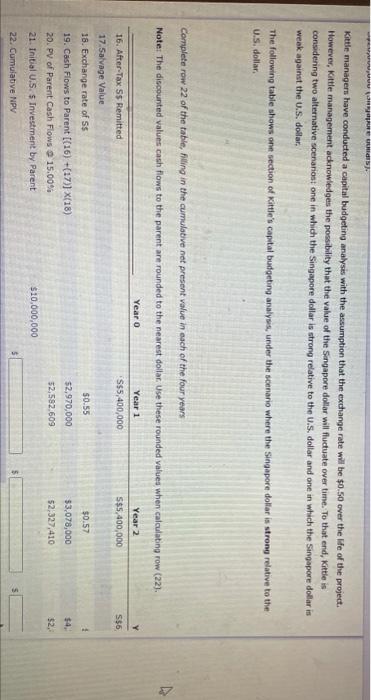

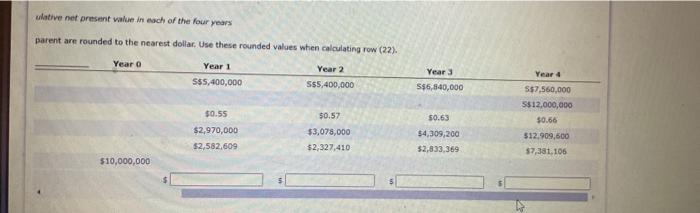

Suppose that Kittle Co. is a U.S. based MNC that is considering setting up a subsidiary in Singapore. Kittle would like this subsidiary to produce and nell guitars locally in Singapore, and needs assistance with capital budgeting. The duration of this project in four years, with an initial investment of 5$20,000,000 (Singapore dollars). Kittle managers have conducted a capital budgeting analysis with the assumption that the exchange rate will be $0.50 over the life of the project. However, Kittle management acknowledges the possibility that the value of the Singapore dollar will fuctuate over time. To that end, Kitties considering two alternative scenariost one in which the Singapore dollar is strong relative to the U.S. dollar and one in which the Singapore dollar is weak against the U.S. dollar The following table shows one section of Kitle's capital budgeting analysis, under the scenario where the Singapore dollar is strong relative to the U.S. dollar Complete row 22 of the table, filling in the cumulative net present value in each of the four years Note: The discounted values cash flows to the parent are rounded to the nearest dollar. Use these rounded values when calculating row (22) Year o Year 1 Year 2 AR Kittle managers have conducted a capital budgeting analysis with the assumption that the exchange rate will be $0.50 over the life of the project. However, Kittle management acknowledges the possibility that the value of the Singapore dollar will fluctuate over time. To that end, kittle is considering two alternative scenariost one in which the Singapore dollar is strong relative to the U.S. dollar and one in which the Singapore dollar is week against the U.S. dollar. The following table shows one section of Kittle's capital budgeting analysis, under the scenario where the Singapore dollar is strong relative to the U.S. dollar Complete row 22 of the table, Aling in the cumulative net present value in each of the four years Note: The discounted values cash flows to the parent are rounded to the nearest dollar. Use these rounded values when calculating row (22). Year o Year 1 S$5,400,000 Year 2 555,400,000 S$6 $0.55 $0.57 + 16. After-Tax S$ Remitted 17 Salvage Value 18. Exchange rate of Ss 19. Cash Flows to Parent ((16)+(17) X(18) 20. PV of Parent Cash Flows 15.00% 21. Initial U.S. $ Investment by Parent $2,970.000 52.582.609 $3,078,000 52,327,410 $2. $10,000,000 22. Cumulative NPV ulative net present value in each of the four years parent are rounded to the nearest dollar. Use these rounded values when calculating row (22) Year o Year 1 Year 2 555,400,000 555,400,000 Year) S$6,840,000 $0.55 $0.57 $0.63 Year 4 $57,560,000 S$12,000,000 $0.66 $12.909,600 $7,381,106 $2,970,000 $2,582,609 $3,078,000 $2,327,410 $4,309,200 $2,833.369 $10,000,000