Question

Suppose that stock prices are given by a recombinant tree. Let So = 100, u = 1.1, d = ,8t = 1, simple interest

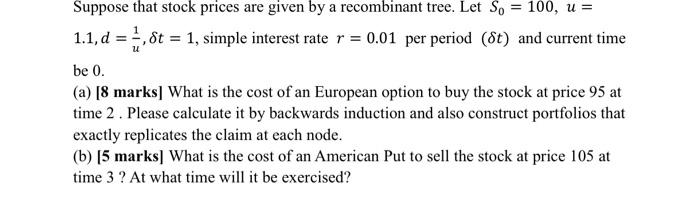

Suppose that stock prices are given by a recombinant tree. Let So = 100, u = 1.1, d = ,8t = 1, simple interest rate r = 0.01 per period (8t) and current time be 0. (a) [8 marks] What is the cost of an European option to buy the stock at price 95 at time 2. Please calculate it by backwards induction and also construct portfolios that exactly replicates the claim at each node. (b) [5 marks] What is the cost of an American Put to sell the stock at price 105 at time 3 ? At what time will it be exercised?

Step by Step Solution

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The image presents a finance problem related to options pricing using a binomial tree model I will address the two separate parts of the question a European Call Option We are given a recombinant bino...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Management Science

Authors: Wayne L. Winston, Christian Albright

5th Edition

1305631540, 1305631544, 1305250907, 978-1305250901

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App