Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering

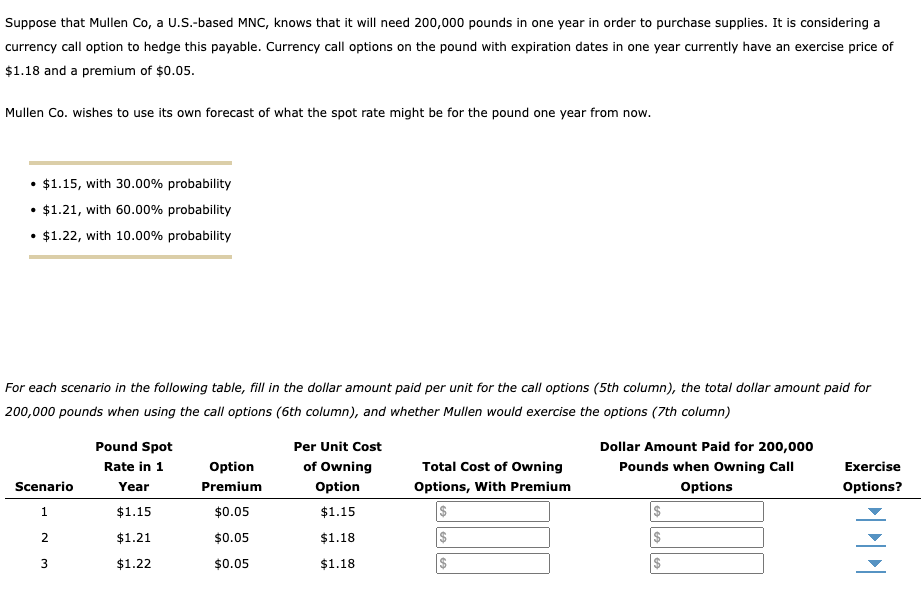

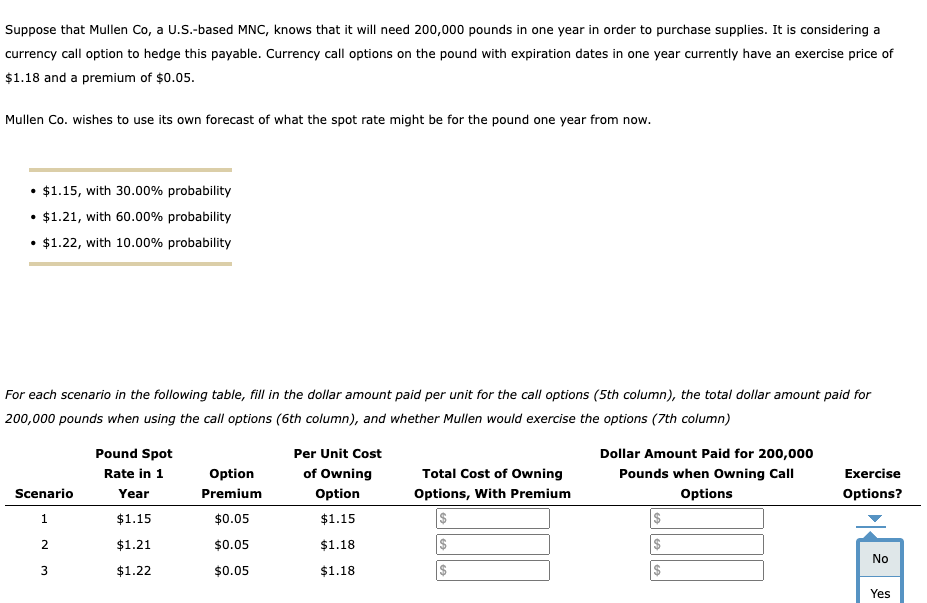

Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.05. Mullen Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. - $1.15, with 30.00% probability - $1.21, with 60.00% probability - $1.22, with 10.00% probability For each scenario in the following table, fill in the dollar amount paid per unit for the call options (5th column), the total dollar amount paid for 200,000 pounds when using the call options (6th column), and whether Mullen would exercise the options (7th column) Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.05. Mullen Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. - $1.15, with 30.00% probability - $1.21, with 60.00% probability - $1.22, with 10.00% probability For each scenario in the following table, fill in the dollar amount paid per unit for the call options (5th column), the total dollar amount paid for 200,000 pounds when using the call options (6th column), and whether Mullen would exercise the options (7th column) Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.05. Mullen Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. - $1.15, with 30.00% probability - $1.21, with 60.00% probability - $1.22, with 10.00% probability For each scenario in the following table, fill in the dollar amount paid per unit for the call options (5th column), the total dollar amount paid for 200,000 pounds when using the call options (6th column), and whether Mullen would exercise the options (7th column) Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.05. Mullen Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. - $1.15, with 30.00% probability - $1.21, with 60.00% probability - $1.22, with 10.00% probability For each scenario in the following table, fill in the dollar amount paid per unit for the call options (5th column), the total dollar amount paid for 200,000 pounds when using the call options (6th column), and whether Mullen would exercise the options (7th column)

Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.05. Mullen Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. - $1.15, with 30.00% probability - $1.21, with 60.00% probability - $1.22, with 10.00% probability For each scenario in the following table, fill in the dollar amount paid per unit for the call options (5th column), the total dollar amount paid for 200,000 pounds when using the call options (6th column), and whether Mullen would exercise the options (7th column) Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.05. Mullen Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. - $1.15, with 30.00% probability - $1.21, with 60.00% probability - $1.22, with 10.00% probability For each scenario in the following table, fill in the dollar amount paid per unit for the call options (5th column), the total dollar amount paid for 200,000 pounds when using the call options (6th column), and whether Mullen would exercise the options (7th column) Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.05. Mullen Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. - $1.15, with 30.00% probability - $1.21, with 60.00% probability - $1.22, with 10.00% probability For each scenario in the following table, fill in the dollar amount paid per unit for the call options (5th column), the total dollar amount paid for 200,000 pounds when using the call options (6th column), and whether Mullen would exercise the options (7th column) Suppose that Mullen Co, a U.S.-based MNC, knows that it will need 200,000 pounds in one year in order to purchase supplies. It is considering a currency call option to hedge this payable. Currency call options on the pound with expiration dates in one year currently have an exercise price of $1.18 and a premium of $0.05. Mullen Co. wishes to use its own forecast of what the spot rate might be for the pound one year from now. - $1.15, with 30.00% probability - $1.21, with 60.00% probability - $1.22, with 10.00% probability For each scenario in the following table, fill in the dollar amount paid per unit for the call options (5th column), the total dollar amount paid for 200,000 pounds when using the call options (6th column), and whether Mullen would exercise the options (7th column) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started