Question

Suppose someone wants to create a fund for future withdrawals, which would begin with a withdrawal of $22,000 at the end of year 16.

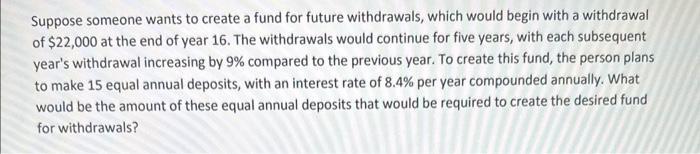

Suppose someone wants to create a fund for future withdrawals, which would begin with a withdrawal of $22,000 at the end of year 16. The withdrawals would continue for five years, with each subsequent year's withdrawal increasing by 9% compared to the previous year. To create this fund, the person plans to make 15 equal annual deposits, with an interest rate of 8.4% per year compounded annually. What would be the amount of these equal annual deposits that would be required to create the desired fund for withdrawals?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the amount of equal annual deposits required to create the desired fund for withdrawals ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

13th Edition

9780470374948, 470423684, 470374942, 978-0470423684

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App