Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose on February 1, 20X6, Northern Motors paid $460 million for a 40% investment in Regal Motors. Assume Regal earned net income of $70

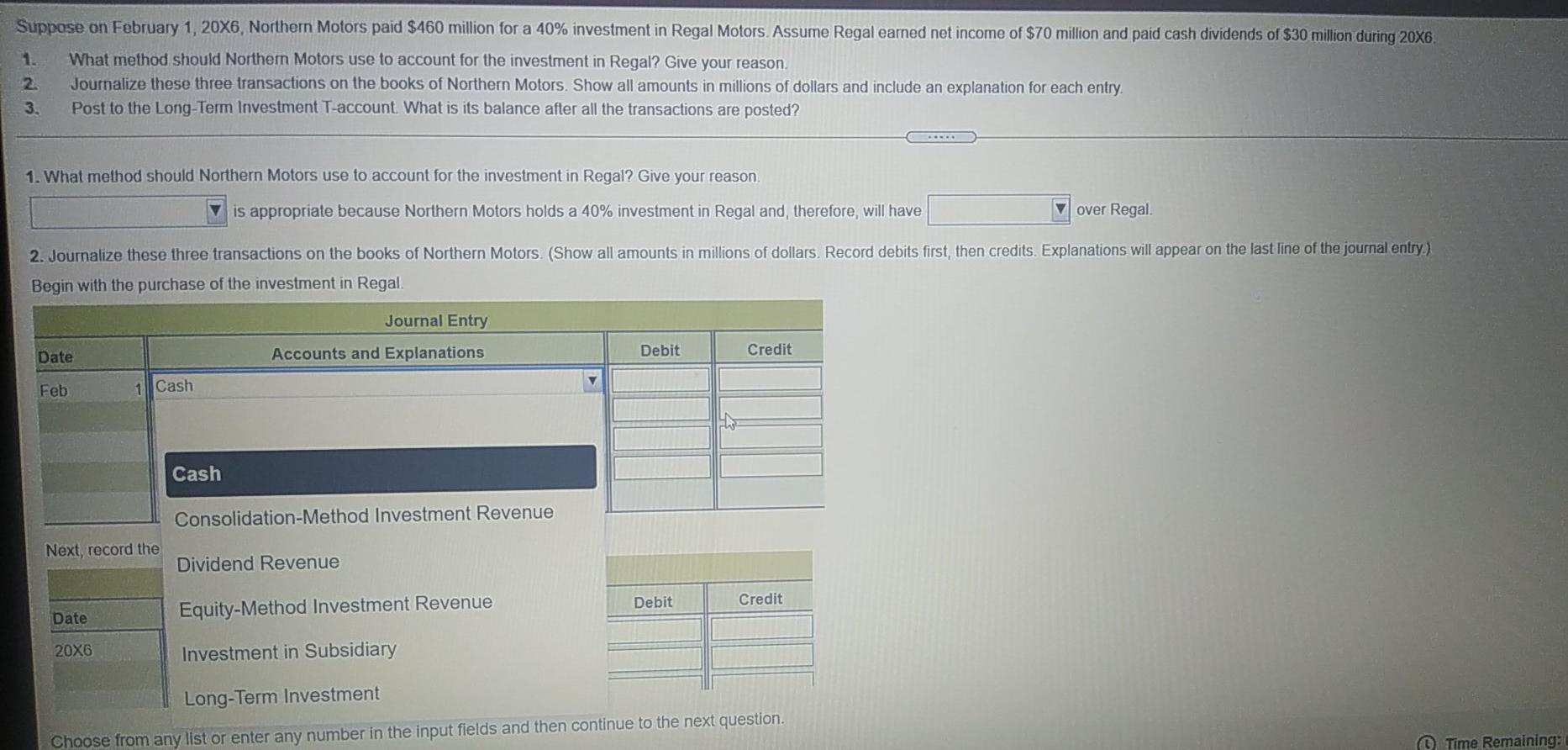

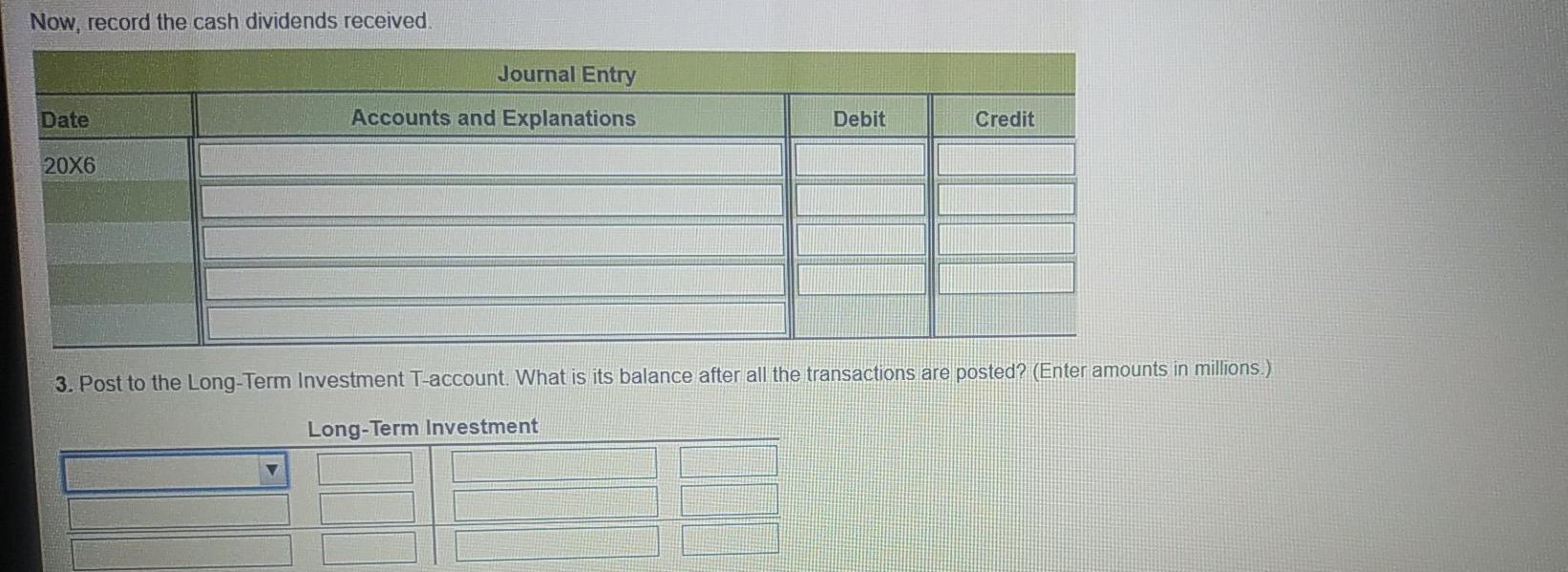

Suppose on February 1, 20X6, Northern Motors paid $460 million for a 40% investment in Regal Motors. Assume Regal earned net income of $70 million and paid cash dividends of $30 million during 20X6 1. What method should Northern Motors use to account for the investment in Regal? Give your reason. 2 Journalize these three transactions on the books of Northern Motors. Show all amounts in millions of dollars and include an explanation for each entry. 3. Post to the Long-Term Investment T-account. What is its balance after all the transactions are posted? 1. What method should Northern Motors use to account for the investment in Regal? Give your reason. over Regal. 2. Journalize these three transactions on the books of Northern Motors. (Show all amounts in millions of dollars. Record debits first, then credits. Explanations will appear on the last line of the journal entry) Begin with the purchase of the investment in Regal. Date Feb Cash Next, record the Date 20X6 Cash is appropriate because Northern Motors holds a 40% investment in Regal and, therefore, will have Journal Entry Accounts and Explanations Consolidation-Method Investment Revenue Dividend Revenue Equity-Method Investment Revenue Investment in Subsidiary Debit Debit Credit Credit Long-Term Investment Choose from any list or enter any number in the input fields and then continue to the next question. Time Remaining: Now, record the cash dividends received. Date 20X6 Journal Entry Accounts and Explanations Debit Credit 3. Post to the Long-Term Investment T-account. What is its balance after all the transactions are posted? (Enter amounts in millions.) Long-Term Investment

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 EQUITY METHOD SHALL BE USED AS 40 WILL CREAT SIGNIFICANT INFLUENCE OVER REAGAL ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started