Answered step by step

Verified Expert Solution

Question

1 Approved Answer

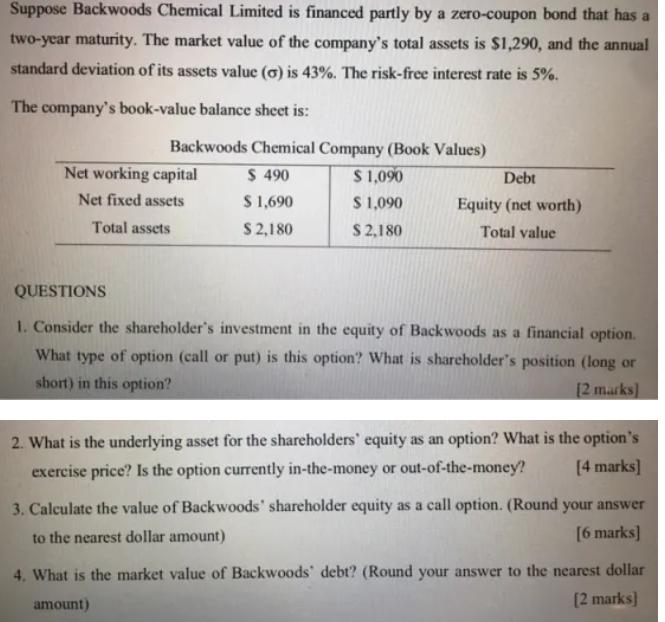

Suppose Backwoods Chemical Limited is financed partly by a zero-coupon bond that has a two-year maturity. The market value of the company's total assets

Suppose Backwoods Chemical Limited is financed partly by a zero-coupon bond that has a two-year maturity. The market value of the company's total assets is $1,290, and the annual standard deviation of its assets value (o) is 43%. The risk-free interest rate is 5%. The company's book-value balance sheet is: Backwoods Chemical Company (Book Values) $ 490 $ 1,090 $ 1,690 $ 1,090 $ 2,180 $ 2,180 Net working capital Net fixed assets Total assets Debt Equity (net worth) Total value QUESTIONS 1. Consider the shareholder's investment in the equity of Backwoods as a financial option. What type of option (call or put) is this option? What is shareholder's position (long or short) in this option? [2 marks] 2. What is the underlying asset for the shareholders' equity as an option? What is the option's exercise price? Is the option currently in-the-money or out-of-the-money? [4 marks] 3. Calculate the value of Backwoods' shareholder equity as a call option. (Round your answer to the nearest dollar amount) [6 marks] 4. What is the market value of Backwoods' debt? (Round your answer to the nearest dollar amount) [2 marks]

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 The shareholders investment in the equity of Backwoods can be considered as a call option The shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started