Answered step by step

Verified Expert Solution

Question

1 Approved Answer

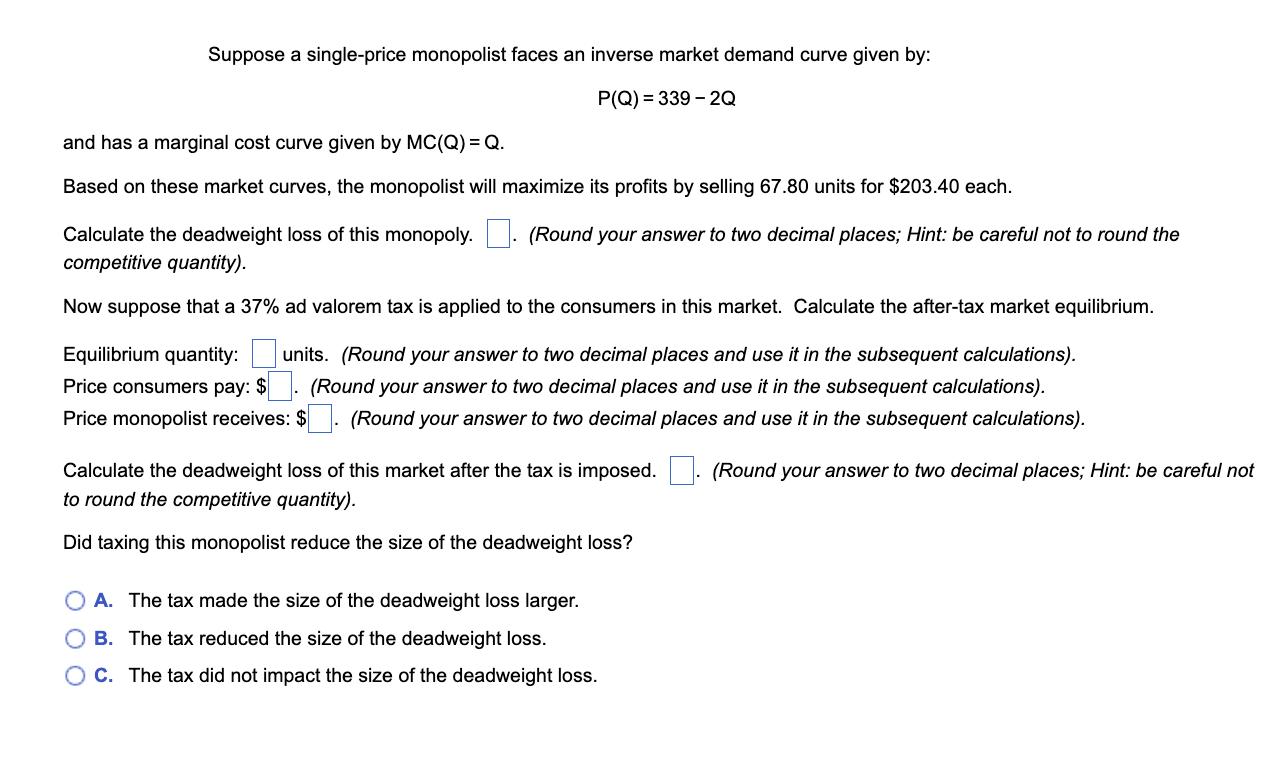

Suppose a single-price monopolist faces an inverse market demand curve given by: P(Q)=339-2Q and has a marginal cost curve given by MC(Q) = Q.

Suppose a single-price monopolist faces an inverse market demand curve given by: P(Q)=339-2Q and has a marginal cost curve given by MC(Q) = Q. Based on these market curves, the monopolist will maximize its profits by selling 67.80 units for $203.40 each. Calculate the deadweight loss of this monopoly. competitive quantity). Now suppose that a 37% ad valorem tax is applied to the consumers in this market. Calculate the after-tax market equilibrium. (Round your answer to two decimal places; Hint: be careful not to round the Equilibrium quantity: units. (Round your answer to two decimal places and use it in the subsequent calculations). Price consumers pay: $ (Round your answer to two decimal places and use it in the subsequent calculations). Price monopolist receives: $ (Round your answer to two decimal places and use it in the subsequent calculations). Calculate the deadweight loss of this market after the tax is imposed. . (Round your answer to two decimal places; Hint: be careful not to round the competitive quantity). Did taxing this monopolist reduce the size of the deadweight loss? A. The tax made the size of the deadweight loss larger. O B. The tax reduced the size of the deadweight loss. O C. The tax did not impact the size of the deadweight loss.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Cal cul ate the dead weight loss of this monopoly competitive quantity Round your answer to two decimal places H int be careful not to round the compet et ive quant int y ANS WER The competitive quant...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started