Answered step by step

Verified Expert Solution

Question

1 Approved Answer

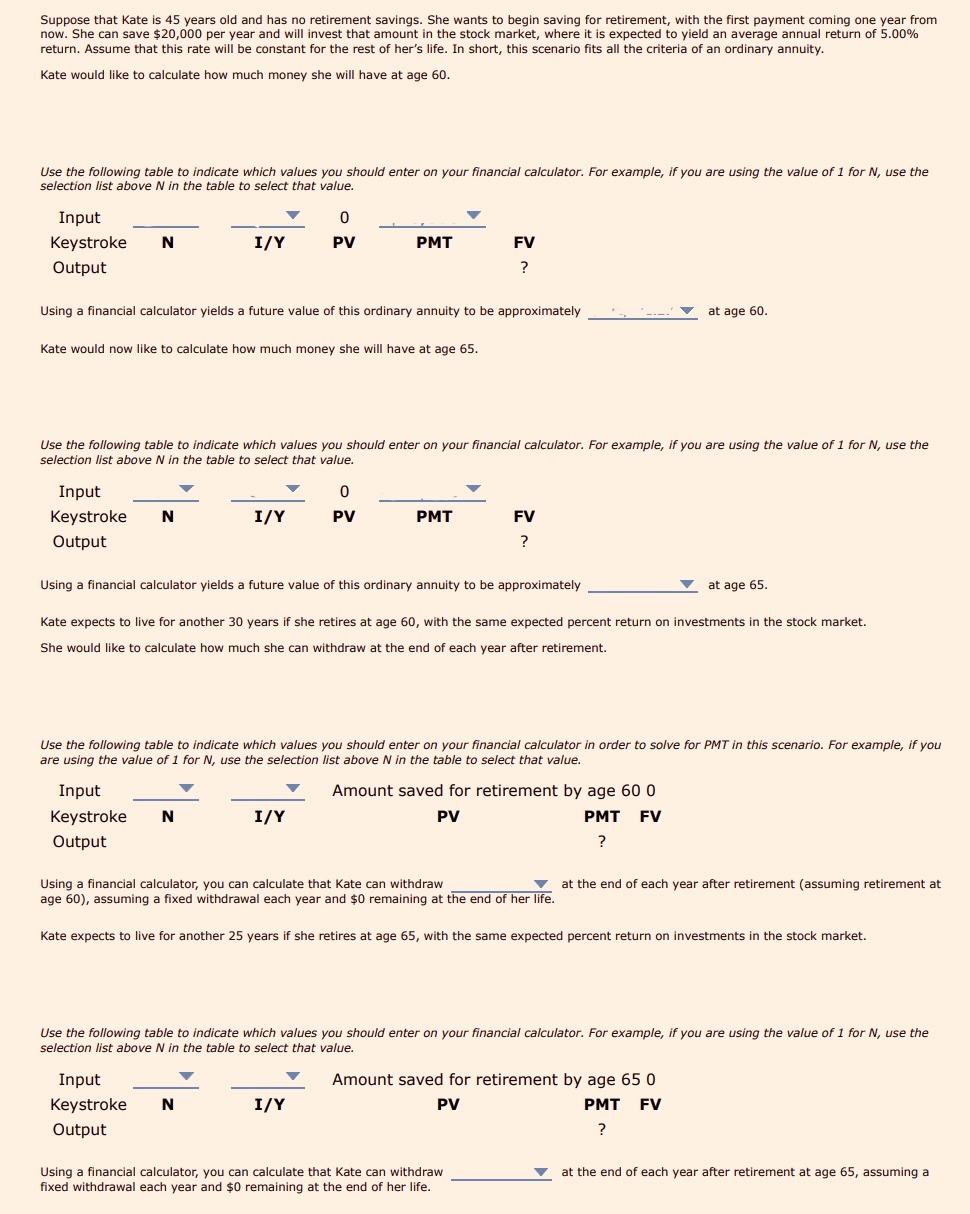

Suppose that Kate is 4 5 years old and has no retirement savings. She wants to begin saving for retirement, with the first payment coming

Suppose that Kate is years old and has no retirement savings. She wants to begin saving for retirement, with the first payment coming one year from

now. She can save $ per year and will invest that amount in the stock market, where it is expected to yield an average annual return of

return. Assume that this rate will be constant for the rest of her's life. In short, this scenario fits all the criteria of an ordinary annuity.

Kate would like to calculate how much money she will have at age

Use the following table to indicate which values you should enter on your financial calculator. For example, if you are using the value of for use the

selection list above in the table to select that value.

Using a financial calculator yields a future value of this ordinary annuity to be approximately

at age

Kate would now like to calculate how much money she will have at age

Use the following table to indicate which values you should enter on your financial calculator. For example, if you are using the value of for use the

selection list above in the table to select that value.

Using a financial calculator yields a future value of this ordinary annuity to be approximately

at age

Kate expects to live for another years if she retires at age with the same expected percent return on investments in the stock market.

She would like to calculate how much she can withdraw at the end of each year after retirement.

Use the following table to indicate which values you should enter on your financial calculator in order to solve for PMT in this scenario. For example, if you

are using the value of for use the selection list above in the table to select that value.

Input

Keystroke

Amount saved for retirement by age

PV

PMT FV

Output

Using a financial calculator, you can calculate that Kate can withdraw

at the end of each year after retirement assuming retirement at

Kate expects to live for another years if she retires at age with the same expected percent return on investments in the stock market.

Use the following table to indicate which values you should enter on your financial calculator. For example, if you are using the value of for use the

selection list above in the table to select that value.

Using a financial calculator, you can calculate that Kate can withdraw

fixed withdrawal each year and $ remaining at the end of her life.

at the end of each year after retirement at age assuming a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started