Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose a potential customer wants to know the projects profitability index (PI). What is the value of the PI for GP Manufacturing, and what is

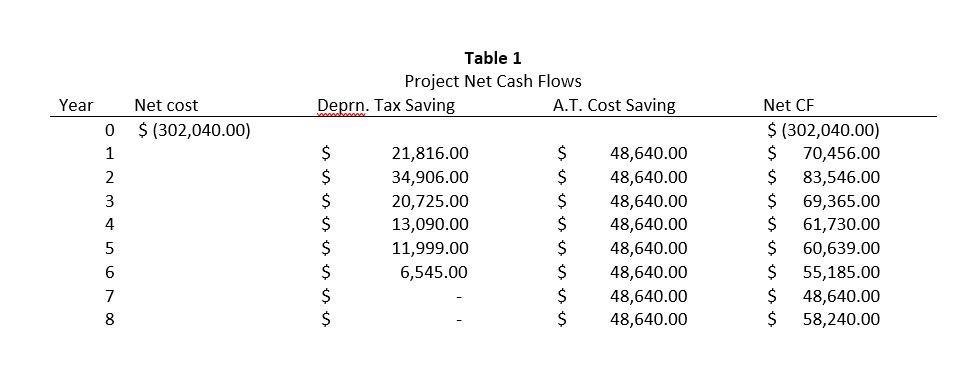

Suppose a potential customer wants to know the project’s profitability index (PI). What is the value of the PI for GP Manufacturing, and what is the rationale behind this measure? (Assume the discount rate is equal to cost of capital: 12%. Tax is 36%). Under what conditions do NPV, IRR, MIRR, and PI all lead to the same accept/reject decision? When can conflicts occur? If a conflict arises, which method should be used, and why?

Year 0 1 2 3 4 5 6 0 00 7 8 Net cost $ (302,040.00) Deprn. Tax Saving ssss es eses es $ $ $ $ Table 1 Project Net Cash Flows $ 21,816.00 34,906.00 20,725.00 13,090.00 11,999.00 6,545.00 A.T. Cost Saving $ $ $ $ $ $ $ $ 48,640.00 48,640.00 48,640.00 48,640.00 48,640.00 48,640.00 48,640.00 48,640.00 Net CF $ (302,040.00) $ 70,456.00 $ 83,546.00 $ 69,365.00 $ 61,730.00 $ 60,639.00 $ 55,185.00 $ 48,640.00 $ 58,240.00

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER The profitability index PI is a measure of the attractiveness of a project or investment It i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started