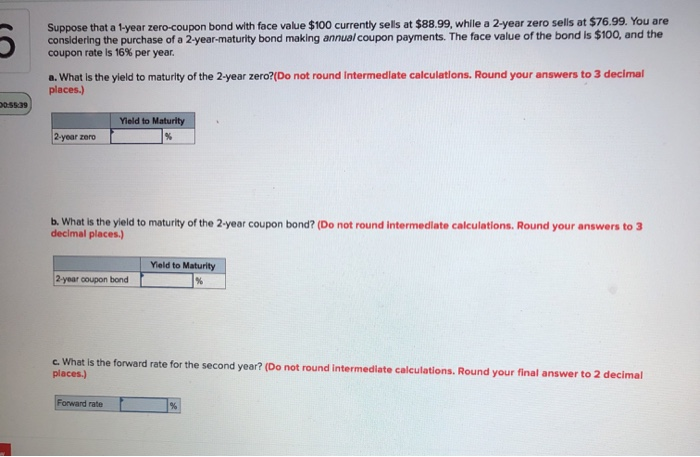

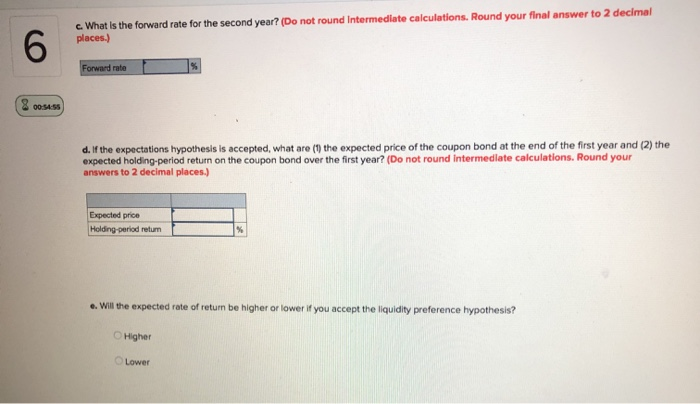

Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $88.99, while a 2 year zero sells at $76.99. You are considering the purchase of a 2-year-maturity bond making annual coupon payments. The face value of the bond is $100, and the coupon rate is 16% per year. a. What is the yield to maturity of the 2-year zero?(Do not round Intermediate calculations. Round your answers to 3 decimal places.) 0 5539 Yield to Maturity 2-year zero b. What is the yield to maturity of the 2-year coupon bond? (Do not round Intermediate calculations. Round your answers to decimal places.) Yield to Maturity 2.year coupon bond c. What is the forward rate for the second year? (Do not round Intermediate calculations. Round your final answer to 2 decimal places.) Forward rate c. What is the forward rate for the second year? (Do not round Intermediate calculations. Round your final answer to 2 decimal places.) Forward rate % (8 00:54:58 d. If the expectations hypothesis is accepted, what are (1) the expected price of the coupon bond at the end of the first year and (2) the expected holding period return on the coupon bond over the first year? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Expected price Holding-period return e. Will the expected rate of return be higher or lower if you accept the liquidity preference hypothesis? Higher Lower Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $88.99, while a 2 year zero sells at $76.99. You are considering the purchase of a 2-year-maturity bond making annual coupon payments. The face value of the bond is $100, and the coupon rate is 16% per year. a. What is the yield to maturity of the 2-year zero?(Do not round Intermediate calculations. Round your answers to 3 decimal places.) 0 5539 Yield to Maturity 2-year zero b. What is the yield to maturity of the 2-year coupon bond? (Do not round Intermediate calculations. Round your answers to decimal places.) Yield to Maturity 2.year coupon bond c. What is the forward rate for the second year? (Do not round Intermediate calculations. Round your final answer to 2 decimal places.) Forward rate c. What is the forward rate for the second year? (Do not round Intermediate calculations. Round your final answer to 2 decimal places.) Forward rate % (8 00:54:58 d. If the expectations hypothesis is accepted, what are (1) the expected price of the coupon bond at the end of the first year and (2) the expected holding period return on the coupon bond over the first year? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Expected price Holding-period return e. Will the expected rate of return be higher or lower if you accept the liquidity preference hypothesis? Higher Lower