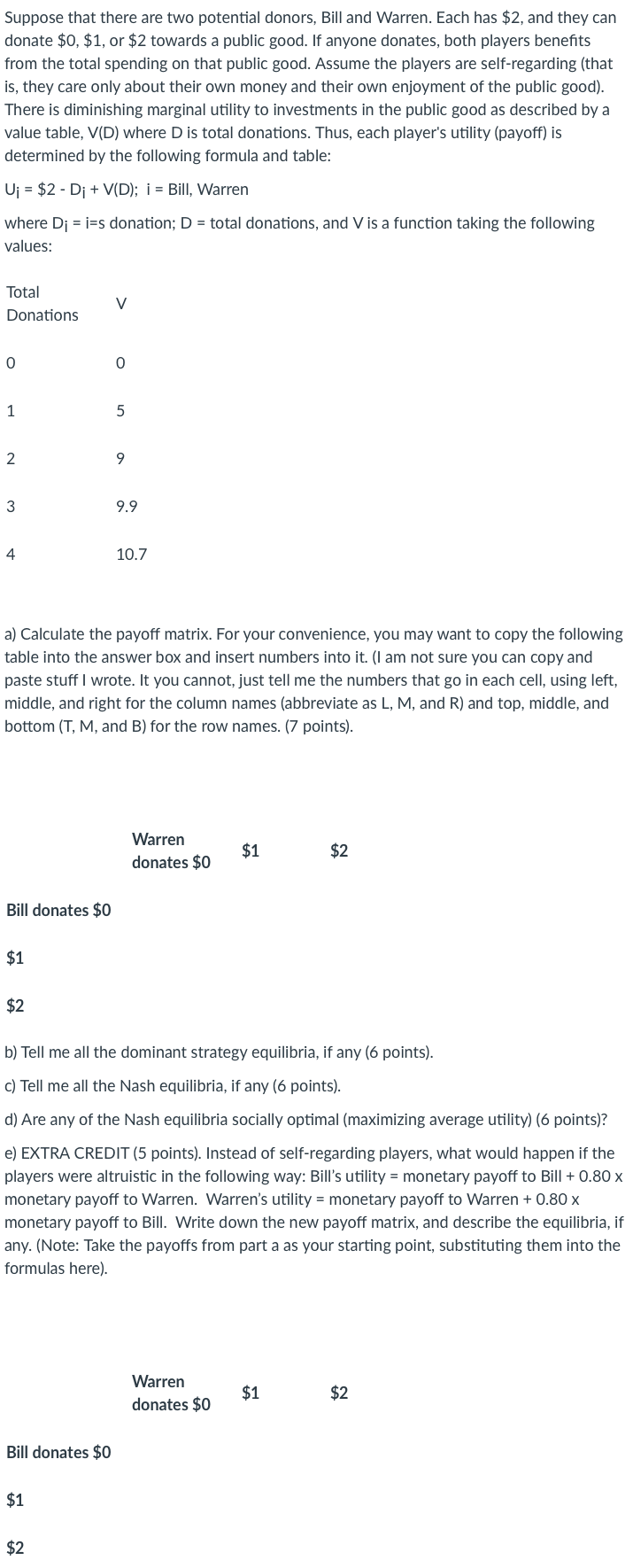

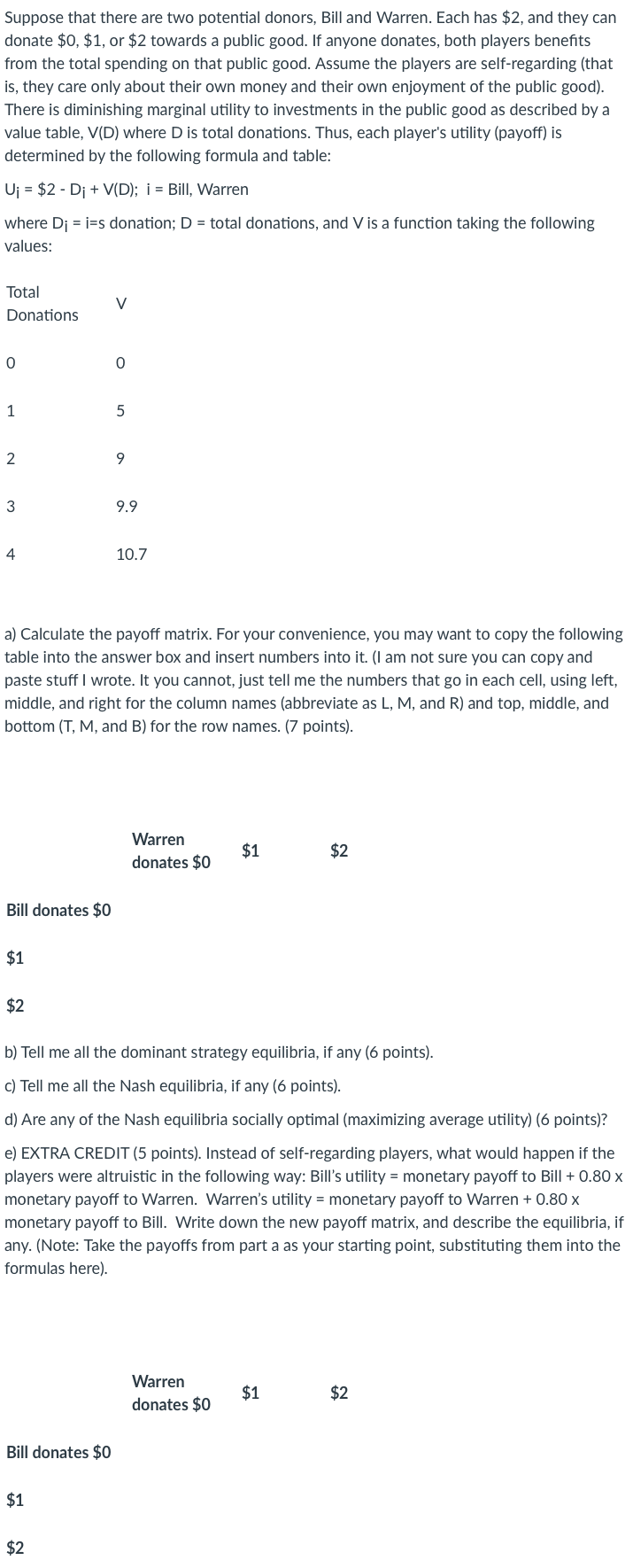

Suppose that there are two potential donors, Bill and Warren. Each has $2, and they can donate $0,$1, or $2 towards a public good. If anyone donates, both players benefits from the total spending on that public good. Assume the players are self-regarding (that is, they care only about their own money and their own enjoyment of the public good). There is diminishing marginal utility to investments in the public good as described by a value table, V(D) where D is total donations. Thus, each player's utility (payoff) is determined by the following formula and table: Ui=$2Di+V(D);i= Bill, Warren where Di=i=s donation; D= total donations, and V is a function taking the following values: a) Calculate the payoff matrix. For your convenience, you may want to copy the following table into the answer box and insert numbers into it. (I am not sure you can copy and paste stuff I wrote. It you cannot, just tell me the numbers that go in each cell, using left, middle, and right for the column names (abbreviate as L, M, and R) and top, middle, and bottom (T, M, and B) for the row names. (7 points). b) Tell me all the dominant strategy equilibria, if any (6 points). c) Tell me all the Nash equilibria, if any (6 points). d) Are any of the Nash equilibria socially optimal (maximizing average utility) (6 points)? e) EXTRA CREDIT (5 points). Instead of self-regarding players, what would happen if the players were altruistic in the following way: Bill's utility = monetary payoff to Bill +0.80x monetary payoff to Warren. Warren's utility = monetary payoff to Warren +0.80x monetary payoff to Bill. Write down the new payoff matrix, and describe the equilibria, if any. (Note: Take the payoffs from part a as your starting point, substituting them into the formulas here). Suppose that there are two potential donors, Bill and Warren. Each has $2, and they can donate $0,$1, or $2 towards a public good. If anyone donates, both players benefits from the total spending on that public good. Assume the players are self-regarding (that is, they care only about their own money and their own enjoyment of the public good). There is diminishing marginal utility to investments in the public good as described by a value table, V(D) where D is total donations. Thus, each player's utility (payoff) is determined by the following formula and table: Ui=$2Di+V(D);i= Bill, Warren where Di=i=s donation; D= total donations, and V is a function taking the following values: a) Calculate the payoff matrix. For your convenience, you may want to copy the following table into the answer box and insert numbers into it. (I am not sure you can copy and paste stuff I wrote. It you cannot, just tell me the numbers that go in each cell, using left, middle, and right for the column names (abbreviate as L, M, and R) and top, middle, and bottom (T, M, and B) for the row names. (7 points). b) Tell me all the dominant strategy equilibria, if any (6 points). c) Tell me all the Nash equilibria, if any (6 points). d) Are any of the Nash equilibria socially optimal (maximizing average utility) (6 points)? e) EXTRA CREDIT (5 points). Instead of self-regarding players, what would happen if the players were altruistic in the following way: Bill's utility = monetary payoff to Bill +0.80x monetary payoff to Warren. Warren's utility = monetary payoff to Warren +0.80x monetary payoff to Bill. Write down the new payoff matrix, and describe the equilibria, if any. (Note: Take the payoffs from part a as your starting point, substituting them into the formulas here)