Answered step by step

Verified Expert Solution

Question

1 Approved Answer

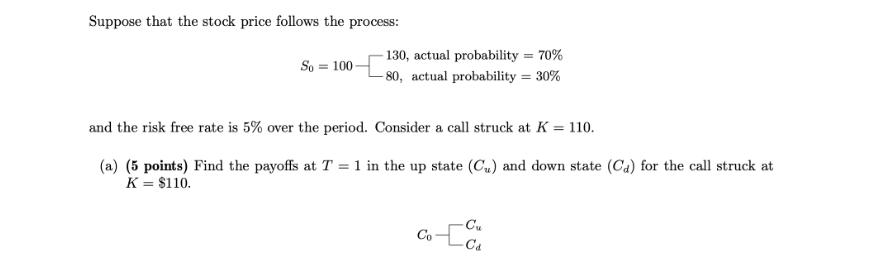

Suppose that the stock price follows the process: So 100- 130, actual probability = 70% -80, actual probability = 30% and the risk free

Suppose that the stock price follows the process: So 100- 130, actual probability = 70% -80, actual probability = 30% and the risk free rate is 5% over the period. Consider a call struck at K = 110. (a) (5 points) Find the payoffs at T = 1 in the up state (Cu) and down state (Ca) for the call struck at K = $110. Co Cu -Ca (b) (25 points) Find the price of the call. You may use any method you like. Solution: Problem 2 (20 points, 5 points each) True or False. State whether the last sentence is true or false. No explanations are necessary; the grade will be based on the answer only. (a) Because we price calls with replication in the binomial pricing model, we do not need to know the expected payoff of the call in order to find the price. Solution: (b) For the stock in Problem 1, the risk-neutral probability of up is 50%. Solution: (c) The A of the call in Problem 1 is 0.60. Solution: (d) In the binomial model, if the risk free rate is 0%, then it must be that the price of the digital up option and the digital down option add up to 1. Solution:

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

It seems that you would like assistance with a set of problems related to options pricing using the binomial model which involves finding payoffs calculating the option price and answering truefalse q...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started