Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you are the new financial manager of YOLO Gaming Company. The board of directors has decided to invest in new projects in line

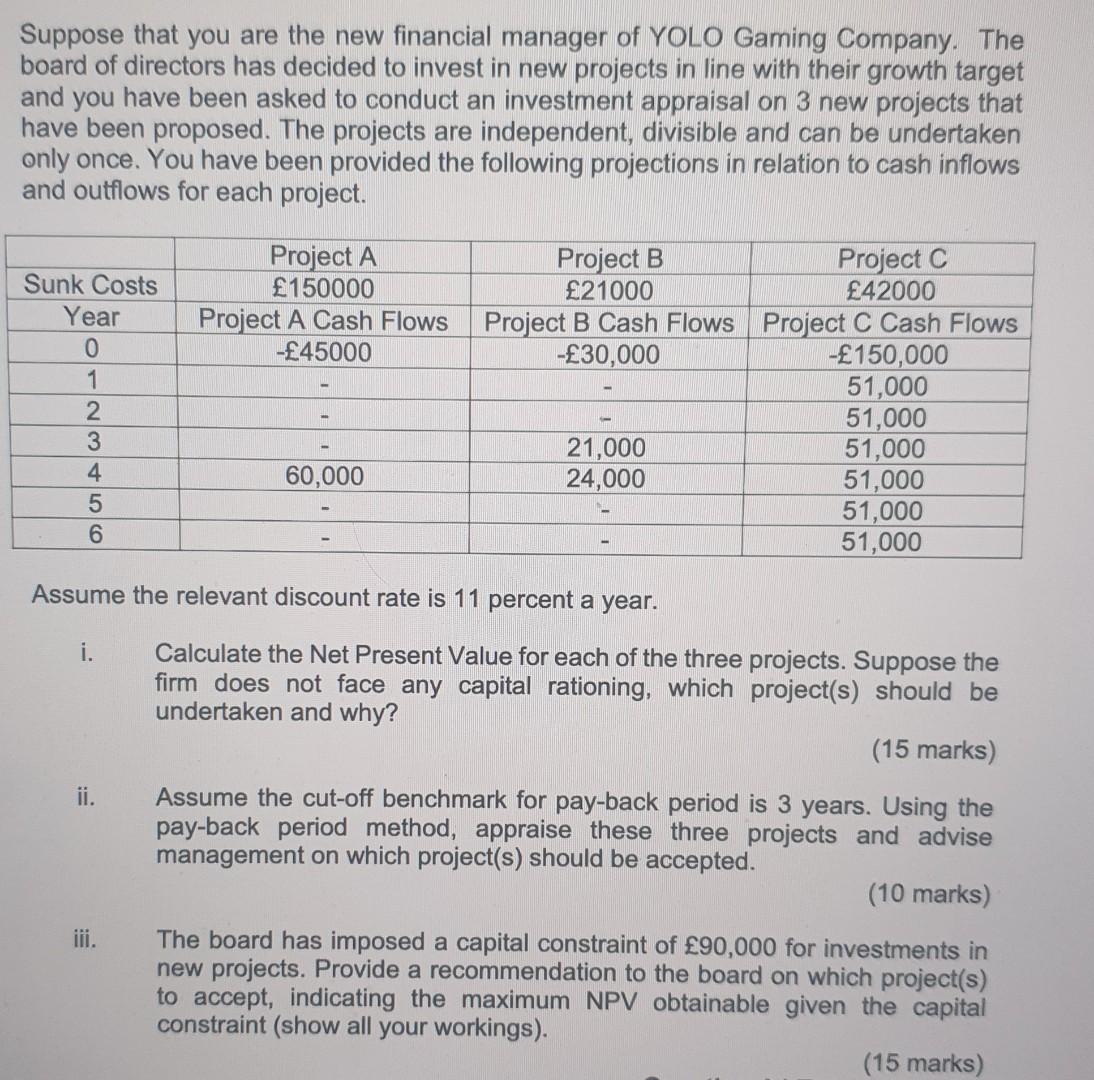

Suppose that you are the new financial manager of YOLO Gaming Company. The board of directors has decided to invest in new projects in line with their growth target and you have been asked to conduct an investment appraisal on 3 new projects that have been proposed. The projects are independent, divisible and can be undertaken only once. You have been provided the following projections in relation to cash inflows and outflows for each project. Project A 150000 Project A Cash Flows -45000 Sunk Costs Year 0 1 2 3 4 5 6 Project B Project C 21000 42000 Project B Cash Flows Project C Cash Flows -30,000 -150,000 51,000 51,000 21,000 51,000 24,000 51,000 51,000 51,000 60,000 Assume the relevant discount rate is 11 percent a year. i. Calculate the Net Present Value for each of the three projects. Suppose the firm does not face any capital rationing, which project(s) should be undertaken and why? (15 marks) ii. Assume the cut-off benchmark for pay-back period is 3 years. Using the pay-back period method, appraise these three projects and advise management on which project(s) should be accepted. (10 marks) iii. The board has imposed a capital constraint of 90,000 for investments in new projects. Provide a recommendation to the board on which project(s) to accept, indicating the maximum NPV obtainable given the capital constraint (show all your workings). (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started