Answered step by step

Verified Expert Solution

Question

1 Approved Answer

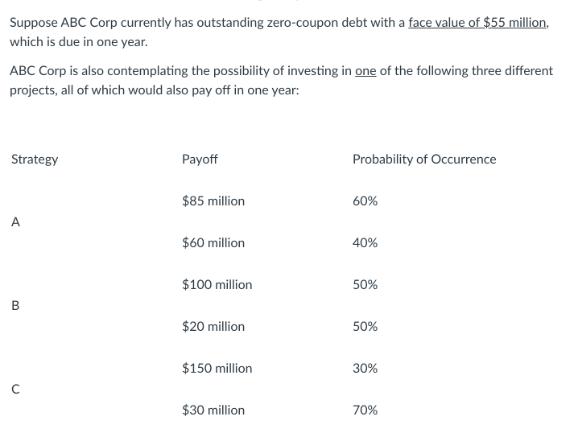

Suppose ABC Corp currently has outstanding zero-coupon debt with a face value of $55 million. which is due in one year. ABC Corp is

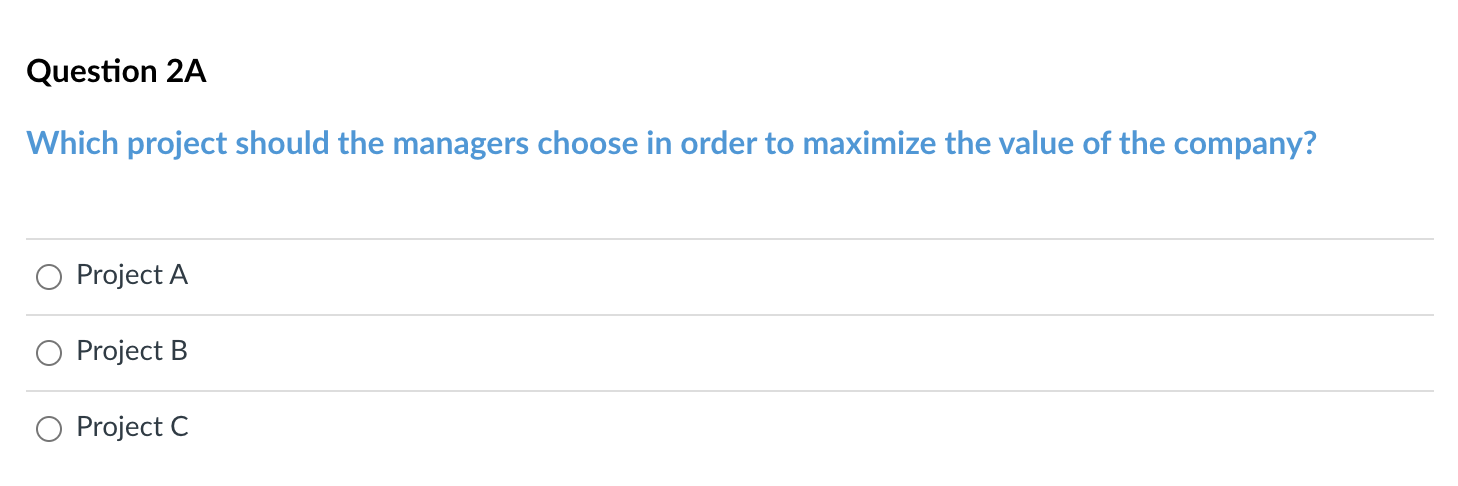

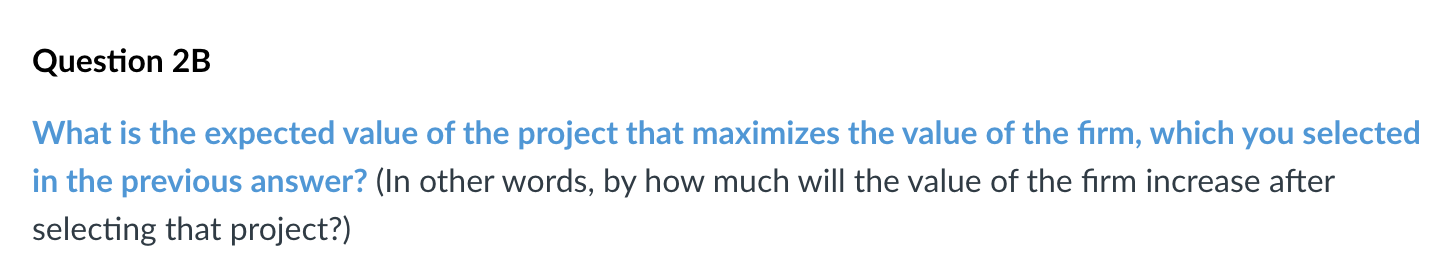

Suppose ABC Corp currently has outstanding zero-coupon debt with a face value of $55 million. which is due in one year. ABC Corp is also contemplating the possibility of investing in one of the following three different projects, all of which would also pay off in one year: Strategy A B Payoff $85 million $60 million $100 million $20 million $150 million $30 million Probability of Occurrence 60% 40% 50% 50% 30% 70% Question 2A Which project should the managers choose in order to maximize the value of the company? Project A Project B Project C Question 2B What is the expected value of the project that maximizes the value of the firm, which you selected in the previous answer? (In other words, by how much will the value of the firm increase after selecting that project?) Question 2C Which project would maximize the value of the equity holders? (Hint: calculate the value of equity for each of the three projects) Project C Project A O Project B Question 2D By how much will the value of equity increase after selecting the project that maximizes the value of equity? Question 2E If the managers are self-serving and maximize the value of equity instead of the value of the firm (that is, they select the answer to question 2C instead of the answer to question 2A), what is the expected agency cost to the firm?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Ans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started