Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that an investor buys an April put option contract on a stock with a strike price of $179.44 today. The put option is priced

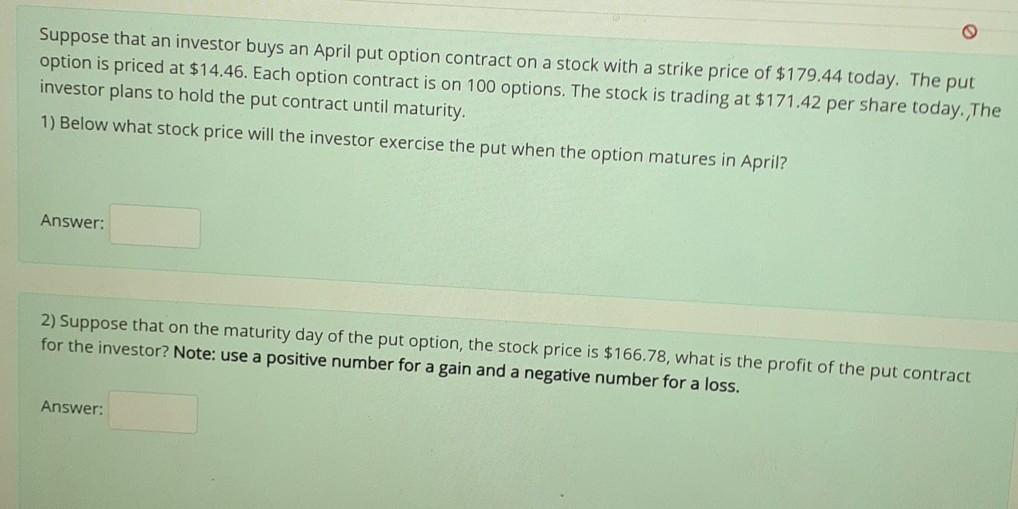

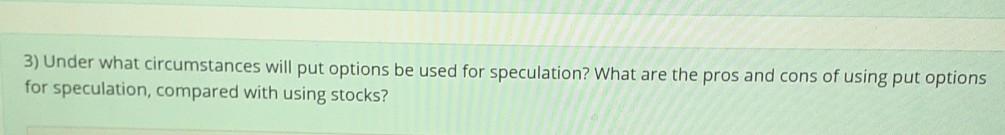

Suppose that an investor buys an April put option contract on a stock with a strike price of $179.44 today. The put option is priced at $14.46. Each option contract is on 100 options. The stock is trading at $171.42 per share today. The investor plans to hold the put contract until maturity. 1) Below what stock price will the investor exercise the put when the option matures in April? Answer: 2) Suppose that on the maturity day of the put option, the stock price is $166.78, what is the profit of the put contract for the investor? Note: use a positive number for a gain and a negative number for a loss. Answer: 3) Under what circumstances will put options be used for speculation? What are the pros and cons of using put options for speculation, compared with using stocks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started