Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the bank has a portfolio of risky assets (loans) that cost 100 at t=0. The bank finances the portfolio with debt (d) and

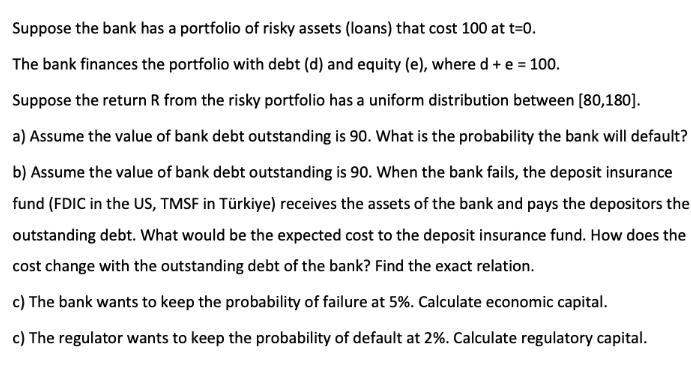

Suppose the bank has a portfolio of risky assets (loans) that cost 100 at t=0. The bank finances the portfolio with debt (d) and equity (e), where d + e = 100. Suppose the return R from the risky portfolio has a uniform distribution between [80,180]. a) Assume the value of bank debt outstanding is 90. What is the probability the bank will default? b) Assume the value of bank debt outstanding is 90. When the bank fails, the deposit insurance fund (FDIC in the US, TMSF in Trkiye) receives the assets of the bank and pays the depositors the outstanding debt. What would be the expected cost to the deposit insurance fund. How does the cost change with the outstanding debt of the bank? Find the exact relation. c) The bank wants to keep the probability of failure at 5%. Calculate economic capital. c) The regulator wants to keep the probability of default at 2%. Calculate regulatory capital.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the probability of default we need to determine the portion of the return distribution that falls below the value of bank debt outstand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started