Question

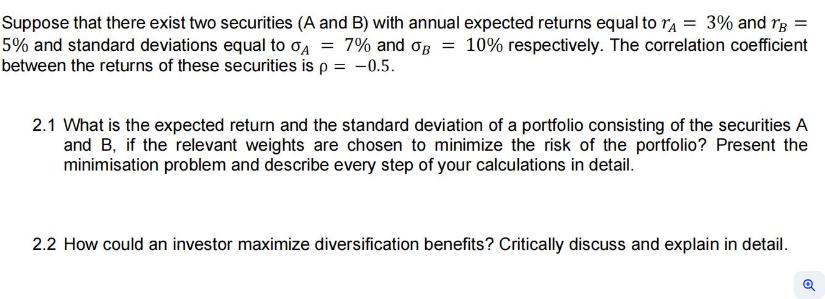

Suppose that there exist two securities (A and B) with annual expected returns equal to = 3% and B = 5% and standard deviations

Suppose that there exist two securities (A and B) with annual expected returns equal to = 3% and B = 5% and standard deviations equal to OA = 7% and OB = 10% respectively. The correlation coefficient between the returns of these securities is p = -0.5. 2.1 What is the expected return and the standard deviation of a portfolio consisting of the securities A and B, if the relevant weights are chosen to minimize the risk of the portfolio? Present the minimisation problem and describe every step of your calculations in detail. 2.2 How could an investor maximize diversification benefits? Critically discuss and explain in detail. Q

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

22 Maximizing Diversification Benefits Diversification benefits can be maximized by selecting assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th International Edition

1265533199, 978-1265533199

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App