Answered step by step

Verified Expert Solution

Question

1 Approved Answer

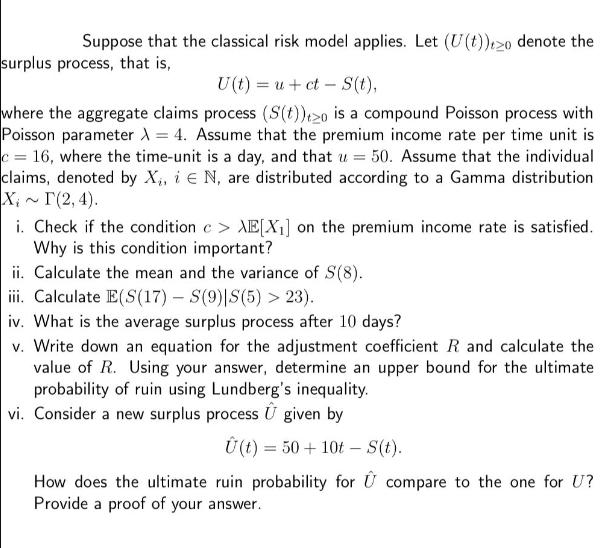

Suppose that the classical risk model applies. Let (U(t))+zo denote the surplus process, that is, U(t)=u+ct - S(t), where the aggregate claims process (S(t))+zo

Suppose that the classical risk model applies. Let (U(t))+zo denote the surplus process, that is, U(t)=u+ct - S(t), where the aggregate claims process (S(t))+zo is a compound Poisson process with Poisson parameter = 4. Assume that the premium income rate per time unit is c=16, where the time-unit is a day, and that u = 50. Assume that the individual claims, denoted by X, EN, are distributed according to a Gamma distribution X,~ T(2, 4). i. Check if the condition c> XE[X] on the premium income rate is satisfied. Why is this condition important? ii. Calculate the mean and the variance of S(8). iii. Calculate E(S(17) S(9)|S(5) > 23). iv. What is the average surplus process after 10 days? v. Write down an equation for the adjustment coefficient R and calculate the value of R. Using your answer, determine an upper bound for the ultimate probability of ruin using Lundberg's inequality. vi. Consider a new surplus process U given by U(t) = 50+10t - S(t). How does the ultimate ruin probability for compare to the one for U? Provide a proof of your answer.

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

i To check if the condition c EX is satisfied we need to calculate the expected value of X and compare it to the product of and EX Given that X follows a Gamma distribution with parameters 2 4 the exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started