Answered step by step

Verified Expert Solution

Question

1 Approved Answer

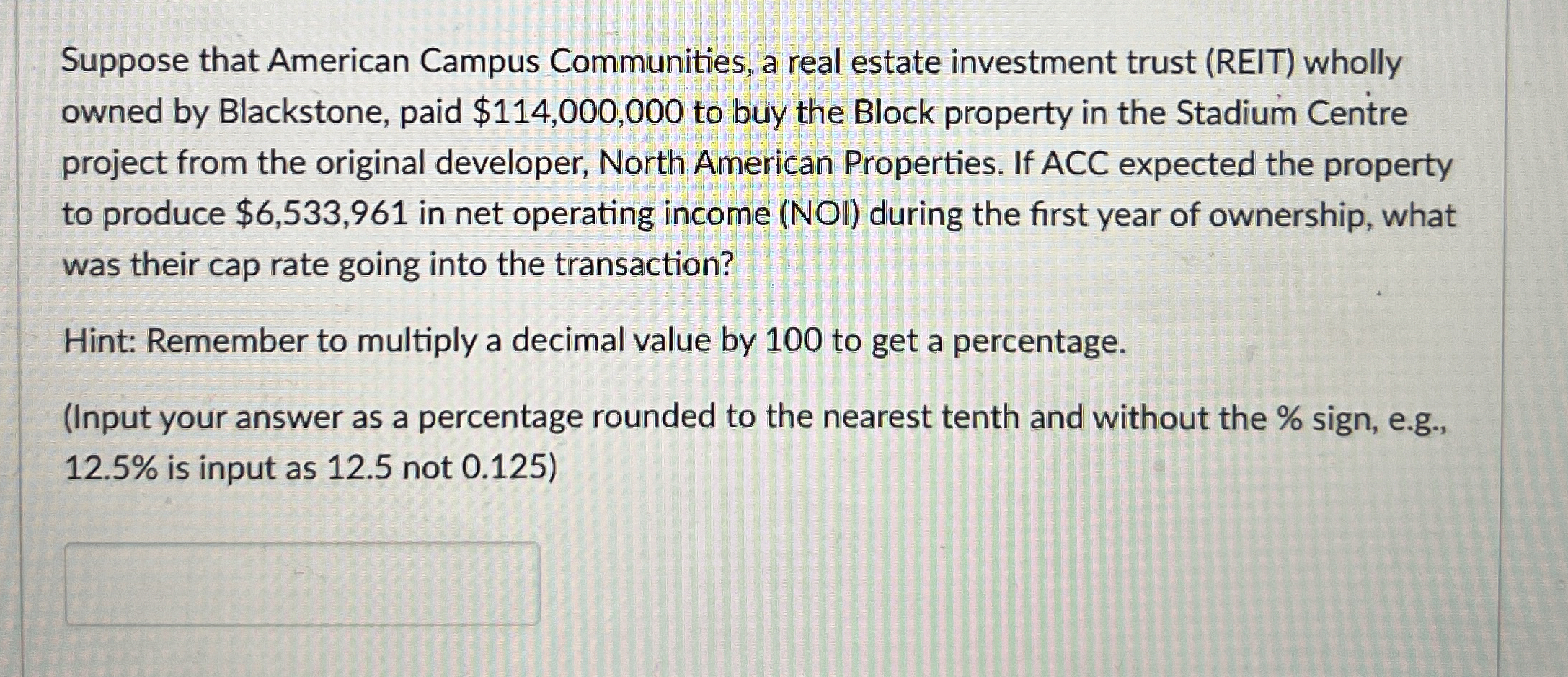

Suppose that American Campus Communities, a real estate investment trust ( REIT ) wholly owned by Blackstone, paid $ 1 1 4 , 0 0

Suppose that American Campus Communities, a real estate investment trust REIT wholly owned by Blackstone, paid $ to buy the Block property in the Stadium Centre project from the original developer, North American Properties. If ACC expected the property to produce $ in net operating income NOI during the first year of ownership, what was their cap rate going into the transaction?

Hint: Remember to multiply a decimal value by to get a percentage.

Input your answer as a percentage rounded to the nearest tenth and without the sign, eg is input as not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started