Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a firm is considering a labor - saving investment. In year 0 , the project requires a $ 1 1 . 7 0 0

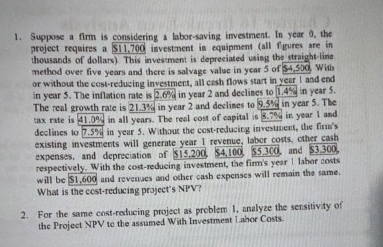

Suppose a firm is considering a laborsaving investment. In year the project requires a $ investment it equipment all fgures are in thousands of dollars This invesiment is depreciated using the straightline method over five years and there is salvage value in year of With or without the costreducing investment, all cash flows start in year I and end in year The inflation rate is in year and declines to in year The real growth rate is in year and declines to in year The tax rate is in all years. The reel cost of capital is in year and declines to in year Without the costrelucing investnent, the fim's existing investments will generate year revenue, labor costs, other cash expenses, and depreciation of $$$ and $ respectively. With the costreducing investment, the firm's year lahor costs will be $ and revenses and other cash expenses will remain the same. What is the cestreducing project's NPV

For the same costreducing project as problem I, analyze the sersitivity of the Project NPV to the assumed With Investment ahor Costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started