Question

Suppose that you own 100 shares of the underlying stock. You would like to use options to protect the returns from your ownership this stock

More specifically, you would like to create an investment portfolio by combining your 100 shares with either long or short positions in the options contracts such that the value of the portfolio will be the same no matter what the realised price of the stock becomes. Assume the price of each call is 0.632 and, the price of each put is 1.50

1. Assuming you use call options to hedge 100 shares, how many call options should you long or short? How much do you pay for these calls?

2. To provide portfolio insurance for these 100 shares, could you use put options? If so, how many and how much would it cost?

![Stock Price Evolution: Exercise Price \( X \) , \[ \begin{array}{l} X=7 \\ \hline \end{array} \]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/05/6464bce366fce_1684323552577.jpg)

![Calculating Gross \& Net Returns Stock Price Evolution: \[ x=7 \] Net Returns: \( \quad u_{n}=\frac{S_{u}}{S_{0}}-1=\frac{9}{](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/05/6464bce441dbe_1684323552905.jpg)

![Value call option using risk neutral method Call option evolution: \[ p^{\star}=0.3 \] alculate value \( C_{0} \) using ris](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/05/6464bce4c62a9_1684323553272.jpg)

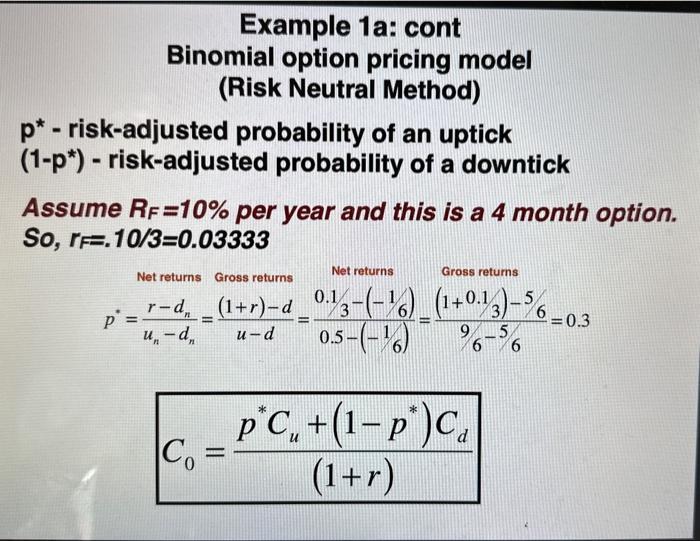

Stock Price Evolution: Su So Example 1a: Pricing Call using Binomial option pricing model (Risk Neutral Method) 6 -SD -9 -5 Exercise Price "X" X=7

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To hedge your 100 shares using call options you need to determine the number of call options you sho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started