Question

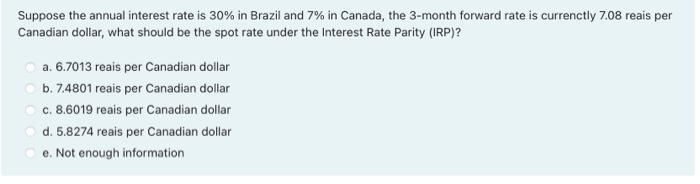

Suppose the annual interest rate is 30% in Brazil and 7% in Canada, the 3-month forward rate is currenctly 7.08 reais per Canadian dollar,

Suppose the annual interest rate is 30% in Brazil and 7% in Canada, the 3-month forward rate is currenctly 7.08 reais per Canadian dollar, what should be the spot rate under the Interest Rate Parity (IRP)? a. 6.7013 reais per Canadian dollar b. 7.4801 reais per Canadian dollar c. 8.6019 reais per Canadian dollar d. 5.8274 reais per Canadian dollar e. Not enough information

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The Interest Rate Parity I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory and Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

2nd Canadian edition

176517308, 978-0176517304

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App