Question

Suppose Dell wants to borrow $460 million, and it is seeking to consider raising the funds in the international bond markets rather than the U.S.

Suppose Dell wants to borrow $460 million, and it is seeking to consider raising the funds in the international bond markets rather than the U.S. market. Assume it will either issue a bond in U.S. dollar terms directly, or it will issue a foreign-currency denominated bond worth the equivalent of the $460 million, and convert the foreign currency into dollars to use for its needs. The maturity for all of the choices is 4 years. Dells choices include

- Borrow in $ using a Eurodollar bond. The bond could be issued at 100.5% of face value with a coupon rate of 5.5%. Expenses associated with the issue would be 1.8% of the amount borrowed.

- Borrow in euros using a euro-denominated Eurobond. The euro- Eurobond will have a Euro-denominated face value that is the euro equivalent to the $460million needed (when evaluated at the spot rate). The euro Eurobond can be issued 99.5% of euro face value with a euro coupon rate of 3.6%. Expenses associated with the issue would be 2.5% of the amount borrowed.

- Borrow using a dual currency Swiss franc Foreign Bond. The bond is issued in Swiss francs (CHF), the coupons are paid in CHF, but the principal is repaid in US$. The bond would be issued in Switzerland, subject to the same registration requirements as an ordinary CHF bond issued in Switzerland. The Swiss franc bond will have a Swiss franc face value that is the Swiss franc equivalent of the $460 million needed (evaluated at the spot rate). The CHF bond will be issued at par value and have a with a CHF coupon of 6.2%. Expenses associated with the issue would be 2.2% of the amount borrowed. At maturity, the bonds face value dollar repayment would be $442 million.

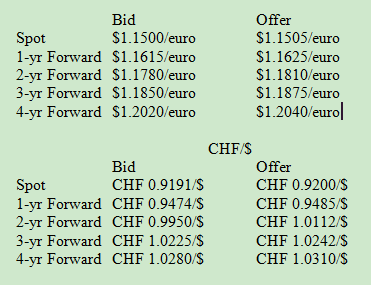

Assume that Dell would hedge the exchange risk of its international payments using the forward market. The bank is quoting Dell the following rates:

$/euros

Given the three financing alternatives described above, and Dells desire to hedge its exchange risk in the forward market, which alternative offers the lowest financing rate for Dell ? (compute all-in-costs and show your calculations in a spreadsheet)

Bid Spot $1.1500/euro 1-yr Forward $1.1615/euro 2-yr Forward $1.1780/euro 3-yr Forward $1.1850/euro 4-yr Forward $1.2020/euro Offer $1.1505/euro $1.1625/euro $1.1810/euro $1.1875/euro $1.2040/euro CHF/S Bid Offer Spot CHF 0.9191/$ CHF 0.9200/5 1-yr Forward CHF 0.9474/$ CHF 0.9485/$ 2-yr Forward CHF 0.9950/$ CHF 1.0112/S 3-yr Forward CHF 1.0225/$ CHF 1.0242/S 4-yr Forward CHF 1.0280/$ CHF 1.0310/S Bid Spot $1.1500/euro 1-yr Forward $1.1615/euro 2-yr Forward $1.1780/euro 3-yr Forward $1.1850/euro 4-yr Forward $1.2020/euro Offer $1.1505/euro $1.1625/euro $1.1810/euro $1.1875/euro $1.2040/euro CHF/S Bid Offer Spot CHF 0.9191/$ CHF 0.9200/5 1-yr Forward CHF 0.9474/$ CHF 0.9485/$ 2-yr Forward CHF 0.9950/$ CHF 1.0112/S 3-yr Forward CHF 1.0225/$ CHF 1.0242/S 4-yr Forward CHF 1.0280/$ CHF 1.0310/SStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started