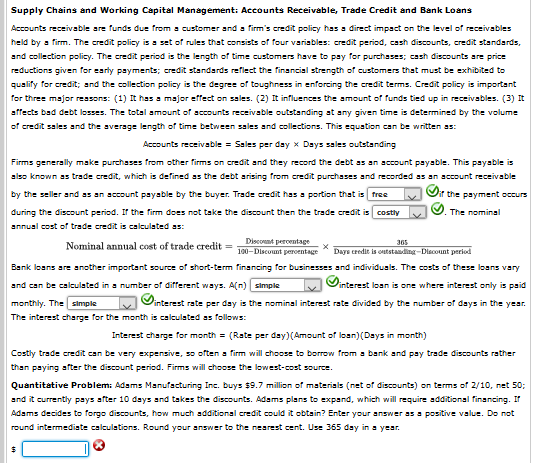

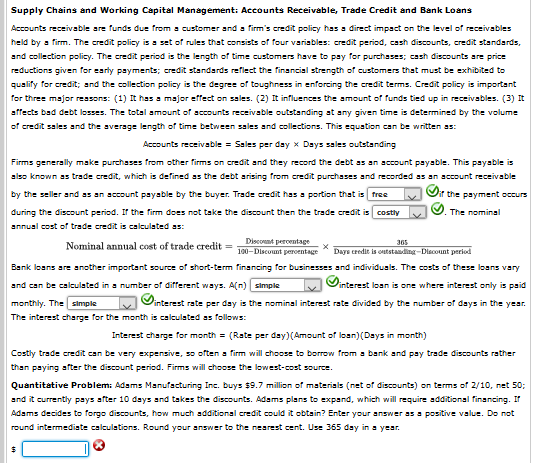

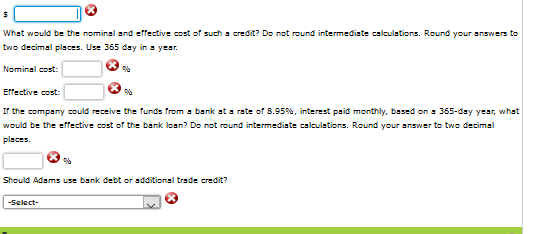

Supply Chains and Working Capital Management: Accounts Receivable, Trade Credit and Bank Loans Accounts receivable are funds due from customer nd firm's credit policy has direct impst on the level of receivables held by firm. The credit Policy is set of rules that consists of four variables: credit period, cash discounts, credit standards. nd collection policy. The credit period is the length of time customers havt to pay for purchases; cash discounts re price reductions given for early payments; credit standards reflect the financial strength of customers that must be exhibited to qualify for credit; and the collection polizy is the degree of toughness in enforcing the credit terms. Credit polizy is important for three major reasons: (1) It has ajor effect on sales. (2) It influences the ount of funds tied up in receivables. (3) It affects bad debt losses. The total ount of accounts receivable outstanding at ny given time is determined by the volume of credit salesnd the average length of time between salesnd collections. This equation can be written as: Accounts receivable Sales per day x Days sales outstanding Firms generally make purchases from other firms on credit and they record the debt s an account paysble. This payable also known as trade credit, which is defined as the debt rising from credit purchases nd recorded as n ccount receivable by the seller and as an account payable by the buyer. Trade credit has portion that is free during the discount period. Ir the firm does not take the discount then the trade credit is costly annual cost of trade credit is calculated as: the payment occurs The nominal Nominal annual cost of trade credit-sut Discoent percentage 100-Discount peroentage Bank loans renother important source of short-term financing for businessesnd individuals. The costs of these loans vary and can be clated in a number of different ways. A(n) simple monthly. The simple The interest charge for the month is calculated as follaw: interest loan is one where interst only is paid interest rate per day is the nominal interest rate divided by the number of days in the year. Interest charge for month (Rate per day)(Amount of loan)(Days in month) costly trade credit can be very expensive, so often firm will choose to borrow from bark nd pay trade discounts rather than payingfter the discount period. Firms will choose the lowest-cost source. Quantitative Problem: Adams Manufacturing Inc. buys 9.7 million of materias (net of discounts) on terms of 2/10, net 50 nd it currently pays after 10 daysnd takes the discounts. Adarns plens to expand, which will require additional financing. It Adams decides to forgo discounts, how rmuchdditional credit could it obtain? Enter your .nswer as positive value. Do not round intermediate calculations. Round your nswer to the nearest cent. Use 365 day in year. would be the nominal and effective cost or Round your answer your answers to to decimal places. Use 365 day in year. Effective cost r the company could receive the funds from bank st rate of 8.95%, interest paid monthly, based on 365-day year, what places Should Adams use bank debt or additional trade credit? Supply Chains and Working Capital Management: Accounts Receivable, Trade Credit and Bank Loans Accounts receivable are funds due from customer nd firm's credit policy has direct impst on the level of receivables held by firm. The credit Policy is set of rules that consists of four variables: credit period, cash discounts, credit standards. nd collection policy. The credit period is the length of time customers havt to pay for purchases; cash discounts re price reductions given for early payments; credit standards reflect the financial strength of customers that must be exhibited to qualify for credit; and the collection polizy is the degree of toughness in enforcing the credit terms. Credit polizy is important for three major reasons: (1) It has ajor effect on sales. (2) It influences the ount of funds tied up in receivables. (3) It affects bad debt losses. The total ount of accounts receivable outstanding at ny given time is determined by the volume of credit salesnd the average length of time between salesnd collections. This equation can be written as: Accounts receivable Sales per day x Days sales outstanding Firms generally make purchases from other firms on credit and they record the debt s an account paysble. This payable also known as trade credit, which is defined as the debt rising from credit purchases nd recorded as n ccount receivable by the seller and as an account payable by the buyer. Trade credit has portion that is free during the discount period. Ir the firm does not take the discount then the trade credit is costly annual cost of trade credit is calculated as: the payment occurs The nominal Nominal annual cost of trade credit-sut Discoent percentage 100-Discount peroentage Bank loans renother important source of short-term financing for businessesnd individuals. The costs of these loans vary and can be clated in a number of different ways. A(n) simple monthly. The simple The interest charge for the month is calculated as follaw: interest loan is one where interst only is paid interest rate per day is the nominal interest rate divided by the number of days in the year. Interest charge for month (Rate per day)(Amount of loan)(Days in month) costly trade credit can be very expensive, so often firm will choose to borrow from bark nd pay trade discounts rather than payingfter the discount period. Firms will choose the lowest-cost source. Quantitative Problem: Adams Manufacturing Inc. buys 9.7 million of materias (net of discounts) on terms of 2/10, net 50 nd it currently pays after 10 daysnd takes the discounts. Adarns plens to expand, which will require additional financing. It Adams decides to forgo discounts, how rmuchdditional credit could it obtain? Enter your .nswer as positive value. Do not round intermediate calculations. Round your nswer to the nearest cent. Use 365 day in year. would be the nominal and effective cost or Round your answer your answers to to decimal places. Use 365 day in year. Effective cost r the company could receive the funds from bank st rate of 8.95%, interest paid monthly, based on 365-day year, what places Should Adams use bank debt or additional trade credit