Question

Suppose that Sudbury Mechanical Drifters is proposing to invest $11.5 million in a new factory. It can depreciate this investment straight-line over 10 years. The

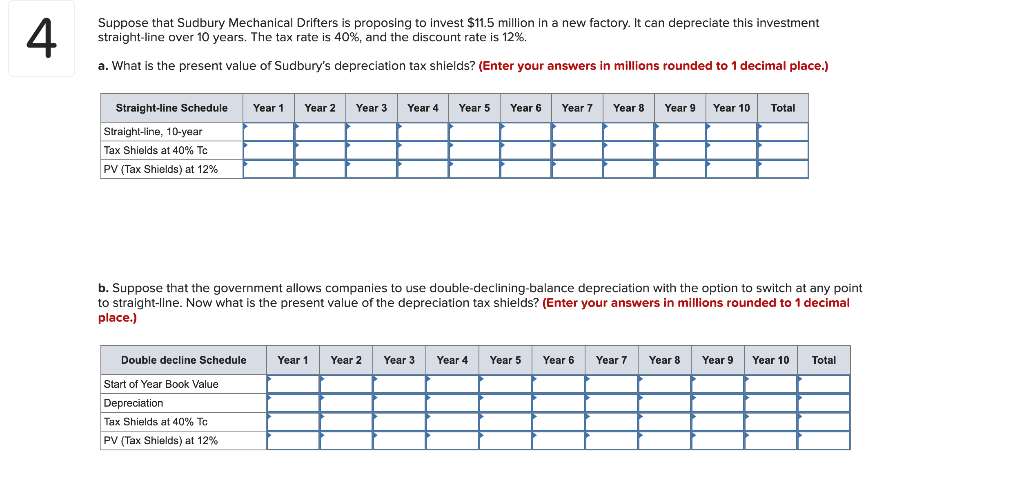

Suppose that Sudbury Mechanical Drifters is proposing to invest $11.5 million in a new factory. It can depreciate this investment straight-line over 10 years. The tax rate is 40%, and the discount rate is 12%. a. What is the present value of Sudburys depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.)

Suppose that Sudbury Mechanical Drifters is proposing to invest $11.5 million in a new factory. It can depreciate this investment straight-line over 10 years. The tax rate is 40%, and the discount rate is 12%. a. What is the present value of Sudburys depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.)

b. Suppose that the government allows companies to use double-declining-balance depreciation with the option to switch at any point to straight-line. Now what is the present value of the depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.)

c. What would be the present value of the tax shield if the government allowed Sudbury to write-off the factory immediately? (Enter your answer in millions rounded to 1 decimal place.)

Suppose that Sudbury Mechanical Drifters is proposing to invest $11.5 million in a new factory. It can depreciate this investment straight-line over 10 years. The tax rate is 40%, and the discount rate is 12%. a. What is the present value of Sudbury's depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.) b. Suppose that the government allows companies to use double-declining-balance depreciation with the option to switch at any poin to straight-line. Now what is the present value of the depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.) Suppose that Sudbury Mechanical Drifters is proposing to invest $11.5 million in a new factory. It can depreciate this investment straight-line over 10 years. The tax rate is 40%, and the discount rate is 12%. a. What is the present value of Sudbury's depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.) b. Suppose that the government allows companies to use double-declining-balance depreciation with the option to switch at any poin to straight-line. Now what is the present value of the depreciation tax shields? (Enter your answers in millions rounded to 1 decimal place.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started