Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the Australian share market has an expected annual return of 12% and an annualised standard deviation of 16%, and the yield on Commonwealth

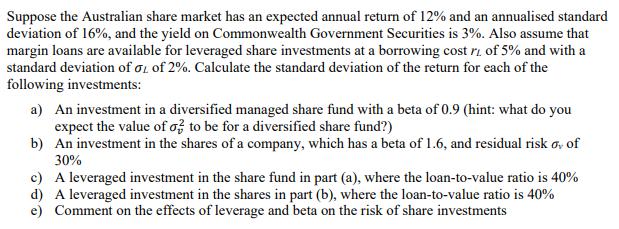

Suppose the Australian share market has an expected annual return of 12% and an annualised standard deviation of 16%, and the yield on Commonwealth Government Securities is 3%. Also assume that margin loans are available for leveraged share investments at a borrowing cost r of 5% and with a standard deviation of L of 2%. Calculate the standard deviation of the return for each of the following investments: a) An investment in a diversified managed share fund with a beta of 0.9 (hint: what do you expect the value of o? to be for a diversified share fund?) b) An investment in the shares of a company, which has a beta of 1.6, and residual risk of of 30% c) A leveraged investment in the share fund in part (a), where the loan-to-value ratio is 40% d) A leveraged investment in the shares in part (b), where the loan-to-value ratio is 40% e) Comment on the effects of leverage and beta on the risk of share investments

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a o 12 09 16 72 16 09 144 b o 12 16 16 16 16 16 224 c o 72 09 16 272 16 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started