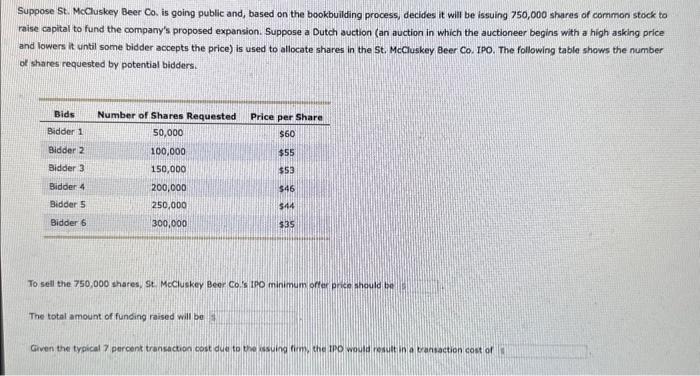

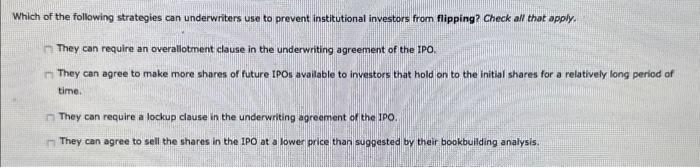

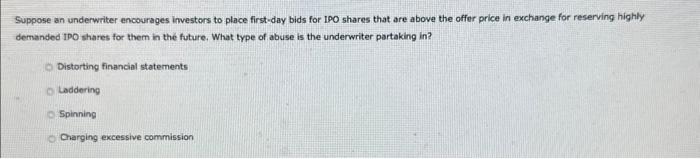

Suppose St. MoCluskey Beer Co. is going public and, based on the bookbuilding process, decides it will be issuing 750,000 shares of common stock to raise capital to fund the company's proposed expansion. Suppose a Dutch auction (an auction in which the auctioneer begins with a high asking price and lowers it until some bidder accepts the price) is used to allocate shares in the 5t, McCluskey Beer Co. IPO. The following table shows the number of shares requested by potential bidders. To sell the 750,000 shares, st. Mocluskey Beor Co's tpo minimum orfer price should be The total amount of funding raised will be Given the typical 7 percent transaction cost due to the issuing fime, the tiof would result in a varisaction cost of Which of the following strategies can underwriters use to prevent institutional investors from flipping? Check all that apply. They con require an overallotment clause in the underwniting agreement of the IPO. They can agree to make more shares of future IPOs avallable to investors that hold on to the initial shares for a relatively long period of time. They can require a lockup clause in the underwriting agreement of the IPO. They can agree to sell the shares in the IPO at a lower price than suggested by their bookbuilding analysis. Suppose an underwriter encourages investors to place first-day bids for 190 shares that are above the offer price in exchange for reserving highly demanded IPO shares for them in the future. What type of abuse is the underwriter partaking in? Distorting financial statements Laddering Spinning Charging excessive commission Suppose St. MoCluskey Beer Co. is going public and, based on the bookbuilding process, decides it will be issuing 750,000 shares of common stock to raise capital to fund the company's proposed expansion. Suppose a Dutch auction (an auction in which the auctioneer begins with a high asking price and lowers it until some bidder accepts the price) is used to allocate shares in the 5t, McCluskey Beer Co. IPO. The following table shows the number of shares requested by potential bidders. To sell the 750,000 shares, st. Mocluskey Beor Co's tpo minimum orfer price should be The total amount of funding raised will be Given the typical 7 percent transaction cost due to the issuing fime, the tiof would result in a varisaction cost of Which of the following strategies can underwriters use to prevent institutional investors from flipping? Check all that apply. They con require an overallotment clause in the underwniting agreement of the IPO. They can agree to make more shares of future IPOs avallable to investors that hold on to the initial shares for a relatively long period of time. They can require a lockup clause in the underwriting agreement of the IPO. They can agree to sell the shares in the IPO at a lower price than suggested by their bookbuilding analysis. Suppose an underwriter encourages investors to place first-day bids for 190 shares that are above the offer price in exchange for reserving highly demanded IPO shares for them in the future. What type of abuse is the underwriter partaking in? Distorting financial statements Laddering Spinning Charging excessive commission