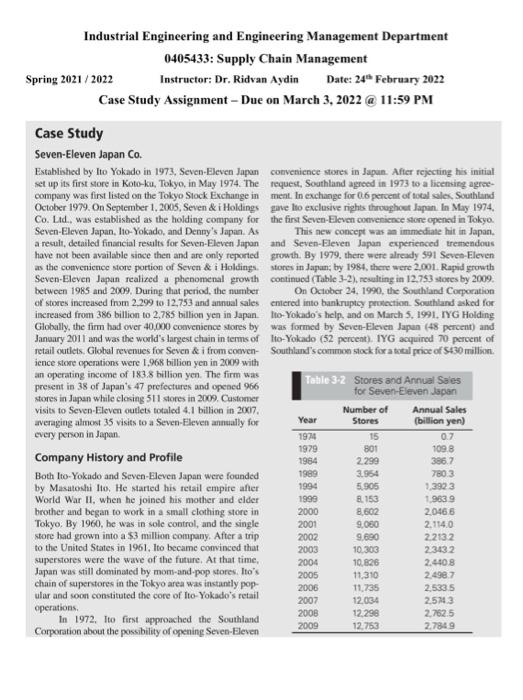

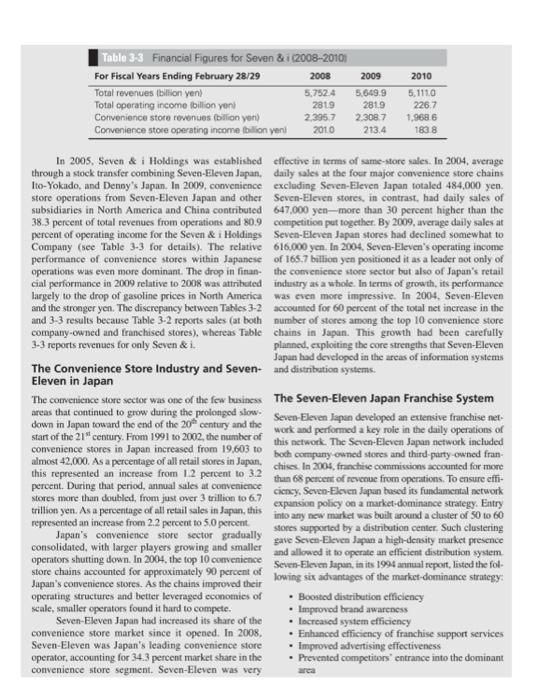

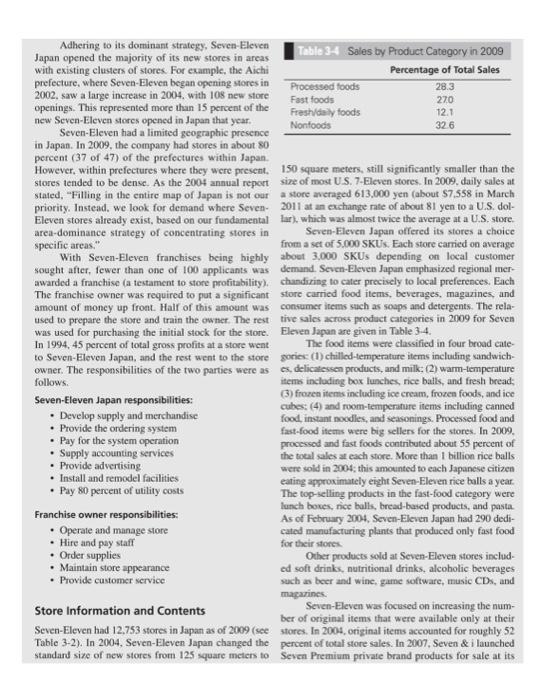

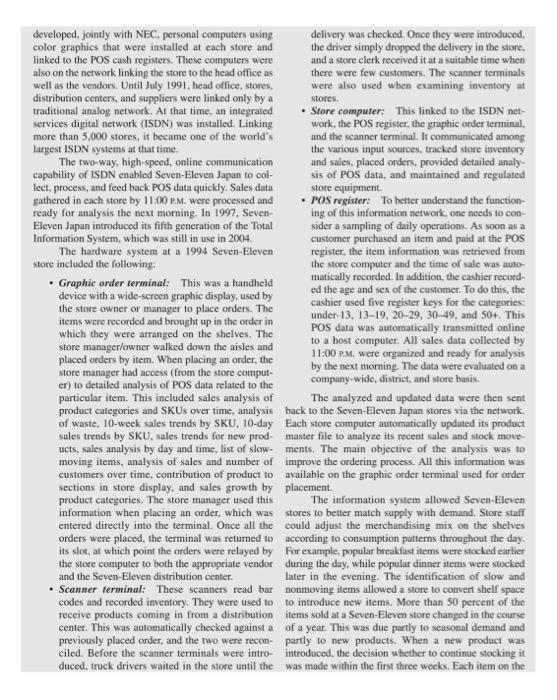

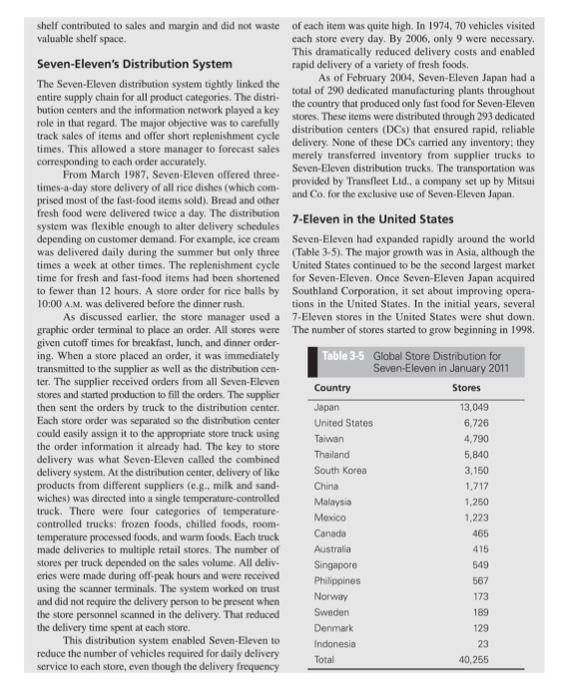

Industrial Engineering and Engineering Management Department 0405433: Supply Chain Management Spring 2021/2022 Instructor: Dr. Ridvan Aydin Date: 24 February 2022 Case Study Assignment - Due on March 3, 2022 @ 11:59 PM Case Study Seven-Eleven Japan Co. Established by Ito Yokado in 1973, Seven-Eleven Japan convenience stores in Japan. After rejecting his initial set up its first store in Koto-ku, Tokyo, in May 1974. The request, Southland agreed in 1973 to a licensing agree- company was first listed on the Tokyo Stock Exchange in ment. In exchange for 0.6 percent of total sales Southland October 1979. On September 1, 2005, Seven & i Holdings give to exclusive rights throughout Japan. In May 1974, Co. Ltd., was established as the holding company for the first Seven-Eleven convenience store opened in Tokyo. Seven-Eleven Japan, Ito-Yokado, Denny's Japan. As This new concept was an immediate hit in Japan. a result, detailed financial results for Seven-Eleven Japan and Seven-Eleven Japan experienced tremendous have not been available since then and are only reported growth. By 1979. there were already 591 Seven Eleven as the convenience store portion of Seven & i Holdings stores in Japan, by 1984, there were 2.001. Rapid growth Seven-Eleven Japan realized a phenomenal growth continued (Table 3-2), nesulting in 12.753 stores by 2009 between 1985 and 2009. During that period, the number On October 24, 1990, the Southland Corporation of stores increased from 2.299 to 12,753 and annual sales entered into bankruptcy protection Southland asked for increased from 386 billion to 2.785 billion yen in Japan. tro-Yokado's help, and on March 5. 1991. IYG Holding Globally, the firm had over 40,000 convenience Stores by was formed by Seven-Eleven Japan (48 percent) and January 2011 and was the world's largest chain in terms of Ito-Yokado (52 percent). IYG acquired 70 percent of retail outlets. Global revenues for Seven & i from conven- Southland's common stock forstal price of 5430 million. ience store operations were 1.968 billion yen in 2009 with an operating income of 183.8 billion yen. The firm was present in 38 of Japan's 47 prefectures and opened 966 Table 3-2 Stores and Annual Sales stores in Japan while closing 511 stores in 2009. Customer for Seven-Eleven Japan visits to Seven-Eleven outlets totaled 4.1 billion in 2017. Number of Annual Sales averaging almost 35 visits to a Seven-Eleven annually for Year Stores (billion yen) every person in Japan 1974 15 0.7 1979 801 1098 Company History and Profile 1984 2.299 3862 Both lto-Yokado and Seven-Eleven Japan were founded 1989 3.954 7803 by Masatoshi Ito. He started his retail empire after 1994 5.905 7.3923 World War II, when he joined his mother and elder 1999 B. 153 19839 brother and began to work in a small clothing store in 2000 8,602 20466 Tokyo. By 1960, he was in sole control, and the single 2001 9,080 2.114.0 store had grown into a $3 million company. After a trip 2002 9.690 22132 to the United States in 1961. Ito became convinced that 2003 10.303 23132 superstores were the wave of the future. At that time, 2004 10.826 2.4408 Japan was still dominated by mom-and-pop stores. Ito's 2005 11,310 2.4987 chain of superstores in the Tokyo area was instantly pop 2006 11,735 2.533.5 ular and soon constituted the core of Ito Yokado's retail 2007 12.034 2.5743 operations 2008 12.298 In 1972. Ito first approached the Southland 2.7625 2009 12.763 27849 Corporation about the possibility of opening Seven-Eleven Tablo 3-3 Financial Figures for Seven & 1 (2008-20101 For Fiscal Years Ending February 28/29 2008 Total revenues (billion yeni 5,7524 Total operating income billion yeni 2819 Convenience store revenues billion yen) 2.3957 Convenience store operating income billion yeni 2010 2009 5,649.9 2819 2.3087 213.4 2010 5.1110 226.7 1.9686 183.8 In 2005, Seven & i Holdings was established effective in terms of same-store sales. In 2004, average through a stock transfer combining Seven-Eleven Japan. daily sales at the four major convenience store chains Ito-Yokado, and Denny's Japan. In 2009, convenience excluding Seven-Eleven Japan totaled 484,000 yen. store operations from Seven-Eleven Japan and other Seven-Eleven stores, in contrast, had daily sales of subsidiaries in North America and China contributed 647,000 yen-more than 30 percent higher than the 38.3 percent of total revenues from operations and 809 competition put together. By 2009, average daily sales at percent of operating income for the Seven & Holdings Seven-Eleven Japan stores had declined somewhat to Company (see Table 3-3 for details). The relative 616,000 yen. In 2004. Seven-Eleven's operating income performance of convenience stores within Japanese of 165.7 billion yen positioned it as a leader not only of operations was even more dominant. The drop in finan- the convenience store sector but also of Japan's retail cial performance in 2009 relative to 2008 was attributed industry as a whole. In terms of growth, its performance largely to the drop of gasoline prices in North America was even more impressive. In 2004. Seven-Eleven and the stronger yen. The discrepancy between Tables 3-2 accounted for 60 percent of the total net increase in the and 3-3 results because Table 3-2 reports sales (at both number of stores among the top 10 convenience store company-owned and franchised stores), whereas Table chains in Japan. This growth had been carefully 3-3 reports revenues for only Seven & i. planned, exploiting the core strengths that Seven-Eleven Japan had developed in the areas of information systems The Convenience Store Industry and Seven- and distribution systems. Eleven in Japan The convenience store sector was one of the few business The Seven-Eleven Japan Franchise System areas that continued to grow during the prolonged Seven-Eleven Japan developed an extensive franchise net- down in Japan toward the end of the 20 century and the work and performed a key role in the daily operations of start of the 21" century. From 1991 to 2002, the number of this network. The Seven-Eleven Japan network included convenience stores in Japan increased from 19,603 to almost 42,000. As a percentage of all retail stores in Japan, chises. In 2004, franchise commissions accounted for more both company owned stores and third party owned fran- this represented an increase from 1.2 percent to 3.2 thun 68 percent of revenue from operations. To ensure effi- percent. During that period, annual sales at convenience stores more than doubled, from just over 3 trillion to 67 ciency Seven-Eleven Japan based its fundamental network trillion yen. As a percentage of all retail sales in Japan, this into any new market was built around a cluster of 0 to 60 expansion policy on a market-dominance strategy. Entry represented an increase from 2.2 percent to 5.0 percent Japan's convenience store sector gradually gave Seven Eleven Japan a high-density market presence stores supported by a distribution center. Such clustering consolidated, with larger players growing and smaller operators shutting down. In 2004, the top 10 convenience Seven Eleen Japan, in its 1996 annual report, listed the fol and allowed it to operate an efficient distribution system store chains accounted for approximately 90 percent of Japan's convenience stores. As the chains improved their lowing six advantages of the market dominance strategy operating structures and better leveraged economies of Boosted distribution efficiency scale, smaller operators found it hard to compete. Improved brand awareness Seven-Eleven Japan had increased its share of the Increased system efficiency convenience store market since it opened. In 2008. Enhanced efficiency of franchise support services Seven-Eleven was Japan's leading convenience store Improved advertising effectiveness operator, accounting for 34.3 percent market share in the Prevented competitors' entrance into the dominant convenience store segment. Seven-Eleven was very Adhering to its dominant strategy, Seven Eleven Japan opened the majority of its new stores in areas Table 34 Sales by Product Category in 2009 with existing clusters of stores. For example, the Aichi Percentage of Total Sales prefecture, where Seven-Eleven began opening stores in Processed foods 28.3 2002. saw a large increase in 2004. with 108 new store Fast foods 270 openings. This represented more than 15 percent of the 12.1 new Seven-Eleven stores opened in Japan that year. Fresh/day foods Nonfoods 326 Seven-Eleven had a limited geographic presence in Japan. In 2009, the company had stores in about 80 percent (37 of 47) of the prefectures within Japan. However, within prefectures where they were present. 150 square meters, still significantly smaller than the stores tended to be dense. As the 2004 annual report size of most U.S. 7-Eleven stores. In 2009, daily sales at stated. "Filling in the entire map of Japan is not our a store averaged 613.000 yen (about $7.558 in March priority. Instead, we look for demand where Seven 2011 at an exchange rate of about 81 yen to a U.S. dol- Eleven stores already exist, based on our fundamental lar), which was almost twice the average at a U.S.store area-dominance strategy of concentrating stores in Seven-Eleven Japan offered its stores a soice specific areas." from a set of 5.000 SKUs. Each store carried on average With Seven-Eleven franchises being highly about 3,000 SKUs depending on local customer sought after, fewer than one of 100 applicants was demand. Seven-Eleven Japan emphasized regional mer awarded a franchise (a testament to store profitability). chandiring to cater precisely to local preferences. Each The franchise owner was required to put a significant store carried food items, beverages, magazines, and amount of money up front. Hall of this amount was consumer items such as soaps and detergents. The rela- used to prepare the store and train the owner. The rest tive sales across product categories in 2009 for Seven was used for purchasing the initial stock for the store. Eleven Japan are given in Table 3-4. In 1994, 45 percent of total gross profits at a store went The food items were classified in four broad cate- to Seven-Eleven Japan, and the rest went to the store gories (1) chilled-temperature items including sandwich owner. The responsibilities of the two parties were as cs, delicatessen products, and milk: (2) warm-temperature follows items including box lunches, rice balls, and fresh bread: (3) frozen items including ice cream, frozen foods, and ice Seven-Eleven Japan responsibilities: cubes: (4) and room-temperature items including canned Develop supply and merchandise food instant noodles, and seasonings. Processed food and Provide the ordering system fast-food items were big sellers for the stores. In 2009. Pay for the system operation processed and fast foods contributed about 55 percent of Supply accounting services the total sales at each store. More than 1 billion rice balls Provide advertising were sold in 2004, this amounted to each Japanese citizen Install and remodel facilities eating approximately eight Seven-Eleven rice balls a year. Pay 80 percent of utility costs The top-selling products in the fast-food category were lunch boxes, rice halls, bread-based products, and pasta. Franchise owner responsibilities: As of February 2004, Seven-Eleven Japan had 290 dedi- Operate and manage store cated manufacturing plants that produced only fast food Hire and pay staff for their stores Order supplies Other products sold at Seven-Eleven stores includ- Maintain store appearance ed soft drinks, nutritional drinks, alcoholic beverages Provide customer service such as beer and wine, game software, music CDs, and magazines Store Information and Contents Seven-Eleven was focused on increasing the num- ber of original items that were available only at their Seven-Eleven had 12.753 stores in Japan as of 2009 (sce stores. In 2004 original items accounted for roughly 52 Table 3-2). In 2004, Seven-Eleven Japan changed the percent of total store sales. In 2007, Seven & i launched Standard size of new stores from 125 square meters to Seven Premium private brand products for sale at its stores. By February 2010, Seven Premium offered customers. A survey by eBook (a joint venture among 1,035 SKUs, and this number was expected to grow in Softbank. Seven-Eleven Japan. Yahoo!Japan, and the future. Private brand products were sold across all Tohan, a publisher) discovered that 92 percent of its cus- store formats and were viewed by the company as an tomers preferred to pick up their online purchases at the important part of the expansion of synergies across its local convenience store, rather than have them delivered various retail formats to their homes. This was understandable given the frequency with which Japanese customers visit their Store Services local convenience store; 7dream hoped to build on this Besides products, Seven-Eleven Japan gradually added a preference along with the synergies from the existing distribution system variety of services that customers could obtain at its stores. The first service, added in October 1987, was the In March 2007. Seven-Eleven Japun introduced in-store payment of Tokyo Electric Power bills. The enabled customers to buy products that were typically "Otoriyose-bin" or Internet shopping. The service company later expanded the set of utilities for which customers could pay their bills in the stores to include not available at the retail stores. Customers were allowed to order on the Web with both pick-up and payment at gas, insurance premiums, and telephone. With more convenient operating hours and locations than banks or Seven-Eleven stores. There was no shipping fee charged other financial institutions, the bill payment service for this service. The company built Seven Net Shopping its Internet site aimed at combining the group's stores attracted millions of additional customers every year. In and Internet services, In April 2007, "manaco" electronic April 1994. Seven-Eleven Japan began accepting install- ment payments on behalf of credit companies. It started money was offered in Seven-Eleven stores. The service selling ski lift pass vouchers in November 1994. In allowed customers to prepay and use a card or cell phone to make payments. The service was offered as a conven- 1995, it began to accept payment for mail-order purchas- es. This was expanded to include payment for Internet ience to customers making small purchases and was also shopping in November 1999. In August 2000, a meal a reward system offering one yen worth of points for delivery service company, Seven- Meal Service Co. Lod. 2007. nanaco was used by customers to make more than every 100 yen spent by the customer. By the end of was established to serve the aging Japanese population Seven Bank was set up as the core operating company 30 million payments each month. for Seven & i in financial services. By 2009. virtually the number of women working outside the home (Seven Given Japan's aging population and an increase in every Seven Eleven Japan sore had an ATM installed with Seven Bank having more than 14,000 ATMs. The Eleven estimated that in 2009 more than 70 percent of women in their 40s worked outside the home). Seven company averaged 114 transactions per ATM per day Other services offered at stores include photo to better serve its customers. The company attempted to Eleven wanted to exploit its "close by convenient stores copying, ticket sales (including baseball games, express buses, and music concerts) using multifunctional do this by offering "mcal solutions that speeded up copiers, and being a pick-up location for parcel delivery cooking at home and services like "home meal delivery companies that typically do not leave the parcel outside Seven-Eleven Japan's Integrated Store if the customer is not at home. In 2010, the convenience stores also started offering some government services Information System such as providing certificates of residence. The major From its start. Seven-Eleven Japan sought to simplify its thrust for offering these services was to take advantage operations by using advanced information technology. of the convenient locations of Seven-Eleven stores in Seven-Eleven Japan attributed a significant part of its Japan. Besides providing additional revenue, the servic- success to the Total Information System installed in es also got customers to visit the stores more frequently, every outlet and linked to headquarters, suppliers, and Several of these services exploited the existing Total the Seven-Eleven distribution centers. The first online Information System (see text following) in the store. network linking the head office, stores, and vendors was In February 2000, Seven-Eleven Japan established established in 1979, though the company did not collect 7dream.com, an e-commerce company. The goal was to point-of-sales (POS) information at that time. In 1982. exploit the existing distribution system and the fact that Seven-Eleven became the first company in Japan to stores were easily accessible to most Japanese, Stores introduce a POS system comprising POS cash registers served as drop-off and collection points for Japanese and terminal control equipment. In 1985, the company developed, jointly with NEC, personal computers using delivery was checked. Once they were introduced, color graphics that were installed at cach store and the driver simply dropped the delivery in the store. linked to the POS cash registers. These computers were and a store clerk received it at a suitable time when also on the network linking the store to the head office as there were few customers. The scanner terminals well as the vendors. Until July 1991, head office, stores. were also used when examining inventory at distribution centers, and suppliers were linked only by a stores traditional analog network. At that time, an integrated Store computer: This linked to the ISDN net- services digital network (ISDN) was installed. Linking work, the POS register, the graphic order terminal. more than 5,000 stores, it became one of the world's and the scanner terminal. It communicated among largest ISDN systems at that time, the various input sources, tracked store inventory The two-way, high-speed, online communication and sales, placed orders, provided detailed analy- capability of ISDN enabled Seven-Eleven Japan to col- sis of POS data, and maintained and regulated lect, process, and feed back POS data quickly. Sales data store equipment gathered in cach store by 11:00 PM. were processed and POS register: To better understand the function ready for analysis the next morning. In 1997, Seven- ing of this information network, one needs to con- Eleven Japan introduced its fifth generation of the Total sider a sampling of daily operations. As soon as a Information System, which was still in use in 2004. customer purchased an item and paid at the POS The hardware system at a 1994 Seven-Eleven register, the item information was retrieved from store included the following: the store computer and the time of sale was auto- Graphic order terminal: This was a handheld matically recorded. In addition, the cashier record- device with a wide-screen graphic display, used by ed the age and sex of the customer. To do this, the the store owner or manager to place orders. The cashier used five register keys for the categories items were recorded and brought up in the order in under-13, 13-19, 20-29, 30-49 and 50+. This which they were arranged on the shelves. The POS data was automatically transmitted online store manager/owner walked down the aisles and to a host computer. All sales data collected by placed orders by item. When placing an order, the 11:00 P.M. were organized and ready for analysis by the next morning. The data were evaluated on a store manager had access from the store comput- er) to detailed analysis of POS data related to the company-wide, district, and store basis. particular item. This included sales analysis of The analyzed and updated data were then sent product categories and SKUs over time, analysis back to the Seven-Eleven Japan stores via the network of waste, 10-weck sales trends by SKU, 10-day Each store computer automatically updated its product sales trends by SKU, sales trends for new prod master file to analyze its recent sales and stock move ucts, sales analysis by day and time. list of slow- ments. The main objective of the analysis was to moving items, analysis of sales and number of improve the ordering process. All this information was customers over time, contribution of product to available on the graphic order terminal used for order sections in store display, and sales growth by placement product categories. The store manager used this The information system allowed Seven-Eleven information when placing an order, which was stores to better match supply with demand. Store staff entered directly into the terminal. Once all the could adjust the merchandising mix on the shelves orders were placed the terminal was returned to according to consumption patterns throughout the day. its slot, at which point the orders were relayed by For example, popular breakfast items were stocked earlier the store computer to both the appropriate vendor during the day, while popular dinner items were stocked and the Seven-Eleven distribution center. later in the evening. The identification of slow and Scanner terminal: These scanners read bar nonmoving items allowed a store to convert shelf space codes and recorded inventory. They were used to to introduce new items. More than 50 percent of the receive products coming in from a distribution items sold at a Seven-Eleven store changed in the course center. This was automatically checked against a of a year. This was due partly to seasonal demand and previously placed order, and the two were recon- partly to new products. When a new product was ciled. Before the scanner terminals were intro- introduced, the decision whether to continue stocking it duced, truck drivers waited in the store until the was made within the first three weeks. Each item on the shelf contributed to sales and margin and did not waste of each item was quite high. In 1974. 70 vehicles visited valuable shelf space cach store every day. By 2006, only 9 were necessary. This dramatically reduced delivery costs and enabled Seven-Eleven's Distribution System rapid delivery of a variety of fresh foods. The Seven-Eleven distribution system tightly linked the As of February 2004, Seven-Eleven Japan had a entire supply chain for all product categories. The distri: total of 290 dedicated manufacturing plants throughout bution centers and the information network played a key the country that produced only fast food for Seven-Eleven track sales of items and offer short replenishment cycle delivery. None of these DCs carried any inventory: they role in that regard. The major objective was to carefully stores. These items were distributed through 293 dedicated distribution centers (DCs) that ensured rapid, reliable times. This allowed a store manager to forecast sales merely transferred inventory from supplier trucks to corresponding to each order accurately, From March 1987, Seven-Eleven offered three. Seven-Eleven distribution trucks. The transportation was times a day store delivery of all tice dishes (which com provided by Transfleet Lad, a company set up by Mitsui prised most of the fast-food items sold). Bread and other and Co. for the exclusive use of Seven-Eleven Japan fresh food were delivered twice a day. The distribution 7-Eleven in the United States system was flexible enough to alter delivery schedules depending on customer demand. For example, ice cream Seven-Eleven had expanded rapidly around the world was delivered daily during the summer but only three (Table 3-5). The major growth was in Asia, although the times a week at other times. The replenishment cycle United States continued to be the second largest market time for fresh and fast-food items had been shortened for Seven-Eleven. Once Seven-Eleven Japan acquired to fewer than 12 hours. A store order for rice balls by Southland Corporation, it set about improving opera- 10:00 A.M. was delivered before the dinner rush tions in the United States. In the initial years, several As discussed earlier, the store manager used a 7-Eleven stores in the United States were shut down. graphic order terminal to place an order. All stores were The number of stores started to grow beginning in 1998, given cutoff times for breakfast, lunch, and dinner order- ing. When a store placed an order, it was immediately Table 3-5 Global Store Distribution for transmitted to the supplier as well as the distribution cen- Seven-Eleven in January 2011 ter. The supplier received orders from all Seven-Eleven stores and started production to fill the orders. The supplier Country Stores then sent the orders by truck to the distribution center Japan 13,049 Each store order was separated so the distribution center United States 6,726 could easily assign it to the appropriate store track using Taiwan 4.790 the order information it already had. The key to store delivery was what Seven-Eleven called the combined Thailand 5,840 delivery system. At the distribution center, delivery of like South Korea 3,150 products from different suppliers (e.g., milk and sand- China 1.717 wiches) was directed into a single temperature-controlled Malaysia 1.250 truck. There were four categories of temperature Mexico controlled trucks: frozen foods, chilled foods, room- 1.223 temperature processed foods, and warm foods. Each truck Canada 465 made deliveries to multiple retail stores. The number of Australia 415 Stores per truck depended on the sales volume. All deliv. Singapore 549 eries were made during off-peak hours and were received Philippines 567 using the scanner terminals. The system worked on trust and did not require the delivery person to be present when Norway 173 the store personnel scanned in the delivery. That reduced Sweden 189 the delivery time spent at each store Denmark 129 This distribution system enabled Seven-Eleven to Indonesia 23 reduce the number of vehicles required for daily delivery Total 40.255 service to each store, even though the delivery frequency Historically, the distribution structure in the United North American inventory turnover rate in 2004 was States was completely different from that in Japan. about 19, compared to more than 50 in Japan. This, how- Stores in the United States were replenished using direct ever, represented a significant improvement in North store delivery (DSD) by some manufacturers, with the American performance, where inventory turns in 1992 remaining products delivered by wholesalers. DSD were around 12. accounted for about half the total volume, with the rest coming from wholesalers. Study Questions With the goal of introducing "fresh" products in the United States, 7-Eleven introduced the concept of 1. A convenience store chain attempts to be responsive and provide customers with what they need, when they need it. combined distribution centers (CDCs) around 2000. By where they need it. What are some different ways that a 2003, 7-Eleven had 23 CDCs located throughout North convenience store supply chain can be responsive? What America supporting about 80 percent of the store net- are some risks in each case? work. CDCs delivered fresh items such as sandwiches, 2. Seven-Eleven's supply chain strategy in Japan can be bakery products, bread, produce, and other perishables described as attempting to micro-match supply and once a day. A variety of fresh-food suppliers sent prod- demand using rapid replenishment. What are some risks uct to the CDC throughout the day, where they were associated with this choice? sorted for delivery to stores at night. Requests from store 3. What has Seven-Eleven done in its choice of facility loca- managers were sent to the nearest CDC, and by 10:00 P.M., tion, inventory management, transportation, and information the products were en route to the stores. Relative to infrastructure to develop capabilities that support its supply chain strategy in Japan? Japan, a greater fraction of the food sold, especially hot food such as wings and pizza, was prepared in the store. 4. Seven-Eleven does not allow direct store delivery in Japan but has all products flow through its distribution center. Fresh-food sales in North America exceeded $450 What benefit does Seven-Eleven derive from this policy? million in 2003. During this period, DSD by manufac- When is direct store delivery more appropriate? turers and wholesaler delivery to stores also continued. 5. What do you think about the dream concept for Seven- This was a period when 7-Eleven worked very hard Eleven Japan? From a supply chain perspective, is it to introduce new fresh-food items with a goal of compet- likely to be more successful in Japan or the United ing more directly with the likes of Starbucks than with States? Why? traditional gas station food marts. 7-Eleven in the United 6. Seven-Eleven is attempting to duplicate the supply chain States had more than 63 percent of its sales from non- structure that has succeeded in Japan and the United States gasoline products compared to the rest of the industry, for with the introduction of CDCs. What are the pros and cons which this number was closer to 35 percent. The goal of this approach? Keep in mind that stores are also replen- ished by wholesalers and DSD by manufacturers. was to continue to increase sales in the fresh-food and 7. The United States has food service distributors that also fast-food categories with a special focus on hot foods. replenish convenience stores. What are the pros and cons In 2009, revenue in the United States and Canada to having a distributor replenish convenience stores versus totaled $16.0 billion, with about 63 percent coming from a company like Seven-Eleven managing its own distribu- merchandise and the rest from the sale of gasoline. The tion function

case study

answer the qustions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock