Question

Suppose that you are a wheat farmer. Answer the following questions. It is September, and you intend to have 50,000 bushels of wheat harvested and

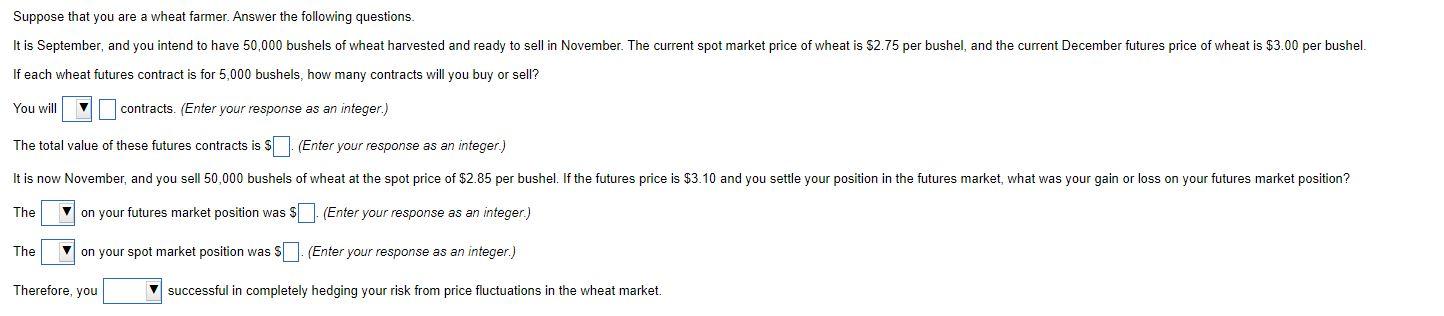

Suppose that you are a wheat farmer. Answer the following questions.

It is

September,

and you intend to have

50,000

bushels of wheat harvested and ready to sell in November. The current spot market price of wheat is

$2.75

per bushel, and the current December futures price of wheat is

$3.00

per bushel.

Part 2

If each wheat futures contract is for

5,000

bushels, how many contracts will you buy or sell?

You will

buy

sell

enter your response here

contracts. (Enter your response as an

integer.)

Part 3

The total value of these futures contracts is

$enter your response here.

(Enter your response as an

integer.)

Part 4

It is now November, and you sell

50,000

bushels of wheat at the spot price of

$2.85

per bushel. If the futures price is

$3.10

and you settle your position in the futures market, what was your gain or loss on your futures market position?

The

gain

loss

on your futures market position was

$enter your response here.

(Enter your response as an

integer.)

Part 5

The

gain

loss

on your spot market position was

$enter your response here.

(Enter your response as an

integer.)

Part 6

Therefore, you

were

were not

successful in completely hedging your risk from price fluctuations in the wheat market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started