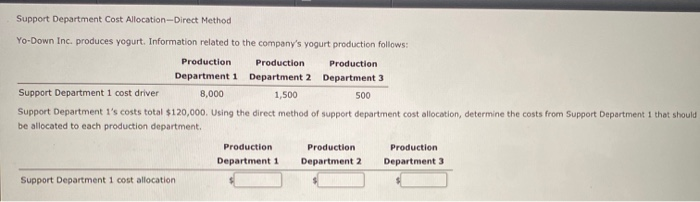

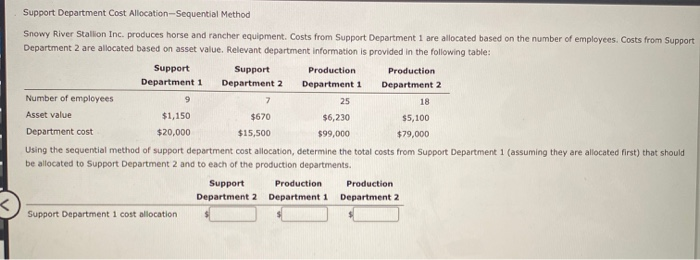

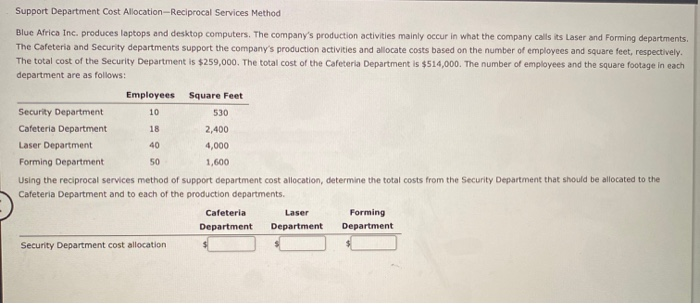

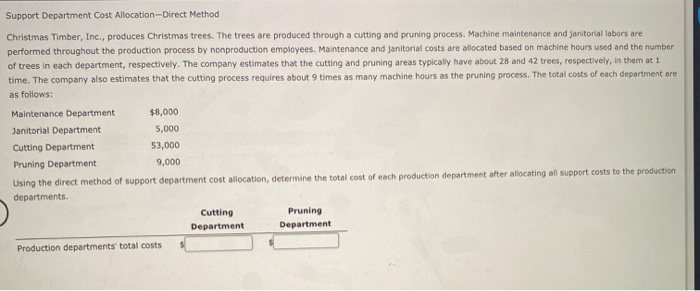

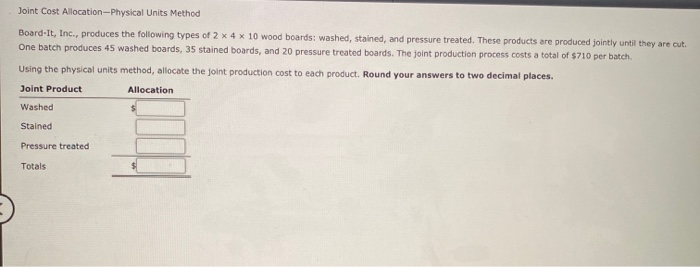

Support Department Cost Allocation-Direct Method Yo-Down Inc. produces yogurt. Information related to the company's yogurt production follows: Production Production Production Department 1 Department 2 Department 3 Support Department 1 cost driver 8,000 1,500 500 Support Department 1's costs total $120,000. Using the direct method of support department cost allocation, determine the costs from Support Department 1 that should be allocated to each production department, Production Production Production Department 1 Department 2 Department 3 Support Department 1 cost allocation Support Department Cost Allocation-Sequential Method Snowy River Stallion Inc. produces horse and rancher equipment. Costs from Support Department 1 are allocated based on the number of employees. Costs from Support Department 2 are allocated based on asset value. Relevant department information is provided in the following table: Support Support Production Production Department 1 Department 2 Department 1 Department 2 Number of employees 9 7 25 18 Asset value $1,150 $670 $6,230 $5,100 Department cost $20,000 $15,500 $99,000 $79,000 Using the sequential method of support department cost allocation, determine the total costs from Support Department 1 (assuming they are allocated first) that should be allocated to Support Department 2 and to each of the production departments. Support Production Production Department 2 Department 1 Department 2 Support Department 1 cost allocation Support Department Cost Allocation-Reciprocal Services Method Blue Africa Inc, produces laptops and desktop computers. The company's production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the company's production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is $259,000. The total cost of the Cafeteria Department is $514,000. The number of employees and the square footage in each department are as follows: Employees Square Feet Security Department 10 530 Cafeteria Department 18 2,400 Laser Department 4,000 Forming Department 50 1,600 Using the reciprocal services method of support department cost allocation, determine the total costs from the Security Department that should be allocated to the Cafeteria Department and to each of the production departments. Cafeteria Laser Forming Department Department Department Security Department cost allocation 40 Support Department Cost Allocation-Direct Method Christmas Timber, Inc., produces Christmas trees. The trees are produced through a cutting and pruning process. Machine maintenance and janitorial labors are performed throughout the production process by nonproduction employees. Maintenance and Janitorial costs are allocated based on machine hours used and the number of trees in each department, respectively. The company estimates that the cutting and pruning areas typically have about 28 and 42 trees, respectively, in them at 1 time. The company also estimates that the cutting process requires about 9 times as many machine hours as the pruning process. The total costs of each department are as follows: Maintenance Department $8,000 Janitorial Department 5,000 Cutting Department 53,000 Pruning Department 9,000 Using the direct method of support department cost allocation, determine the total cost of each production department after allocating all support costs to the production departments Cutting Department Pruning Department Production departments' total costs Joint Cost Allocation--Physical Units Method Board-It, Inc., produces the following types of 2 x 4 x 10 wood boards: washed, stained, and pressure treated. These products are produced jointly until they are cut. One batch produces 45 washed boards, 35 stained boards, and 20 pressure treated boards. The joint production process costs a total of $710 per batch. Using the physical units method, allocate the joint production cost to each product. Round your answers to two decimal places. Joint Product Washed Allocation Stained Pressure treated Totals