Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a couple in their early 30s is planning to buy a new HDB flat. The selling price of the HDB flat is $350,000.

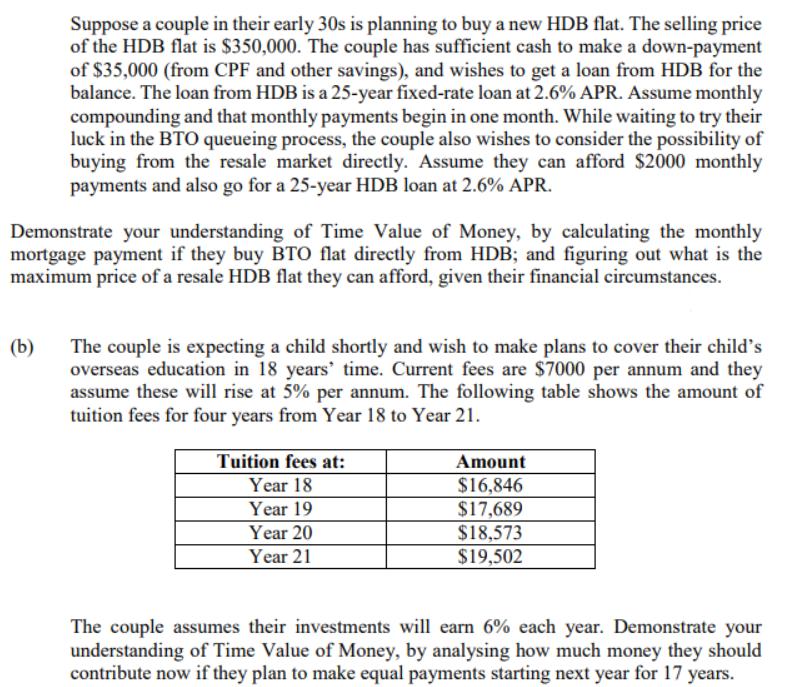

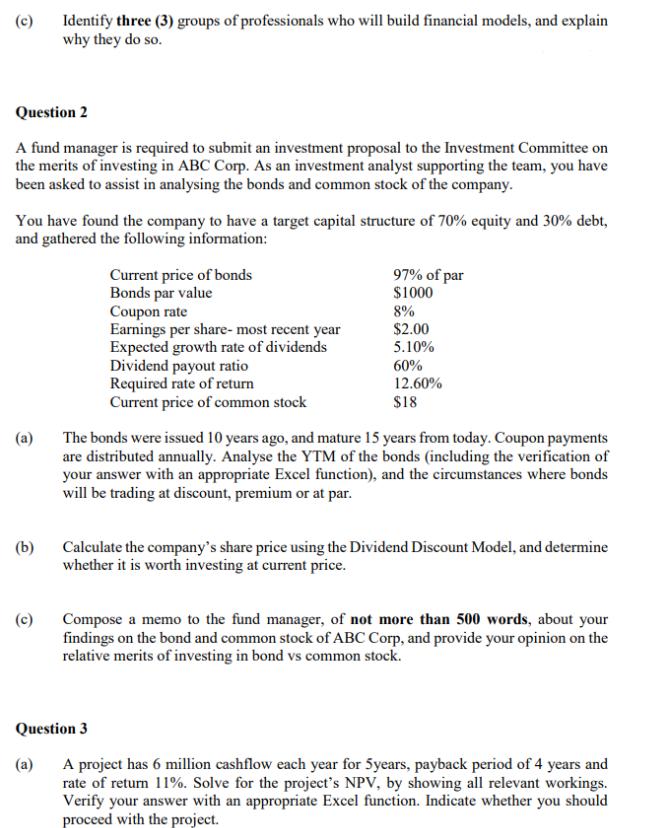

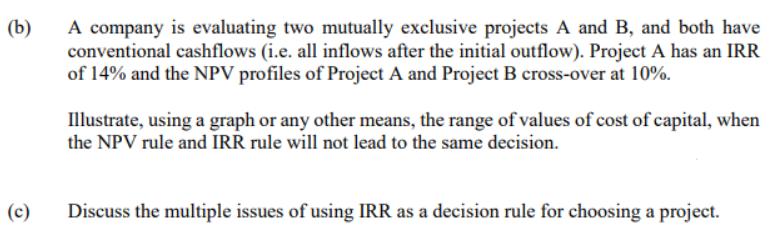

Suppose a couple in their early 30s is planning to buy a new HDB flat. The selling price of the HDB flat is $350,000. The couple has sufficient cash to make a down-payment of $35,000 (from CPF and other savings), and wishes to get a loan from HDB for the balance. The loan from HDB is a 25-year fixed-rate loan at 2.6% APR. Assume monthly compounding and that monthly payments begin in one month. While waiting to try their luck in the BTO queueing process, the couple also wishes to consider the possibility of buying from the resale market directly. Assume they can afford $2000 monthly payments and also go for a 25-year HDB loan at 2.6% APR. Demonstrate your understanding of Time Value of Money, by calculating the monthly mortgage payment if they buy BTO flat directly from HDB; and figuring out what is the maximum price of a resale HDB flat they can afford, given their financial circumstances. (b) The couple is expecting a child shortly and wish to make plans to cover their child's overseas education in 18 years' time. Current fees are $7000 per annum and they assume these will rise at 5% per annum. The following table shows the amount of tuition fees for four years from Year 18 to Year 21. Tuition fees at: Year 18 Year 19 Year 20 Year 21 Amount $16,846 $17,689 $18,573 $19,502 The couple assumes their investments will earn 6% each year. Demonstrate your understanding of Time Value of Money, by analysing how much money they should contribute now if they plan to make equal payments starting next year for 17 years. (c) Question 2 A fund manager is required to submit an investment proposal to the Investment Committee on the merits of investing in ABC Corp. As an investment analyst supporting the team, you have been asked to assist in analysing the bonds and common stock of the company. You have found the company to have a target capital structure of 70% equity and 30% debt, and gathered the following information: (a) Identify three (3) groups of professionals who will build financial models, and explain why they do so. (b) (c) Current price of bonds Bonds par value Coupon rate Earnings per share- most recent year Expected growth rate of dividends Dividend payout ratio Required rate of return Current price of common stock 97% of par $1000 8% $2.00 5.10% 60% 12.60% $18 The bonds were issued 10 years ago, and mature 15 years from today. Coupon payments are distributed annually. Analyse the YTM of the bonds (including the verification of your answer with an appropriate Excel function), and the circumstances where bonds will be trading at discount, premium or at par. Calculate the company's share price using the Dividend Discount Model, and determine whether it is worth investing at current price. Compose a memo to the fund manager, of not more than 500 words, about your findings on the bond and common stock of ABC Corp, and provide your opinion on the relative merits of investing in bond vs common stock. Question 3 (a) A project has 6 million cashflow each year for 5years, payback period of 4 years and rate of return 11%. Solve for the project's NPV, by showing all relevant workings. Verify your answer with an appropriate Excel function. Indicate whether you should proceed with the project. (b) (c) A company is evaluating two mutually exclusive projects A and B, and both have conventional cashflows (i.e. all inflows after the initial outflow). Project A has an IRR of 14% and the NPV profiles of Project A and Project B cross-over at 10%. Illustrate, using a graph or any other means, the range of values of cost of capital, when the NPV rule and IRR rule will not lead to the same decision. Discuss the multiple issues of using IRR as a decision rule for choosing a project.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Monthly mortgage payment for BTO flat To calculate the monthly mortgage payment for the BTO flat we can use the formula for a fixedrate loan M P r 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started