Question

Suppose that XYZ Inc. plans on growing substantially next year. All Assets, Spontaneous Liabilities and Sales are planned to grow at a rate of

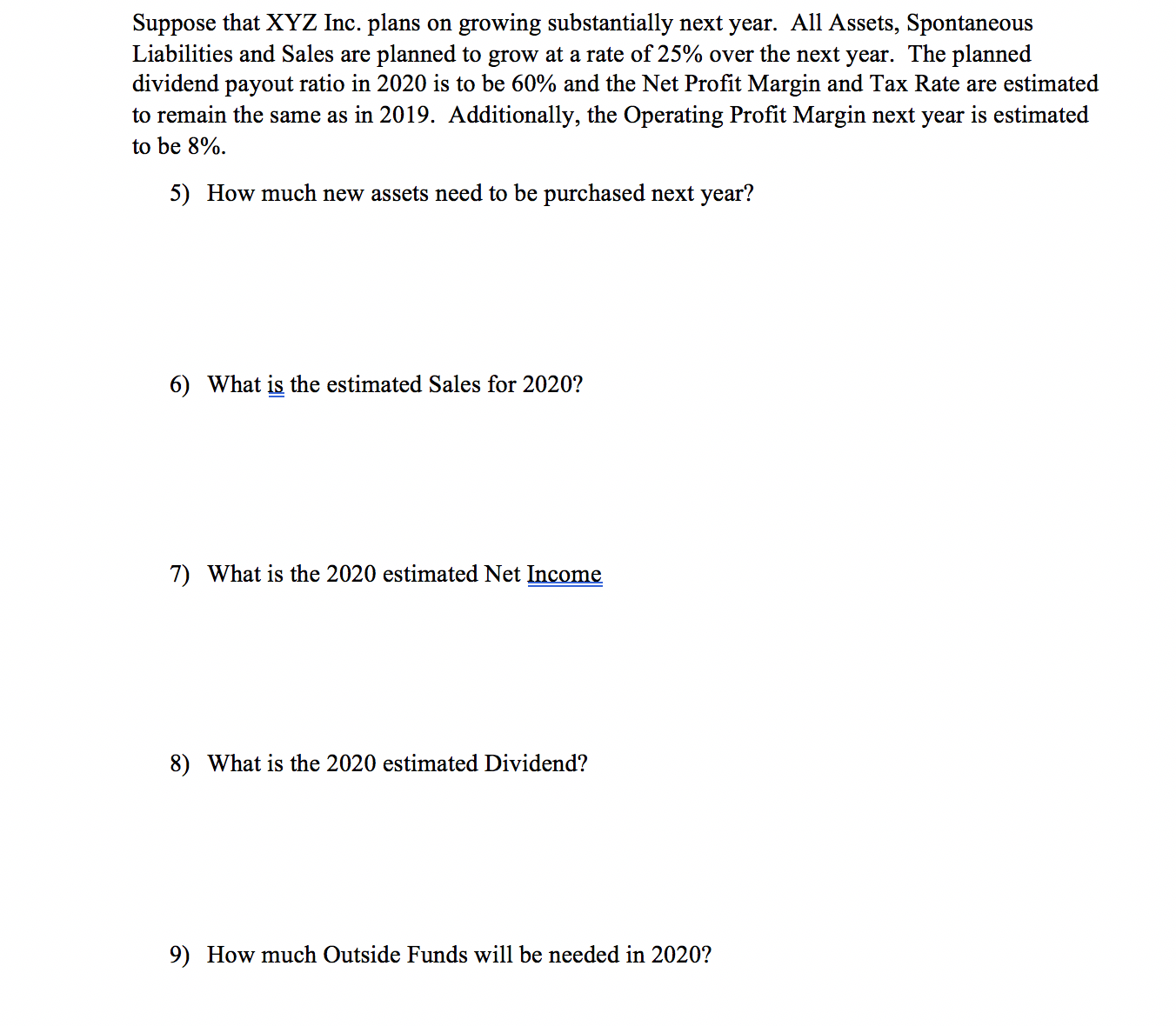

Suppose that XYZ Inc. plans on growing substantially next year. All Assets, Spontaneous Liabilities and Sales are planned to grow at a rate of 25% over the next year. The planned dividend payout ratio in 2020 is to be 60% and the Net Profit Margin and Tax Rate are estimated to remain the same as in 2019. Additionally, the Operating Profit Margin next year is estimated to be 8%. 5) How much new assets need to be purchased next year? 6) What is the estimated Sales for 2020? 7) What is the 2020 estimated Net Income 8) What is the 2020 estimated Dividend? 9) How much Outside Funds will be needed in 2020?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

5 To calculate the amount of new assets that need to be purchased next year we need to use the formu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

2nd Edition

978-0470933268, 470933267, 470876441, 978-0470876442

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App