Answered step by step

Verified Expert Solution

Question

1 Approved Answer

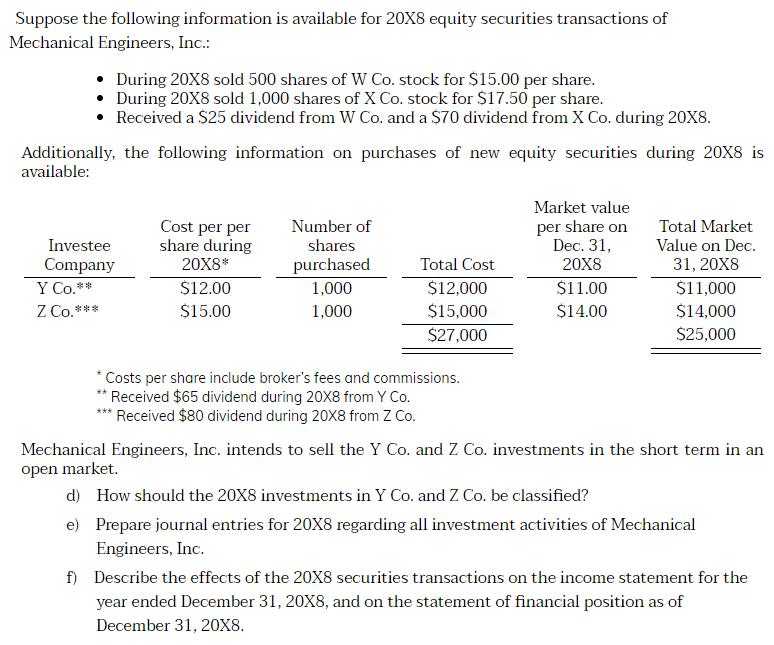

Suppose the following information is available for 20X8 equity securities transactions of Mechanical Engineers, Inc.: During 20X8 sold 500 shares of W Co. stock

Suppose the following information is available for 20X8 equity securities transactions of Mechanical Engineers, Inc.: During 20X8 sold 500 shares of W Co. stock for $15.00 per share. During 20X8 sold 1,000 shares of X Co. stock for $17.50 per share. Received a $25 dividend from W Co. and a $70 dividend from X Co. during 20X8. Additionally, the following information on purchases of new equity securities during 20X8 is available: Market value Cost per per share during Investee Company Number of shares purchased 1,000 per share on Dec. 31, 20X8 Total Market Value on Dec. 31, 20X8 20X8* Total Cost $12.00 $12,000 $11.00 $11,000 Y Co.** Z Co. *** $15.00 1,000 $15,000 $14.00 $14,000 $27,000 $25,000 Costs per share include broker's fees and commissions. ** *Received $65 dividend during 20X8 from Y Co. Received $80 dividend during 20X8 from Z Co. Mechanical Engineers, Inc. intends to sell the Y Co. and Z Co. investments in the short term in an open market. d) How should the 20X8 investments in Y Co. and Z Co. be classified? e) Prepare journal entries for 20X8 regarding all investment activities of Mechanical Engineers, Inc. f) Describe the effects of the 20X8 securities transactions on the income statement for the year ended December 31, 20X8, and on the statement of financial position as of December 31, 20X8.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

d The 20X8 investments in Y Co and Z Co should be classified as trading securities e Journal entries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started