Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that a business expects to have profits of $200,000 if it is not sued over the coming year. The probability of a suit is

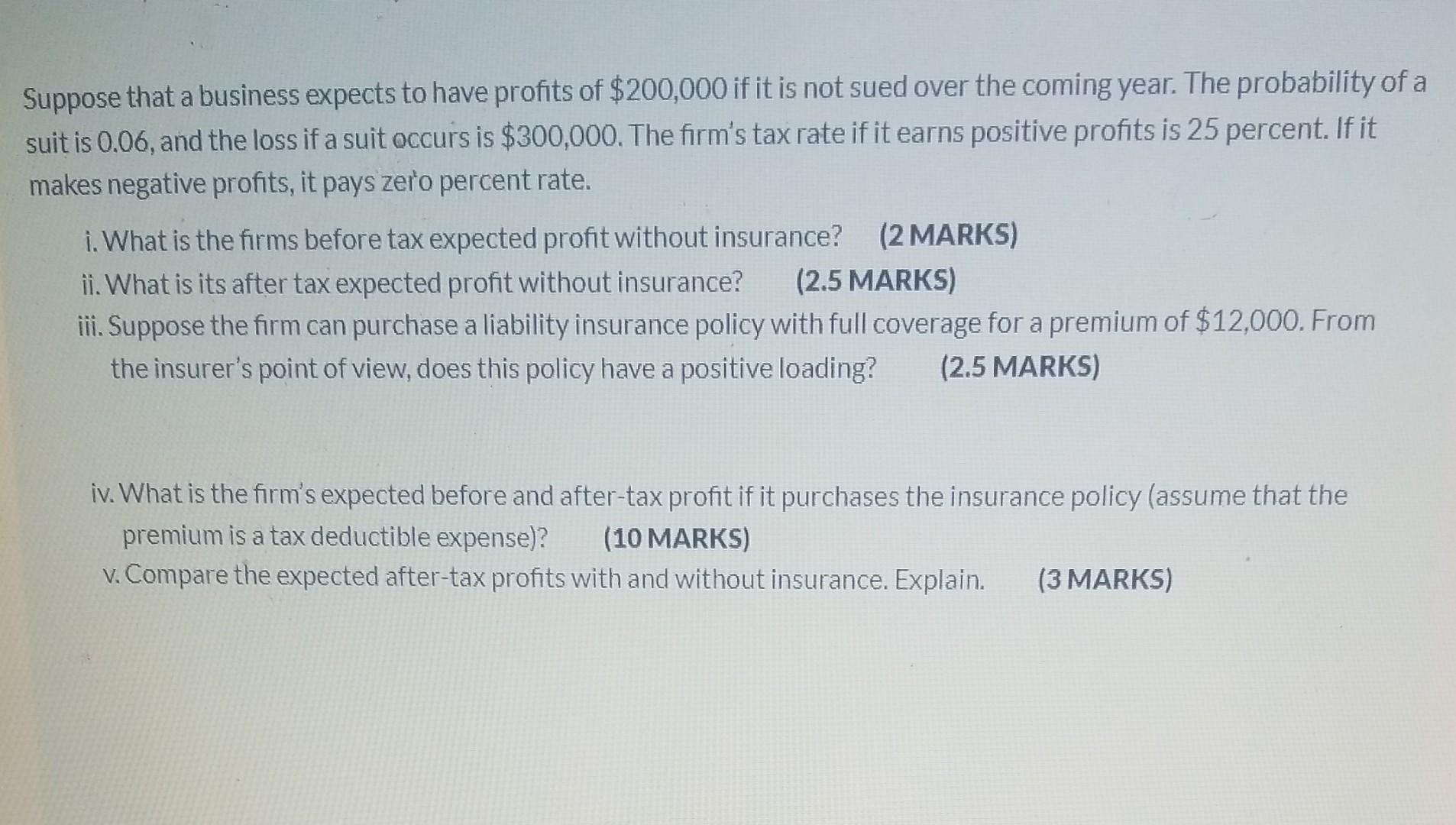

Suppose that a business expects to have profits of $200,000 if it is not sued over the coming year. The probability of a suit is 0.06, and the loss if a suit occurs is $300,000. The firm's tax rate if it earns positive profits is 25 percent. If it makes negative profits, it pays zero percent rate. i. What is the firms before tax expected profit without insurance? (2 MARKS) ii. What is its after tax expected profit without insurance? (2.5 MARKS) iii. Suppose the firm can purchase a liability insurance policy with full coverage for a premium of $12,000. From the insurer's point of view, does this policy have a positive loading? (2.5 MARKS) iv. What is the firm's expected before and after-tax profit if it purchases the insurance policy (assume that the premium is a tax deductible expense)? (10 MARKS) v. Compare the expected after-tax profits with and without insurance. Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started